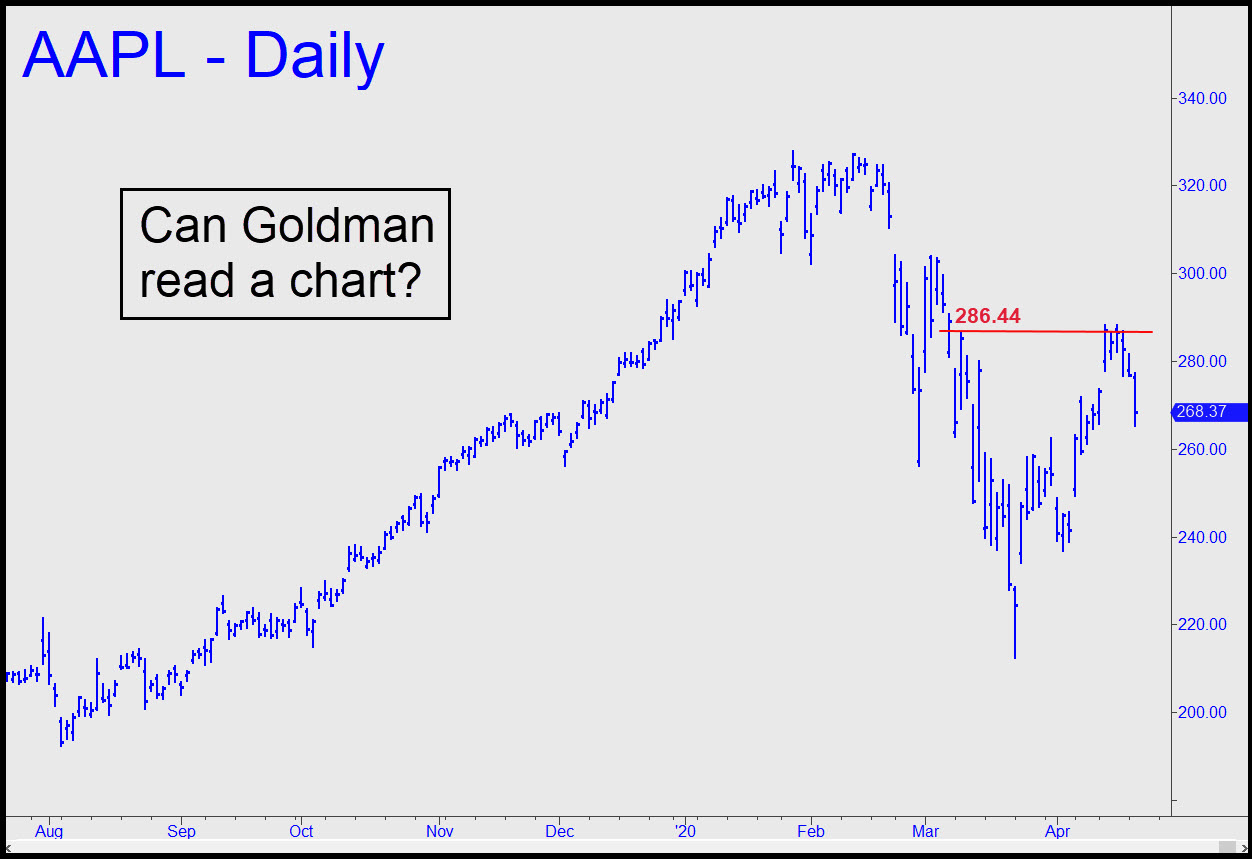

In the Trading Room this morning, a subscriber recalled my certitude recently that AAPL’s bear rally would reach a minimum 313.58 before sputtering out. As it happened, the stock swan-dived 8% after going no higher than 288.25. Should I double down on my target? As far as the subscriber was concerned, Goldman Sachs already won the bet: “Rick,” he texted, “I’m going to give the point to Goldman.” True, the renowned investment firm had presciently waved the yellow flag just ahead of AAPL’s fall. Some would say it was Goldman’s warning itself that caused the stock to plunge, and they would be right. That doesn’t necessarily mean it won’t keep falling. For all we know, Goldman’s vaunted analysts have nailed a very important top. But I doubt it, given the fact that the 288.25 high slightly exceeded an ‘external’ peak at 286.44 recorded a month earlier (see inset). The seemingly failed rally generated a powerful, albeit well camouflaged, impulse leg on the daily chart, implying that the selloff begun Friday is corrective and will eventually give way to a new rally leg. Anyone care to lay me some odds? Incidentally, my long term forecast for AAPL calls for an eventual drop below $100 — an outlook far less sanguine than you will find among self-aggrandizing dartboard prognosticators like Goldman who retail stocks to the public, and whose front-run advisories notoriously lag big moves in either direction. ______ UPDATE (Apr 27, 8:59 p.m. EDT): No, you’re not imagining it, Apple really does face some big problems, including: 1) shifting assembly out of China; 2) maintaining sales of a high-margin product during a global recession/depression, and 3) competing in a streaming market glutted with competitors. Even so, I’ll stick to the bullish targets flagged above. Buyers are struggling with the 285.26 midpoint resistance shown in this chart, but once decisively above it they’ll have a clear path to at least 305.08. _______ UPDATE (Apr 29, 10:25 p.m.): This morning’s short-squeeze gap through the 285.26 resistance demonstrated beyond doubt that Buffett and DaBoyz are firmly in control of the stock. So successful have they been in maneuvering it higher in order to unload their holdings on The Stupid Money that they must be surprised themselves by the rabid ferocity of the short-covering panic that has made this possible. Look for more upside most immediately to p2=295.17, and thence to D=305.08 if any higher. Here’s the chart.

In the Trading Room this morning, a subscriber recalled my certitude recently that AAPL’s bear rally would reach a minimum 313.58 before sputtering out. As it happened, the stock swan-dived 8% after going no higher than 288.25. Should I double down on my target? As far as the subscriber was concerned, Goldman Sachs already won the bet: “Rick,” he texted, “I’m going to give the point to Goldman.” True, the renowned investment firm had presciently waved the yellow flag just ahead of AAPL’s fall. Some would say it was Goldman’s warning itself that caused the stock to plunge, and they would be right. That doesn’t necessarily mean it won’t keep falling. For all we know, Goldman’s vaunted analysts have nailed a very important top. But I doubt it, given the fact that the 288.25 high slightly exceeded an ‘external’ peak at 286.44 recorded a month earlier (see inset). The seemingly failed rally generated a powerful, albeit well camouflaged, impulse leg on the daily chart, implying that the selloff begun Friday is corrective and will eventually give way to a new rally leg. Anyone care to lay me some odds? Incidentally, my long term forecast for AAPL calls for an eventual drop below $100 — an outlook far less sanguine than you will find among self-aggrandizing dartboard prognosticators like Goldman who retail stocks to the public, and whose front-run advisories notoriously lag big moves in either direction. ______ UPDATE (Apr 27, 8:59 p.m. EDT): No, you’re not imagining it, Apple really does face some big problems, including: 1) shifting assembly out of China; 2) maintaining sales of a high-margin product during a global recession/depression, and 3) competing in a streaming market glutted with competitors. Even so, I’ll stick to the bullish targets flagged above. Buyers are struggling with the 285.26 midpoint resistance shown in this chart, but once decisively above it they’ll have a clear path to at least 305.08. _______ UPDATE (Apr 29, 10:25 p.m.): This morning’s short-squeeze gap through the 285.26 resistance demonstrated beyond doubt that Buffett and DaBoyz are firmly in control of the stock. So successful have they been in maneuvering it higher in order to unload their holdings on The Stupid Money that they must be surprised themselves by the rabid ferocity of the short-covering panic that has made this possible. Look for more upside most immediately to p2=295.17, and thence to D=305.08 if any higher. Here’s the chart.