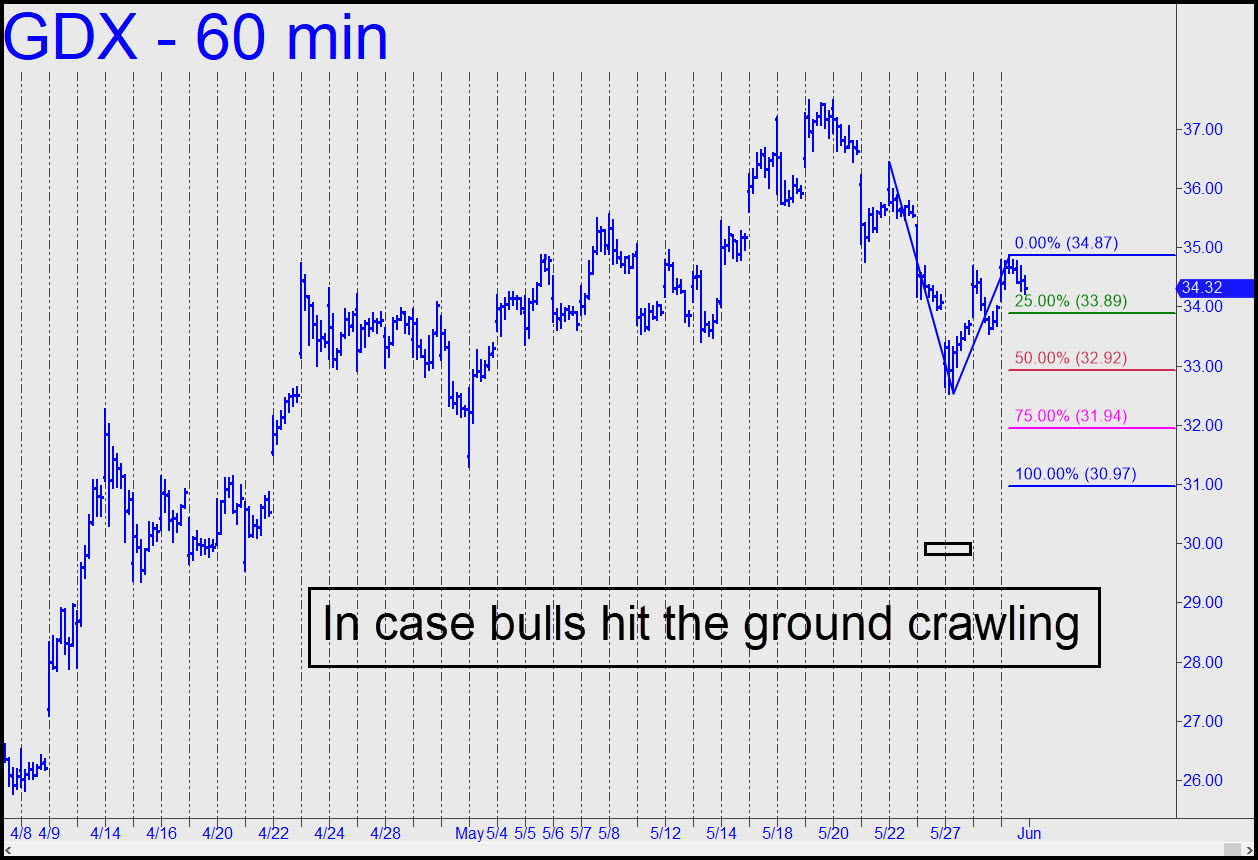

Although GDX has not fallen to the green line to put the 30.97 target in play (see inset), I’ve drawn the pattern with a bearish bias just in case. I am not down on this vehicle at the moment, but a little bit of weakness could set up an attractive buying opportunity at 32.92, the pattern’s midpoint Hidden Pivot. I will continue nevertheless to solicit crowdsourced ideas for getting long, and possibly even building a long-term position. But if we are going to attempt a buy-and-hold from the get-go, it will require an optimal entry point with clear opportunities to take partial profits along the way. _____ UPDATE (June 1, 7:13 p.m. EDT): A pullback to p at 2:00 p.m. generated an appealing ‘mechanical’ buy signal at 34.88. The subsequent rally appears bound for at least 35.54. No one has mentioned GDX in the Trading Room since Friday, implying there is very little interest in this vehicle at the moment. It is still a crowdsource project. ______ UPDATE (June 2, 5:35 p.m.): Two Hidden Pivot levels I mentioned in the Trading Room this morning look promising for bottom-fishing: 33.65 and, especially, 31.77 (corrected). Here’s the chart. I’ve suggested using rABC or ‘camouflage’ to get aboard, but a limit bid and tight stop-loss will do if easy entries are your preference. ______ UPDATE (June 3, 8:45 p.m.): I’d suggest a light touch if you plan to bottom-fish this cinder block at 31.77 — a 12-cent stop-loss at most. If it’s hit, we can try again ‘counterintuitively’ beneath the 31.31 low recorded on May 1. Tune to the Trading Room for rABC guidance in real time. ______ UPDATE (June 8, 9:56 p.m.): GDX tripped a picture-perfect ‘mechanical’ buy at 32.39, but it went unnoticed in the Trading Room. I’ll leave this vehicle on the list for another day, but if there is no show of interest, it’ll go on the shelf for a while.

Although GDX has not fallen to the green line to put the 30.97 target in play (see inset), I’ve drawn the pattern with a bearish bias just in case. I am not down on this vehicle at the moment, but a little bit of weakness could set up an attractive buying opportunity at 32.92, the pattern’s midpoint Hidden Pivot. I will continue nevertheless to solicit crowdsourced ideas for getting long, and possibly even building a long-term position. But if we are going to attempt a buy-and-hold from the get-go, it will require an optimal entry point with clear opportunities to take partial profits along the way. _____ UPDATE (June 1, 7:13 p.m. EDT): A pullback to p at 2:00 p.m. generated an appealing ‘mechanical’ buy signal at 34.88. The subsequent rally appears bound for at least 35.54. No one has mentioned GDX in the Trading Room since Friday, implying there is very little interest in this vehicle at the moment. It is still a crowdsource project. ______ UPDATE (June 2, 5:35 p.m.): Two Hidden Pivot levels I mentioned in the Trading Room this morning look promising for bottom-fishing: 33.65 and, especially, 31.77 (corrected). Here’s the chart. I’ve suggested using rABC or ‘camouflage’ to get aboard, but a limit bid and tight stop-loss will do if easy entries are your preference. ______ UPDATE (June 3, 8:45 p.m.): I’d suggest a light touch if you plan to bottom-fish this cinder block at 31.77 — a 12-cent stop-loss at most. If it’s hit, we can try again ‘counterintuitively’ beneath the 31.31 low recorded on May 1. Tune to the Trading Room for rABC guidance in real time. ______ UPDATE (June 8, 9:56 p.m.): GDX tripped a picture-perfect ‘mechanical’ buy at 32.39, but it went unnoticed in the Trading Room. I’ll leave this vehicle on the list for another day, but if there is no show of interest, it’ll go on the shelf for a while.

GDX – Gold Miners ETF (Last:32.79)

Posted on May 31, 2020, 10:31 pm EDT

Last Updated June 9, 2020, 11:00 pm EDT

Posted on May 31, 2020, 10:31 pm EDT

Last Updated June 9, 2020, 11:00 pm EDT