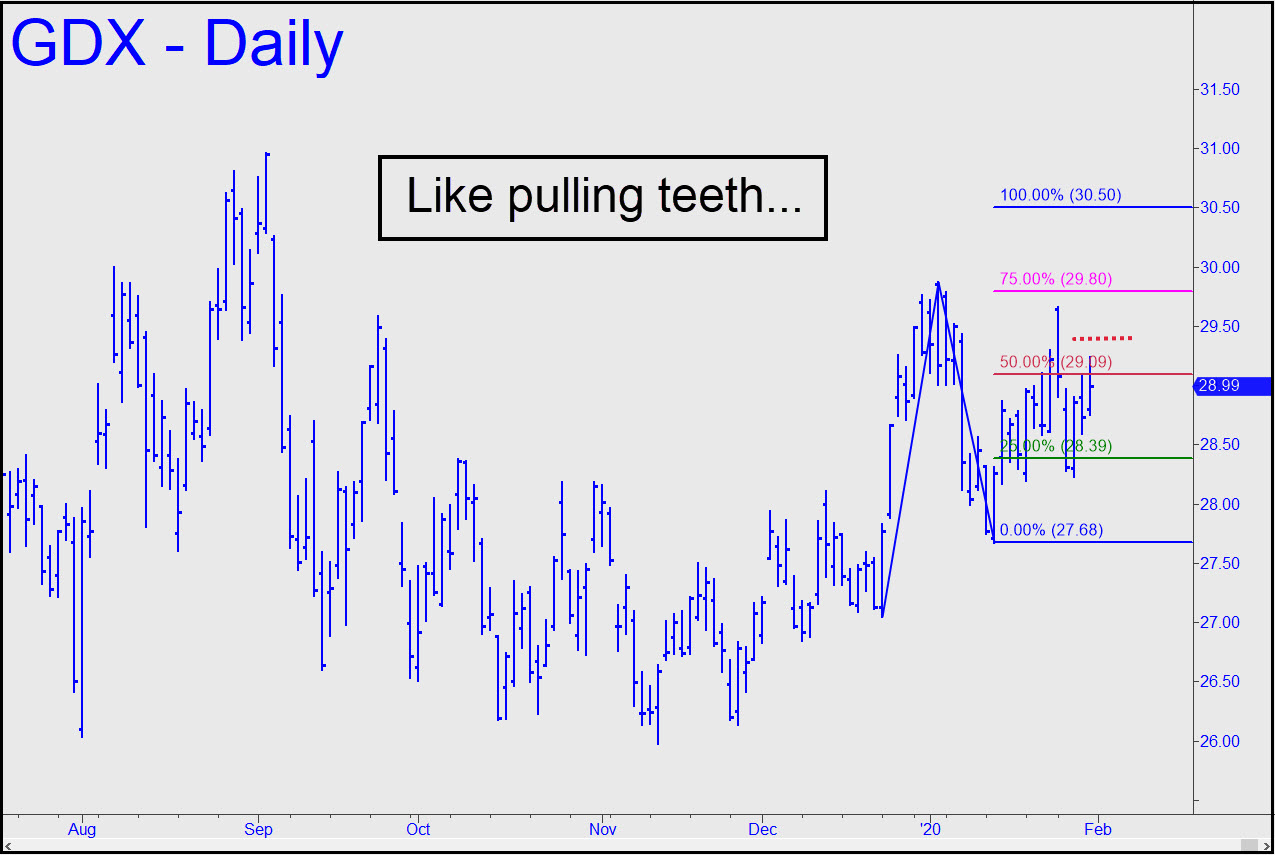

I’m  tracking a long position consisting of 400 shares purchased last week for 28.39 when this vehicle dove to 28.23. Ordinarily I would suggest taking half off at the red line, 29.09, but because so many subscribers took the trade, and to demonstrate how well these ‘mechanical’ set-ups work to those who hadn’t tried one, I’m being a little greedy this time. Accordingly, I’ll recommend that you continue to offer 200 shares (or half of the original position) at 29.42. We’ll look to exit another 25% if and when GDX achieves the 30.50 target. _______ UPDATE (Feb 4, 9:14 a.m. EST): Gold is getting hit hard ahead of the opening because stocks are once again in the grip of short-squeeze madness. The GDX position will produce a theoretical loss of $288 on four round lots if it is stopped out. I am recommending sticking with it because that is what disciplined trading requires. ________ UPDATE (Feb 4, 9:53 p.m.): The position hung on by a thread today when GDX swooned to 27.77, a dime above our stop-loss. _______ UPDATE (Feb 6, 8:44 p.m.): Were stuck with the position because…well, because we are. Continue to offer half of it at 29.42, with an o-c-o stop-loss at 27.67.

tracking a long position consisting of 400 shares purchased last week for 28.39 when this vehicle dove to 28.23. Ordinarily I would suggest taking half off at the red line, 29.09, but because so many subscribers took the trade, and to demonstrate how well these ‘mechanical’ set-ups work to those who hadn’t tried one, I’m being a little greedy this time. Accordingly, I’ll recommend that you continue to offer 200 shares (or half of the original position) at 29.42. We’ll look to exit another 25% if and when GDX achieves the 30.50 target. _______ UPDATE (Feb 4, 9:14 a.m. EST): Gold is getting hit hard ahead of the opening because stocks are once again in the grip of short-squeeze madness. The GDX position will produce a theoretical loss of $288 on four round lots if it is stopped out. I am recommending sticking with it because that is what disciplined trading requires. ________ UPDATE (Feb 4, 9:53 p.m.): The position hung on by a thread today when GDX swooned to 27.77, a dime above our stop-loss. _______ UPDATE (Feb 6, 8:44 p.m.): Were stuck with the position because…well, because we are. Continue to offer half of it at 29.42, with an o-c-o stop-loss at 27.67.

GDX – Gold Miners ETF (Last:28.39)

Posted on February 2, 2020, 5:10 pm EST

Last Updated February 15, 2020, 2:13 pm EST

Posted on February 2, 2020, 5:10 pm EST

Last Updated February 15, 2020, 2:13 pm EST