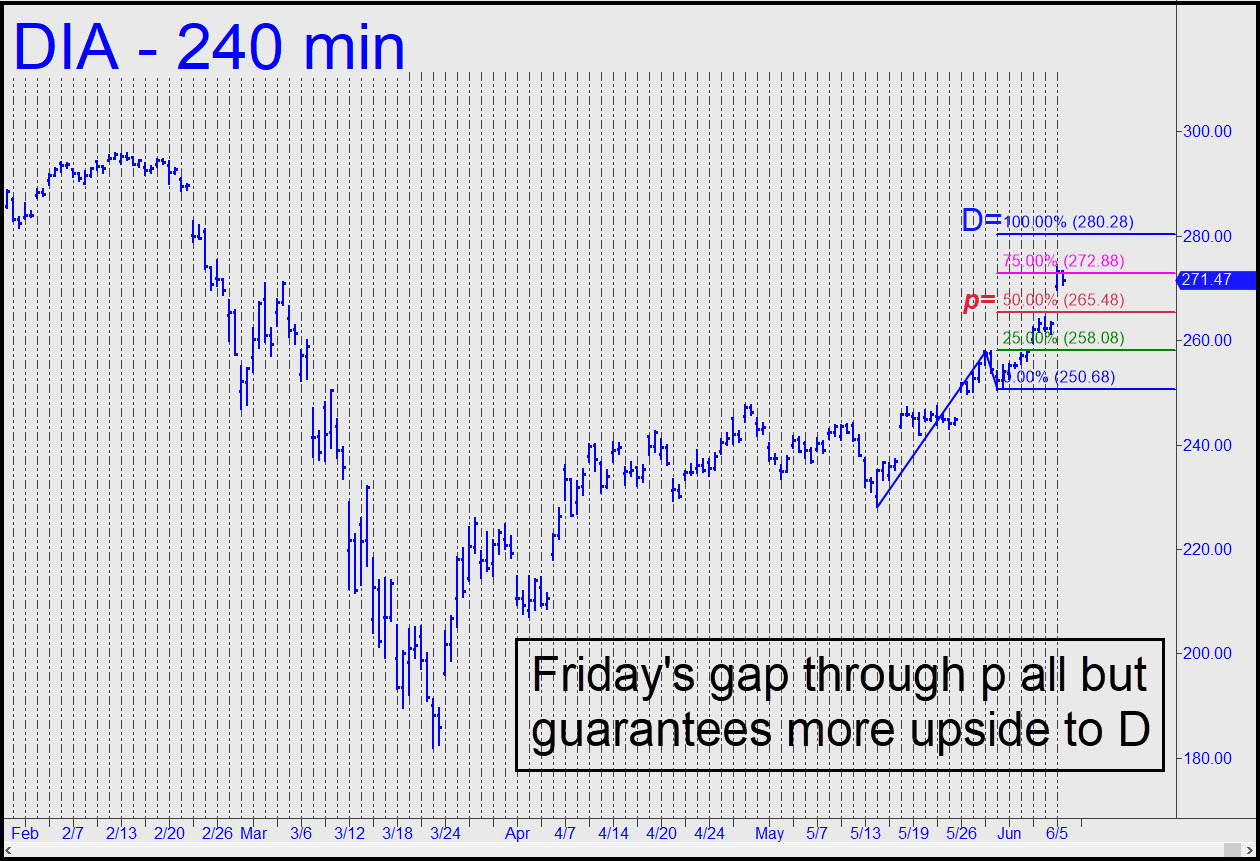

DIA’s gap-up openings have provided no opportunities to get long on-the-fly. Instead, we’ll have to settle for a short initiated at D=280.28, a Hidden Pivot that is all but guaranteed to be reached because of Friday’s gap through p=265.48. I’ll suggest buying the first near-expiration puts priced under $1 when DIA gets within 0.05 points of the target. I may be able to refine that strategy in real time, so stay tuned to the Trading Room if you care. A move to the target will turn the old record high at 295.87 magnetic, so we should have no illusions about D’s stopping power. _____ UPDATE (June 10, 9:40 p.m. EDT): The 280.28 target is still an odds-on bet, but DIA looks like it’s fixing to roll down hard before the next bull thrust. Ordinarily I would suggest placing a ‘mechanical’ bid at 265.48, but my gut it saying we’ll be able to get in cheaper if we wait. Here’s a nice chart to hearten all of you bears who have been waiting so patiently for a breath of sanity. _______ UPDATE (June 11, 8:21 p.m.): DIA crashed without quite reaching the 280.28 target, and although some subscribers apparently got short ahead of the plunge, they acted on their own initiative, so I am not establishing a tracking position. My gut feeling is that the selling will continue into next week, and I’d therefore suggest caution if you jump on any rallies on Friday. _______ UPDATE (June 14, 11:07 p.m.): The midpoint pivot has held so far, since the Mini-Dow futures have traded no lower than 25,080 as of 11 p.m. Sunday night. If it is breached decisively, that would put the 237.52 target in play. The pattern could be tradeable, so tune to the chat room if you care. _______ UPDATE (Jun 15, 9:02 p.m.): No clear opportunities were present on the hourly chart as of Monday night. Stay tuned to the Trading Room for further guidance. _______ UPDATE (June 16, 10:41 p.m.): If the point ‘C’ low of this pattern survives the first hour, expect minimum upside to p=269.49. An opportunity to get short there with a tight stop could materialize, so stay tuned to the chat room for guidance. _______ UPDATE (Jun 17, 9:42 p.m.): Buyers provided no lift, only sideways movement that allowed DaBoyz to distribute stock all day long. Look for DIA to head lower into week’s end, perhaps significantly. The nearest important support lies at 254.62, a midpoint Hidden Pivot that can serve for now as a minimum downside objective. An easy breach would grease the skids down to 242.09. Here’s the chart.

