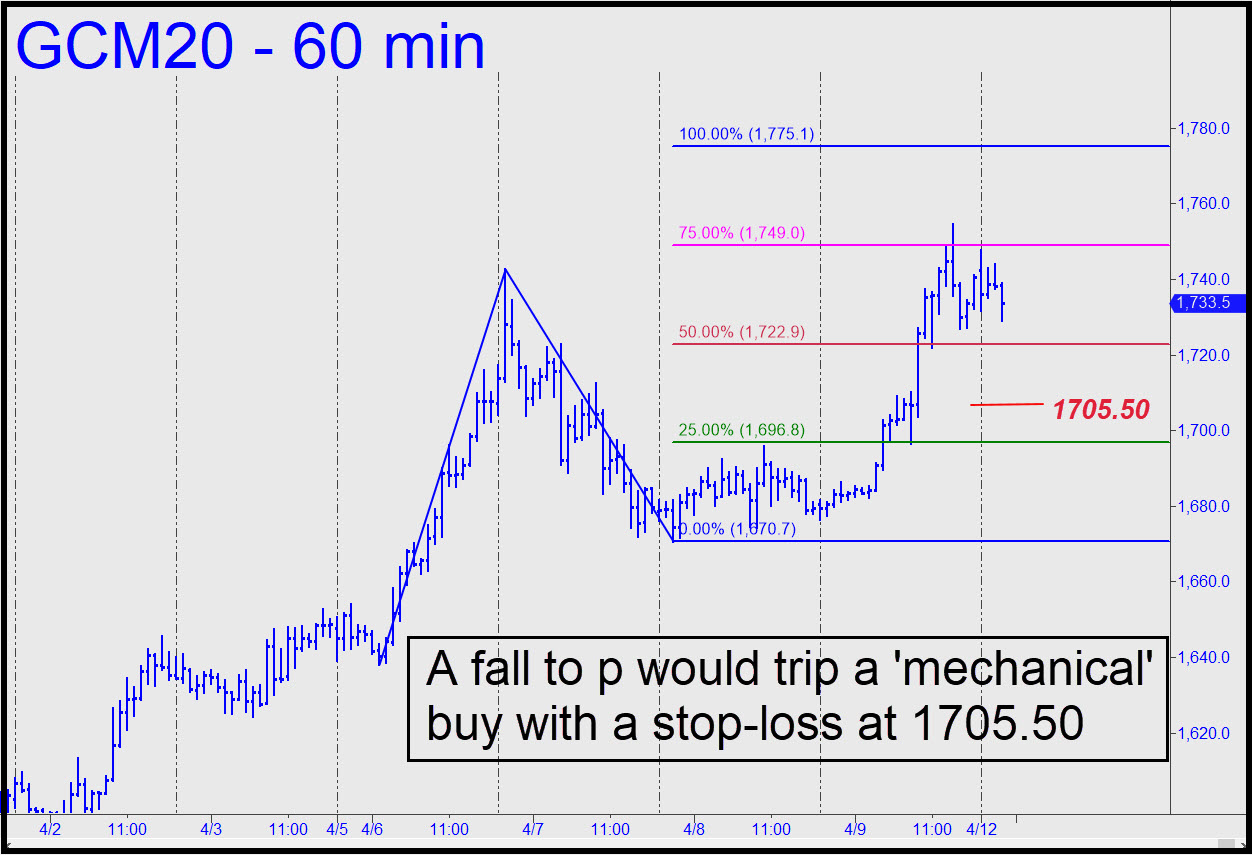

Gold is down an unpersuasive $24 at the moment, perhaps resting for more-challenging adversity in the wee hours. We remain focused on two rally targets nonetheless: one at 1782.30 that is tied to a big pattern that’s been in play for more than a week; and another, lesser Hidden Pivot at 1775.10 that is shown in the chart. Ordinarily we look to bid patterns like this one at the green line — here 1696.80, and an implied stop-loss at 1670.60. That’s risking $24,000 on a four-lot trade, so I am recommending it only to those with the Hidden Pivot chops to cut the risk by 80% or more. A buy at the green line would entail about the same dollar risk (using a 1696.80 bid, stop 1670.60), although it would be somewhat less hazardous, as well- developed green-line entries tend to be. By that point, depending on the time of day, it may be possible to substitute GLD, or options on it, for the futures contract. _______ UPDATE (Apr 13, 8:15 a.m. EDT): The trade recommended above missed triggering at 11:00 p.m. by a micron. Cancel the order, since I’m not keen on sloppy seconds in this instance. If anyone filled the order using an rABC (a=1731.80 at 7:00 p.m. on the hourly chart) or a camo set-up, please let me know so that I can establish a tracking position. It could have produced a profit so far of as much as $8,600 on four lots.

Gold is down an unpersuasive $24 at the moment, perhaps resting for more-challenging adversity in the wee hours. We remain focused on two rally targets nonetheless: one at 1782.30 that is tied to a big pattern that’s been in play for more than a week; and another, lesser Hidden Pivot at 1775.10 that is shown in the chart. Ordinarily we look to bid patterns like this one at the green line — here 1696.80, and an implied stop-loss at 1670.60. That’s risking $24,000 on a four-lot trade, so I am recommending it only to those with the Hidden Pivot chops to cut the risk by 80% or more. A buy at the green line would entail about the same dollar risk (using a 1696.80 bid, stop 1670.60), although it would be somewhat less hazardous, as well- developed green-line entries tend to be. By that point, depending on the time of day, it may be possible to substitute GLD, or options on it, for the futures contract. _______ UPDATE (Apr 13, 8:15 a.m. EDT): The trade recommended above missed triggering at 11:00 p.m. by a micron. Cancel the order, since I’m not keen on sloppy seconds in this instance. If anyone filled the order using an rABC (a=1731.80 at 7:00 p.m. on the hourly chart) or a camo set-up, please let me know so that I can establish a tracking position. It could have produced a profit so far of as much as $8,600 on four lots.

GCM20 – June Gold (Last:1746.40)

Posted on April 12, 2020, 10:37 pm EDT

Last Updated April 13, 2020, 8:17 am EDT

Posted on April 12, 2020, 10:37 pm EDT

Last Updated April 13, 2020, 8:17 am EDT