During the more than two weeks my bullish forecast for the E-Mini S&Ps has fixated on a 2921.75 target, the futures have mostly acted constipated, but also at times tedious, violent (in both directions), turgid and deceptive. One thing that hasn’t changed is the chart itself, which never wavered from the once-laughable target no matter how grim the news. There were skeptics in the Rick’s Picks Trading Room when the broad averages dove last week for two straight sessions. More recently, however, with four days of upward progress, a presumptive finishing stroke to 2921.75 now looks like a given. It is no longer a matter of whether the target will be reached, but how soon.

During the more than two weeks my bullish forecast for the E-Mini S&Ps has fixated on a 2921.75 target, the futures have mostly acted constipated, but also at times tedious, violent (in both directions), turgid and deceptive. One thing that hasn’t changed is the chart itself, which never wavered from the once-laughable target no matter how grim the news. There were skeptics in the Rick’s Picks Trading Room when the broad averages dove last week for two straight sessions. More recently, however, with four days of upward progress, a presumptive finishing stroke to 2921.75 now looks like a given. It is no longer a matter of whether the target will be reached, but how soon.

Some in the trading room speculated it would occur as early as Monday night. This tells me that one of two things is about to happen: 1) the rally will die without having reached the target. I give this scenario a 15% chance; or 2) buyers will soon reach 2921.75, then blow past it with such force as to leave us wondering whether new all-time highs are coming. If this proves to be the case, be aware that it will have nothing to do with the ridiculous, conflicted reasons the MSM is sure to concoct. We are witnessing a powerful short-squeeze is all, even if the dim bulbs who invent the news each day are incapable of choking out those two words, and even if none of them will ever understand that the ups and downs of the stock market are not driven by the economy, but the other way around. With that in mind, realize that the Wall Street operators who have been nurturing and manipulating this short-covering binge are not about to squash it with heavy-handed selling, at least not until the last bear has been ripped a new orifice.

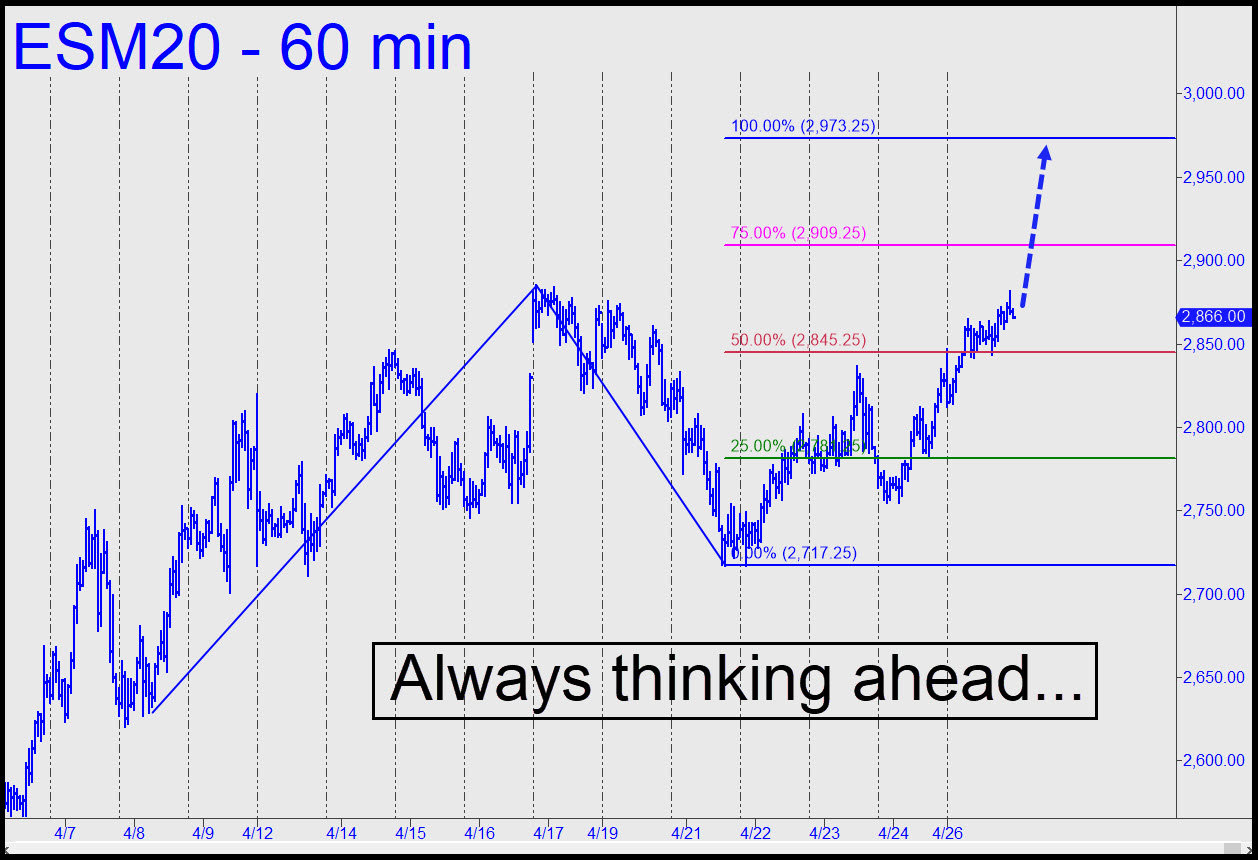

Mardi Gras in Pyongyang

So how do we prepare? For starters, by fixing the new target at 2973.25 (see inset) firmly in mind, since that’s where the June contract will be headed if and when it impales our old friend, 2921.75. You can get short at that number if you know what you’re doing, since there are good technical reasons to expect a tradeable pullback from it despite its high visibility on the Rick’s Picks marquee for the last two weeks. A thrust exceeding it would be telegraphing more upside to at least 2973.75, at which point even benighted pundits and analysts will begin to realize that stocks are not paying much attention to the news. Lately, it has featured Treasury’s Mnuchin cheerleading a Q3 economic recovery that, unless you define a dead-cat bounce as growth, seems as likely as a Mardi Gras parade in Pyongyang. Trust your instincts on this, no meaningful recover is on the horizon, even if a national clampdown has temporarily frustrated Covid-19. _______ UPDATE (Apr 28, 8:59 p.m.): Have the futures traveled nearly 500 points since April 3, only to fall eight points shy of the well-advertised target at 2921.75 noted above? So it would seem, since they fell 60 points this morning after topping at 2913.50. The plunge was not impulsive even on the hourly chart, and so we shouldn’t be too surprised if bulls turn things around and have another go at it. Attempting to get short on a second pass would be less enticing, but we might do so anyway. Stay tuned to the chat room for guidance in real time if you care. Please note that a decisive pop through the target would put the 2973.25 target in play. Alternatively, weakness exceeding 2843.75 to the downside over the next day or two would generate a mildly concerning impulse leg on the hourly chart.