DIA’s gap-up openings have provided no opportunities to get long on-the-fly. Instead, we’ll have to settle for a short initiated at D=280.28, a Hidden Pivot that is all but guaranteed to be reached because of Friday’s gap through p=265.48. I’ll suggest buying the first near-expiration puts priced under $1 when DIA gets within 0.05 points of the target. I may be able to refine that strategy in real time, so stay tuned to the Trading Room if you care. A move to the target will turn the old record high at 295.87 magnetic, so we should have no illusions about D’s stopping power. _____ UPDATE (June 10, 9:40 p.m. EDT): The 280.28 target is still an odds-on bet, but DIA looks like it’s fixing to roll down hard before the next bull thrust. Ordinarily I would suggest placing a ‘mechanical’ bid at 265.48, but my gut it saying we’ll be able to get in cheaper if we wait. Here’s a nice chart to hearten all of you bears who have been waiting so patiently for a breath of sanity. _______ UPDATE (June 11, 8:21 p.m.): DIA crashed without quite reaching the 280.28 target, and although some subscribers apparently got short ahead of the plunge, they acted on their own initiative, so I am not establishing a tracking position. My gut feeling is that the selling will continue into next week, and I’d therefore suggest caution if you jump on any rallies on Friday. _______ UPDATE (June 14, 11:07 p.m.): The midpoint pivot has held so far, since the Mini-Dow futures have traded no lower than 25,080 as of 11 p.m. Sunday night. If it is breached decisively, that would put the 237.52 target in play. The pattern could be tradeable, so tune to the chat room if you care. _______ UPDATE (Jun 15, 9:02 p.m.): No clear opportunities were present on the hourly chart as of Monday night. Stay tuned to the Trading Room for further guidance. _______ UPDATE (June 16, 10:41 p.m.): If the point ‘C’ low of this pattern survives the first hour, expect minimum upside to p=269.49. An opportunity to get short there with a tight stop could materialize, so stay tuned to the chat room for guidance. _______ UPDATE (Jun 17, 9:42 p.m.): Buyers provided no lift, only sideways movement that allowed DaBoyz to distribute stock all day long. Look for DIA to head lower into week’s end, perhaps significantly. The nearest important support lies at 254.62, a midpoint Hidden Pivot that can serve for now as a minimum downside objective. An easy breach would grease the skids down to 242.09. Here’s the chart.

DIA – Dow Industrials ETF (Last:261.81)

Posted on June 7, 2020, 5:15 pm EDT

Last Updated June 17, 2020, 9:42 pm EDT

Posted on June 7, 2020, 5:15 pm EDT

Last Updated June 17, 2020, 9:42 pm EDT