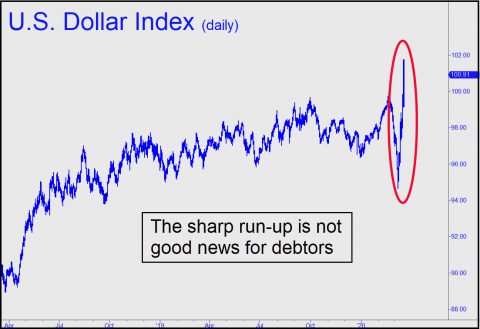

The U.S. dollar has been one of the few big market winners lately, but this is hardly a good thing. If the greenback continues to strengthen, it will hurt U.S. multinationals whose overseas revenues are reckoned in currencies that would be falling. In addition, all who owe will need to repay their loans in dollars more dear than when they were borrowed. And it will sink prices for a broad variety of commodities, particular crude oil, that have been used to collateralize a super-leveraged derivatives market worth perhaps $1.5 quadrillion notional. Do you see the problem?

The U.S. dollar has been one of the few big market winners lately, but this is hardly a good thing. If the greenback continues to strengthen, it will hurt U.S. multinationals whose overseas revenues are reckoned in currencies that would be falling. In addition, all who owe will need to repay their loans in dollars more dear than when they were borrowed. And it will sink prices for a broad variety of commodities, particular crude oil, that have been used to collateralize a super-leveraged derivatives market worth perhaps $1.5 quadrillion notional. Do you see the problem?

Throughout its 25-year history, Rick’s Picks and its predecessor, Black Box Forecasts, have never wavered in their bullish outlook for the dollar. In recent years, our projection for the Dollar Index (DXY), currently trading around 101, has called for a test of highs near 120 recorded in 2002. When DXY slid to 71 between 2002-08, we saw this as merely corrective.

What a Fool Believes

Our outlook for the dollar is congruent with the deflationary bust we foresee puncturing the outsize asset bubble created by the central banks over the last 40 years. Residential real estate is a big piece of it, and you can imagine for yourself whether mortgage lenders will ultimately allow homeowners to pay off their loans with a few hundred-thousand-dollar bills peeled from their overstuffed billfolds.

This is just one of many reasons why a hyperinflation is not coming. Set against them is the entrenched belief that the Fed would never let deflation happen. Well, on Tuesday, the dollar, along with the real burden of debt, soared despite the fact that President Trump was offering up a trillion dollar stimulus package in an attempt to offset economic damage from the pandemic. Ordinarily we would have expected the dollar to reel from news that amounted to the most powerful inflationary shock it has ever received; instead, it rose sharply. This was a wake-up call not only for the fools who still believe the Fed is all-knowing and all-powerful, but for those who think debt doesn’t matter. [Note: Here is a link to an interesting essay from Raoul Pal at LinkedIn: “The Dollar Wrecking Ball”. It dovetails precisely with this commentary.]