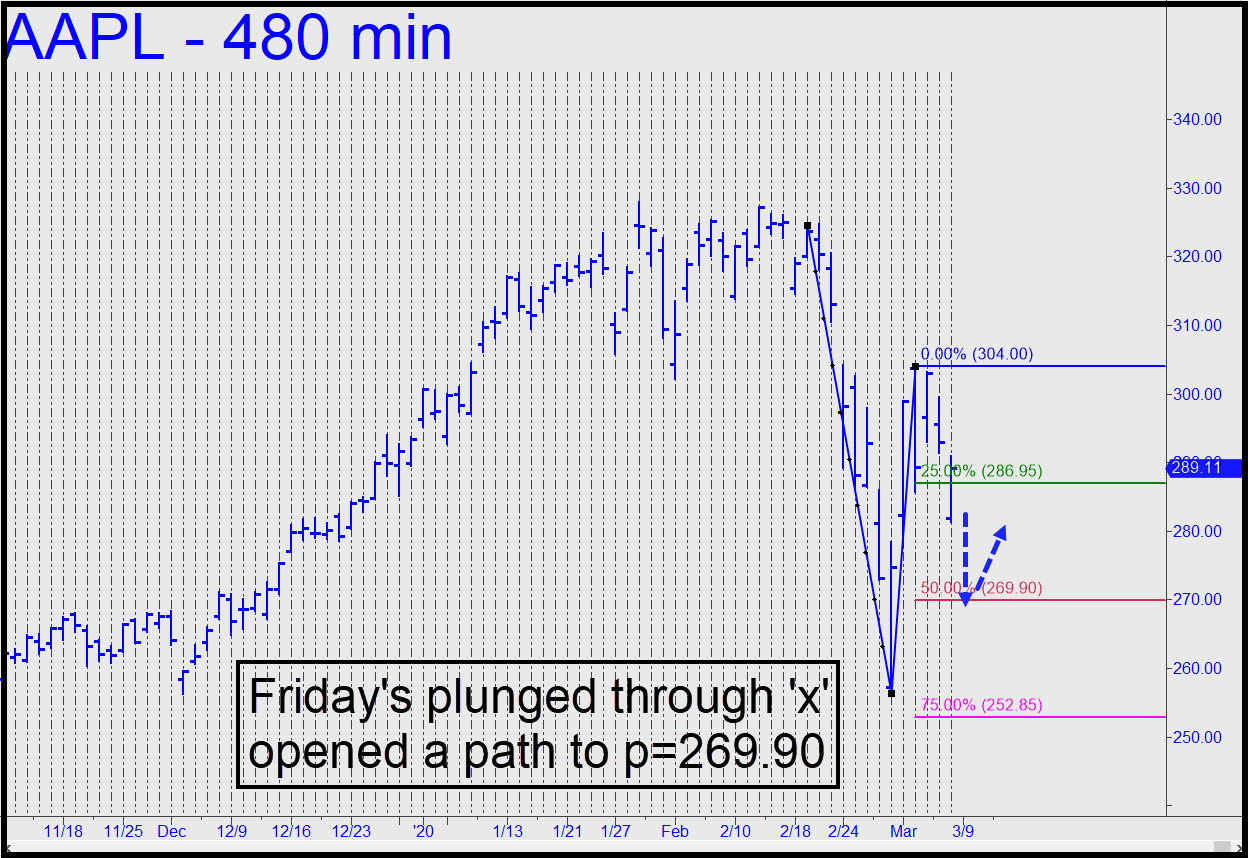

AAPL has traced out a pretty simple pattern that implies minimum slippage from here to at least p=269.86. Although the pattern is obvious enough to attract the attention of the hoi-polloi we always hope to be trading against, the midpoint pivot is probably sufficiently obscure to offer a decent place to attempt bottom-fishing. The stock will be short-able in the meantime intraday, but I’ll leave the details to the Trading Room, assuming there is sufficient interest. The gaps between HP levels are so big that we can hope to trade the stock, by turns, from either side of the market. Nudge me if you’re keen to take a plunge in options when choice opportunities arise. ______ UPDATE (March 9, 8:54 p.m. EDT): Today’s plunge shredded the 269.86 midpoint Hidden Pivot, making further slippage to 235.72 a good bet. Here’s the chart. _______ UPDATE (Mar 10, 9:04): Just an inch more and AAPL will trip a signal to get short ‘mechanically’ at the green line. I’ve spotlighted the stock’s ability to tell us exactly what’s on Mr. Market’s diabolical mind, and so we shall see. I am not recommending the trade, which would require a stop-loss at 304.01, but we’ll track it anyway in order to gt a firm handle on AAPL’s behavior. The 235.72 target flagged above is still viable and will remain so unless the stop-loss on the short is hit. _______ UPDATE (Mar 11, 9:50 p.m.): The stock failed by an inch to trigger a mechanical short by touching 286.93 on the last rally. That will not affect the odds of more slippage to 235.72, however, even though the stock appeared to resist a wholesale collapse today. We can assume AAPL shares are being deftly distributed by DaBoyz, who would be well aware of the company’s vulnerability in a global downturn. Sales of the company’s very pricey flagship product, the iPhone, cannot but suffer if consumers significantly lengthen the interval between replacements as they are about to. At least we’re not hearing ridiculous stories any longer about all the money Apple stands to make in the heavily overcrowded, hypercompetitive streaming-content business._______ UPDATE (Mar 12, 8:53): AAPL’s $50 drop over the last two days, punctuated by a $21 short-squeeze today, has made a tentative low at 235.51 this evening, 21 cents below the 235.72 target we’ve been using. Here’s the chart , and let’s see if the support holds. This feat could be the economic world’s best hope at the moment,

