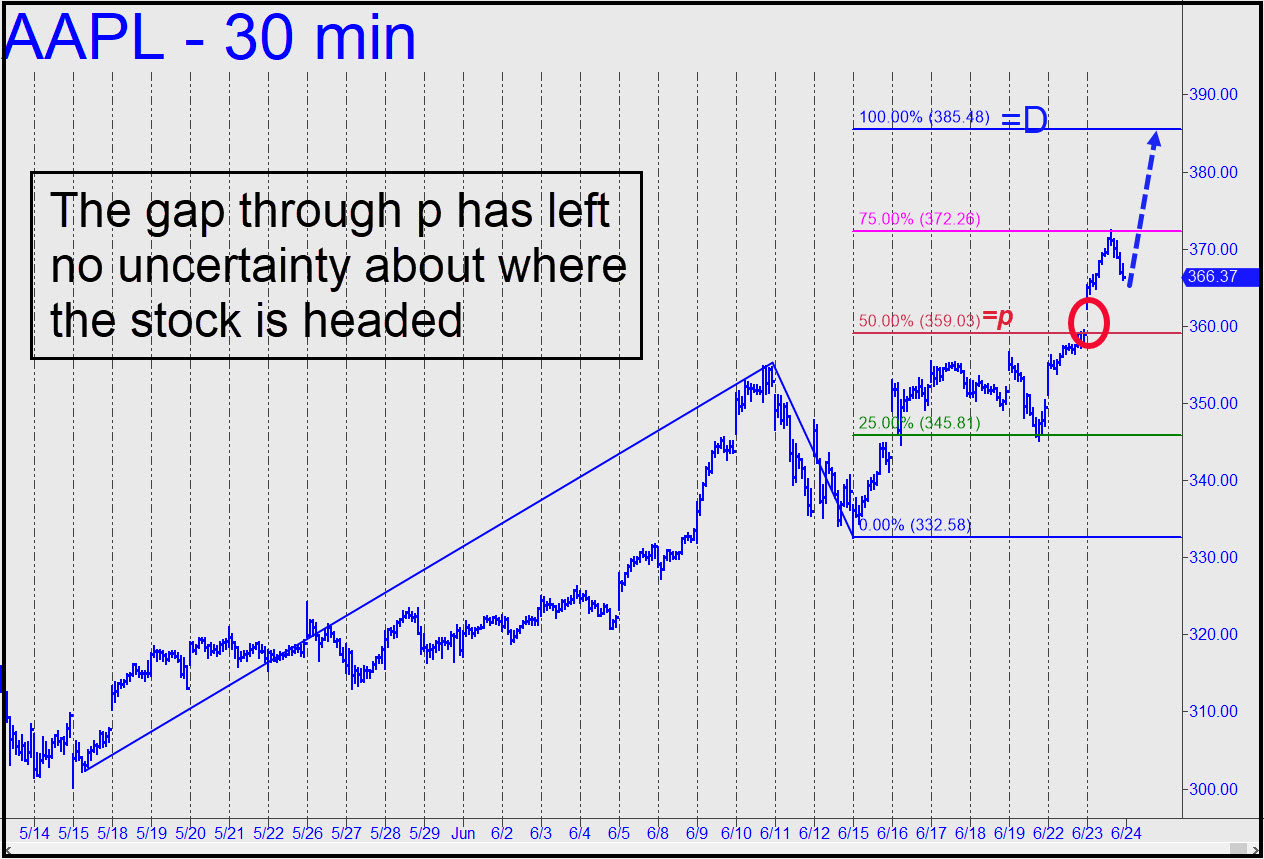

AAPL, the most owned and institutionally loved stock on this planet or any other, has turned our longstanding rally target at 370.15 into chop suey, telegraphing still-higher prices to come. Specifically, the stock is an odds-on bet to reach D=385.48, at least, given the way short-covering bears shredded the 359.03 midpoint resistance after the close. Even the sleazeballs who work this stock couldn’t avoid a pullback from the secondary pivot at 372.26, since, as we know, all vehicles in all times frames, whether moving up or down and irrespective of the news, reverse 100% of the time at p2 (just kidding, sort of). Anyway, we’ll look for ways to leverage a bullish bias — not only in this stock, but in all stocks traded around the world, since AAPL is now carrying them effortlessly higher. _______ UPDATE (Jun 24, 7:16 p.m.): Today’s hard selloff did not change the odds of AAPL’s reaching 385.48. In fact, the weakness tripped a mechanical buy at p=359.03, stop 350.21. I’d suggest paper trading this one, given that the initial risk is almost $900 per round lot. If it works, it will demonstrate yet again how ‘mechanical’ trades allow us to go against our fears and doubts. _______ UPDATE (Jun 25, 5:51 p.m.): For those of you who are paper-trading this one, or are in the trade with real money, I’ll recommend taking off 25% of the position at a current price of 364.60. That will effectively reduce the cost basis of the 300 shares that remain to 357.17. Offer an addition round lot to close at 366.70.

AAPL, the most owned and institutionally loved stock on this planet or any other, has turned our longstanding rally target at 370.15 into chop suey, telegraphing still-higher prices to come. Specifically, the stock is an odds-on bet to reach D=385.48, at least, given the way short-covering bears shredded the 359.03 midpoint resistance after the close. Even the sleazeballs who work this stock couldn’t avoid a pullback from the secondary pivot at 372.26, since, as we know, all vehicles in all times frames, whether moving up or down and irrespective of the news, reverse 100% of the time at p2 (just kidding, sort of). Anyway, we’ll look for ways to leverage a bullish bias — not only in this stock, but in all stocks traded around the world, since AAPL is now carrying them effortlessly higher. _______ UPDATE (Jun 24, 7:16 p.m.): Today’s hard selloff did not change the odds of AAPL’s reaching 385.48. In fact, the weakness tripped a mechanical buy at p=359.03, stop 350.21. I’d suggest paper trading this one, given that the initial risk is almost $900 per round lot. If it works, it will demonstrate yet again how ‘mechanical’ trades allow us to go against our fears and doubts. _______ UPDATE (Jun 25, 5:51 p.m.): For those of you who are paper-trading this one, or are in the trade with real money, I’ll recommend taking off 25% of the position at a current price of 364.60. That will effectively reduce the cost basis of the 300 shares that remain to 357.17. Offer an addition round lot to close at 366.70.

AAPL – Apple Computer (Last:364.70)

Posted on June 23, 2020, 9:44 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT

Posted on June 23, 2020, 9:44 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT