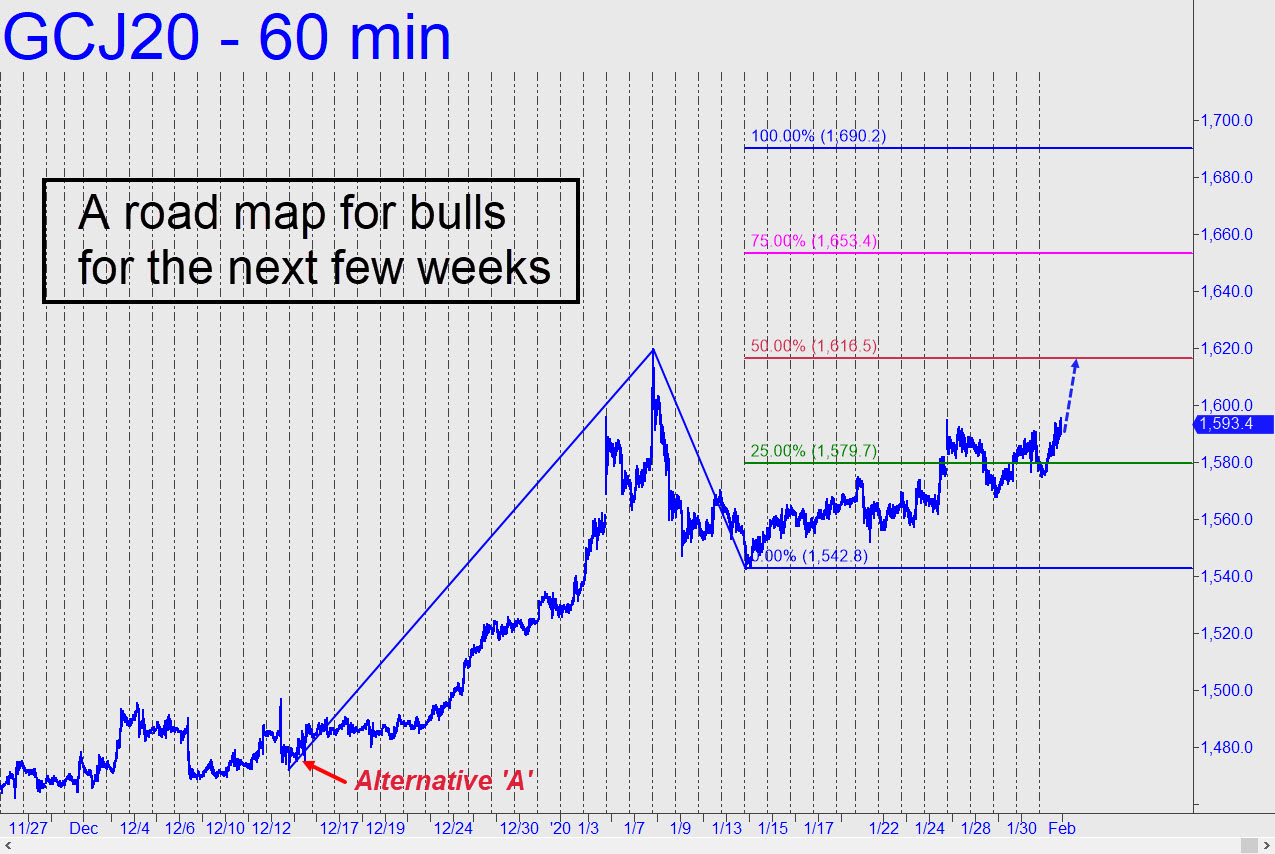

It’s been three weeks since April Gold generated a bullish impulse leg on the hourly chart, but it could happen as early as Sunday night if there’s follow-through to Friday’s upswing. That would exceed the 1603.00 ‘external’ peak shown in the chart, refreshing the energy of buyers. It would also put p=1616.50 of this pattern in play as a minimum upside objective over the near term. As always, an easy move through a midpoint pivot would puts its associative ‘D’ target in play — in this case 1690.20. We can trade the various Hidden Pivot levels long or short as opportunities arise, so stay tuned to the chat room if you’re interested. Incidentally, there is an alternative point ‘A’ low $2.80 above the one I’ve used, but we may have to wait until the futures hit the respective p midpoint of each before we choose which ‘D target to use. _____ UPDATE (Feb 3, 9:37 p.m. EST): Gold’s head-fake Sunday night was short-lived, falling $4.60 shy of the 1603.00 benchmark identified above. The subsequent selloff, all too typical for gold, occurred when index futures took flight, propelled by panicky short-covering. I have nothing new to offer, but the 1616.50 target can still be used as a minimum upside objective. _______ UPDATE (Feb 4, 9:07 a.m.): Gold is getting pulped today, as usual, because the stock market is in the grip of an insane rally. The 1616.50 rally target will remain viable IN THEORY until such time as C=1542.80 is penetrated to the downside. This will come as scant consolation to gold bulls, but it is what the charts say. Worst case, short term: 1540.90 (60-min, a=1603.00 on 1/8 at 1:00 a.m.) _______ UPDATE (Feb 4, 9:47 p.m.): The futures have tripped a minor rABC buy signal of modest appeal at 1558.40 for a shot at 1564.00. (I mentioned this in a post at 18:26 in the Trading Room.) On the 30-minute chart, here are the coordinates: a=1575.90 (1/31 at 12:30 a.m.); b= 1598.50 (2/2 at 6:30 p.m.). _______ UPDATE (Feb 5, 9:15 p.m.): The trade sent out early Tuesday evening worked nicely, producing an overnight gain of about $2,200 for anyone who bought at the green line and exited at the red one. The futures subsequently struggled for loft and would need to surpass Wednesday’s 1566.20 peak to generate a bullish spark.