AAPL has traced out a pretty simple pattern that implies minimum slippage from here to at least p=269.86. Although the pattern is obvious enough to attract the attention of the hoi-polloi we always hope to be trading against, the midpoint pivot is probably sufficiently obscure to offer a decent place to attempt bottom-fishing. The stock will be short-able in the meantime intraday, but I’ll leave the details to the Trading Room, assuming there is sufficient interest. The gaps between HP levels are so big that we can hope to trade the stock, by turns, from either side of the market. Nudge me if you’re keen to take a plunge in options when choice opportunities arise. ______ UPDATE (March 9, 8:54 p.m. EDT): Today’s plunge shredded the 269.86 midpoint Hidden Pivot, making further slippage to 235.72 a good bet. Here’s the chart. _______ UPDATE (Mar 10, 9:04): Just an inch more and AAPL will trip a signal to get short ‘mechanically’ at the green line. I’ve spotlighted the stock’s ability to tell us exactly what’s on Mr. Market’s diabolical mind, and so we shall see. I am not recommending the trade, which would require a stop-loss at 304.01, but we’ll track it anyway in order to gt a firm handle on AAPL’s behavior. The 235.72 target flagged above is still viable and will remain so unless the stop-loss on the short is hit. _______ UPDATE (Mar 11, 9:50 p.m.): The stock failed by an inch to trigger a mechanical short by touching 286.93 on the last rally. That will not affect the odds of more slippage to 235.72, however, even though the stock appeared to resist a wholesale collapse today. We can assume AAPL shares are being deftly distributed by DaBoyz, who would be well aware of the company’s vulnerability in a global downturn. Sales of the company’s very pricey flagship product, the iPhone, cannot but suffer if consumers significantly lengthen the interval between replacements as they are about to. At least we’re not hearing ridiculous stories any longer about all the money Apple stands to make in the heavily overcrowded, hypercompetitive streaming-content business._______ UPDATE (Mar 12, 8:53): AAPL’s $50 drop over the last two days, punctuated by a $21 short-squeeze today, has made a tentative low at 235.51 this evening, 21 cents below the 235.72 target we’ve been using. Here’s the chart , and let’s see if the support holds. This feat could be the economic world’s best hope at the moment,

AAPL – Apple Computer (Last:237.00)

Posted on March 8, 2020, 5:00 pm EDT

Last Updated March 12, 2020, 10:43 pm EDT

Posted on March 8, 2020, 5:00 pm EDT

Last Updated March 12, 2020, 10:43 pm EDT