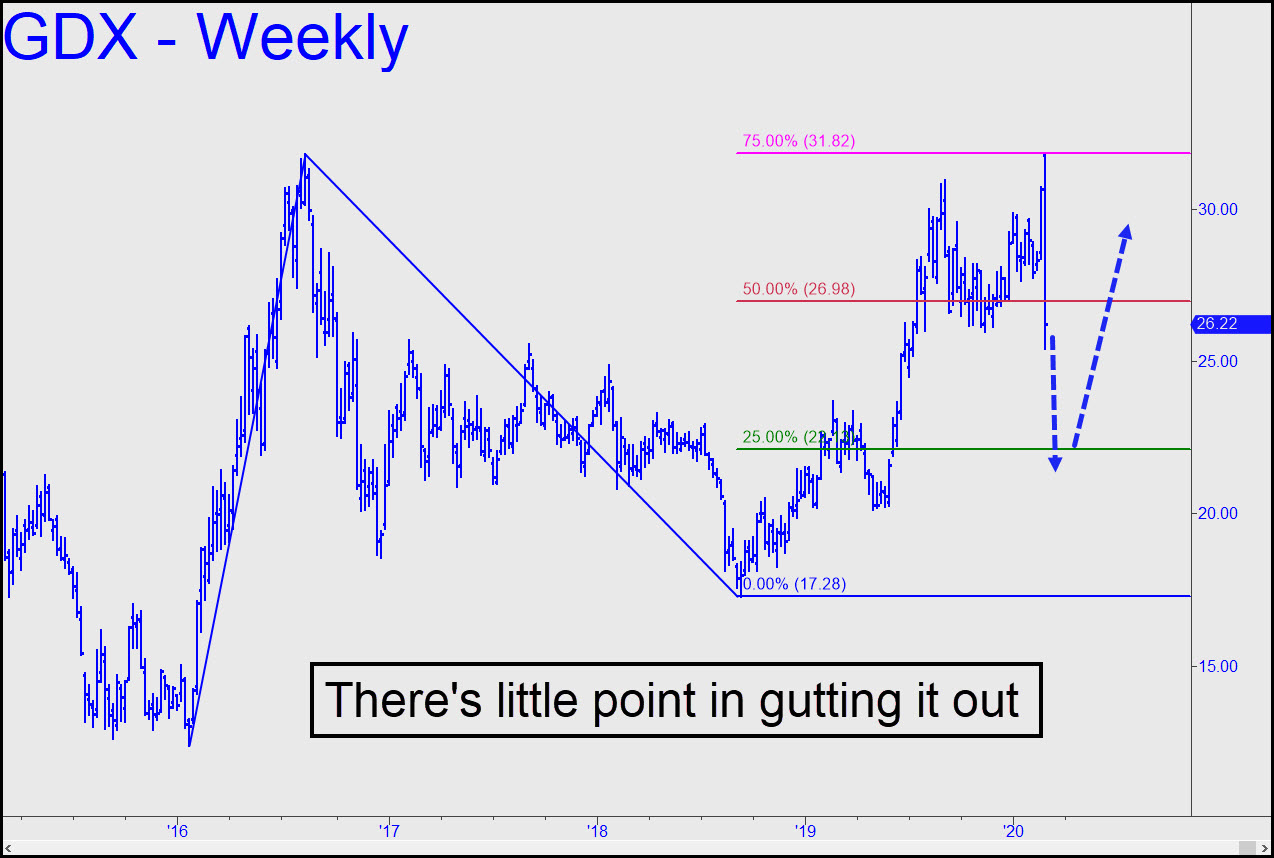

Because we took profits on 75% of our initial position on the way up, last week’s horrific plunge still left us with a more-than-nominal profit. Our effective cost basis was $24.32, and I’ll suggest exiting on the opening. I’d originally planned to gut it out in order to make the point that ‘mechanical’ entries are easy to execute and work well, especially when price action turns violent. However, the more important goal was to provide an absolute no-brainer trade to pay for your subscription, even if you’ve never done anything but lurk in the chat room. Assuming GDX gets even slight lift on the opening from Sunday night’s strong rally in bullion, you should come away with a profit of around $200. I may suggest jumping in again if and when GDX falls to the green line, as it well may. Please stay closely tuned, especially if you’ve never made a dime on other trading services. _______ UPDATE (Mar 2, 11:47 a.m.): Based on this morning’s opening price of 27.24, we exited the remainder of our position for a net profit of $292. Many subscribers reported jumping on this one when I recommended it a month ago. I purposely made it simple enough for traders of all levels of experience, and cheap enough to be suitable for accounts as small as $6,000. If you didn’t do the trade yourself, you ought to be asking yourself why, since it was the every-once-in-a-while lay-up I promised when you subscribed.

Because we took profits on 75% of our initial position on the way up, last week’s horrific plunge still left us with a more-than-nominal profit. Our effective cost basis was $24.32, and I’ll suggest exiting on the opening. I’d originally planned to gut it out in order to make the point that ‘mechanical’ entries are easy to execute and work well, especially when price action turns violent. However, the more important goal was to provide an absolute no-brainer trade to pay for your subscription, even if you’ve never done anything but lurk in the chat room. Assuming GDX gets even slight lift on the opening from Sunday night’s strong rally in bullion, you should come away with a profit of around $200. I may suggest jumping in again if and when GDX falls to the green line, as it well may. Please stay closely tuned, especially if you’ve never made a dime on other trading services. _______ UPDATE (Mar 2, 11:47 a.m.): Based on this morning’s opening price of 27.24, we exited the remainder of our position for a net profit of $292. Many subscribers reported jumping on this one when I recommended it a month ago. I purposely made it simple enough for traders of all levels of experience, and cheap enough to be suitable for accounts as small as $6,000. If you didn’t do the trade yourself, you ought to be asking yourself why, since it was the every-once-in-a-while lay-up I promised when you subscribed.

GDX – Gold Miners ETF (Last:27.26)

Posted on March 1, 2020, 10:15 pm EST

Last Updated March 2, 2020, 10:49 pm EST

Posted on March 1, 2020, 10:15 pm EST

Last Updated March 2, 2020, 10:49 pm EST