It’s been three weeks since April Gold generated a bullish impulse leg on the hourly chart, but it could happen as early as Sunday night if there’s follow-through to Friday’s upswing. That would exceed the 1603.00 ‘external’ peak shown in the chart, refreshing the energy of buyers. It would also put p=1616.50 of this pattern in play as a minimum upside objective over the near term. As always, an easy move through a midpoint pivot would puts its associative ‘D’ target in play — in this case 1690.20. We can trade the various Hidden Pivot levels long or short as opportunities arise, so stay tuned to the chat room if you’re interested. Incidentally, there is an alternative point ‘A’ low $2.80 above the one I’ve used, but we may have to wait until the futures hit the respective p midpoint of each before we choose which ‘D target to use. _____ UPDATE (Feb 3, 9:37 p.m. EST): Gold’s head-fake Sunday night was short-lived, falling $4.60 shy of the 1603.00 benchmark identified above. The subsequent selloff, all too typical for gold, occurred when index futures took flight, propelled by panicky short-covering. I have nothing new to offer, but the 1616.50 target can still be used as a minimum upside objective. _______ UPDATE (Feb 4, 9:07 a.m.): Gold is getting pulped today, as usual, because the stock market is in the grip of an insane rally. The 1616.50 rally target will remain viable IN THEORY until such time as C=1542.80 is penetrated to the downside. This will come as scant consolation to gold bulls, but it is what the charts say. Worst case, short term: 1540.90 (60-min, a=1603.00 on 1/8 at 1:00 a.m.) _______ UPDATE (Feb 4, 9:47 p.m.): The futures have tripped a minor rABC buy signal of modest appeal at 1558.40 for a shot at 1564.00. (I mentioned this in a post at 18:26 in the Trading Room.) On the 30-minute chart, here are the coordinates: a=1575.90 (1/31 at 12:30 a.m.); b= 1598.50 (2/2 at 6:30 p.m.). _______ UPDATE (Feb 5, 9:15 p.m.): The trade sent out early Tuesday evening worked nicely, producing an overnight gain of about $2,200 for anyone who bought at the green line and exited at the red one. The futures subsequently struggled for loft and would need to surpass Wednesday’s 1566.20 peak to generate a bullish spark.

GCJ20 – April Gold (Last:1558.70)

Posted on February 2, 2020, 5:15 pm EST

Last Updated February 6, 2020, 8:27 pm EST

Posted on February 2, 2020, 5:15 pm EST

Last Updated February 6, 2020, 8:27 pm EST