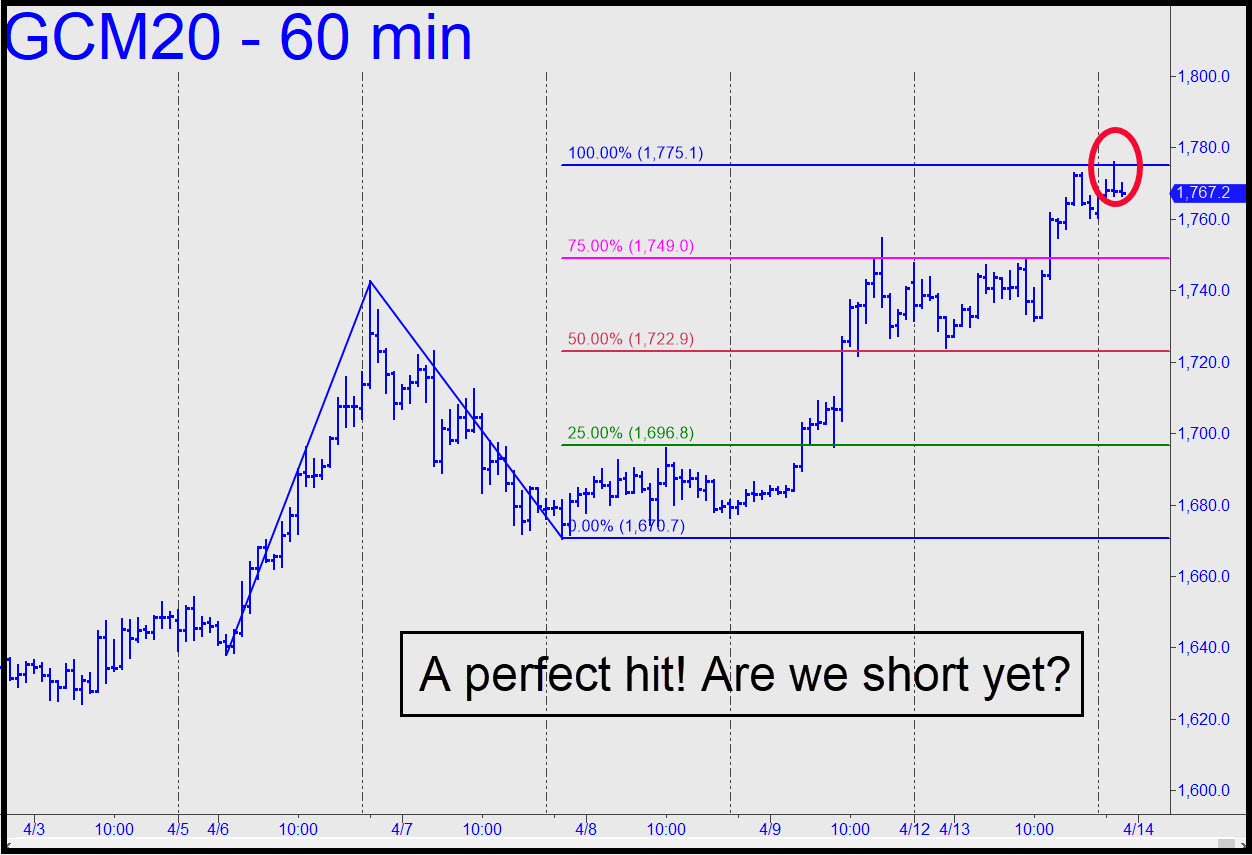

The June futures have topped so far this evening less than a point from the 1775.10 rally target I’d flagged Sunday night (“Gold is down an unpersuasive $24 at the moment…”). The target may have been especially useful to subscribers who felt discouraged by gold’s $30 drop after Thursday’s close. I’d suggested buying on weakness using a ‘mechanical’ bid at 1722.90. It failed by a hair to trigger, but the point of it was to avoid hoping for the gift of a pullback all the way to the green line, where we initiate most of our ‘mechanical’ trades. The chart raised the prospect of an rABC short, but it actually triggered at 1772.20 just after the chart was drawn and produced a $370/contract gain on paper. Here’s the rABC pattern on the 30-minute chart: a=1772.80 (4/13 at 4:00 p.m.) Bulletin: Gold’s pop just now above 1775.10 means the June contract is on its way to at least 1782.30, a bigger-picture target we’ve been using for quite a while that could prove challenging to beat.

The June futures have topped so far this evening less than a point from the 1775.10 rally target I’d flagged Sunday night (“Gold is down an unpersuasive $24 at the moment…”). The target may have been especially useful to subscribers who felt discouraged by gold’s $30 drop after Thursday’s close. I’d suggested buying on weakness using a ‘mechanical’ bid at 1722.90. It failed by a hair to trigger, but the point of it was to avoid hoping for the gift of a pullback all the way to the green line, where we initiate most of our ‘mechanical’ trades. The chart raised the prospect of an rABC short, but it actually triggered at 1772.20 just after the chart was drawn and produced a $370/contract gain on paper. Here’s the rABC pattern on the 30-minute chart: a=1772.80 (4/13 at 4:00 p.m.) Bulletin: Gold’s pop just now above 1775.10 means the June contract is on its way to at least 1782.30, a bigger-picture target we’ve been using for quite a while that could prove challenging to beat.

GCM20 – June Gold (Last:1778.70)

Posted on April 13, 2020, 10:00 pm EDT

Last Updated April 14, 2020, 6:04 pm EDT

Posted on April 13, 2020, 10:00 pm EDT

Last Updated April 14, 2020, 6:04 pm EDT

- April 14, 2020, 11:59 am

Many of your Momentum targets has been exceeded. AAPL, Gold, etc… Must mean we are not near a top? Pump it UP!!!!