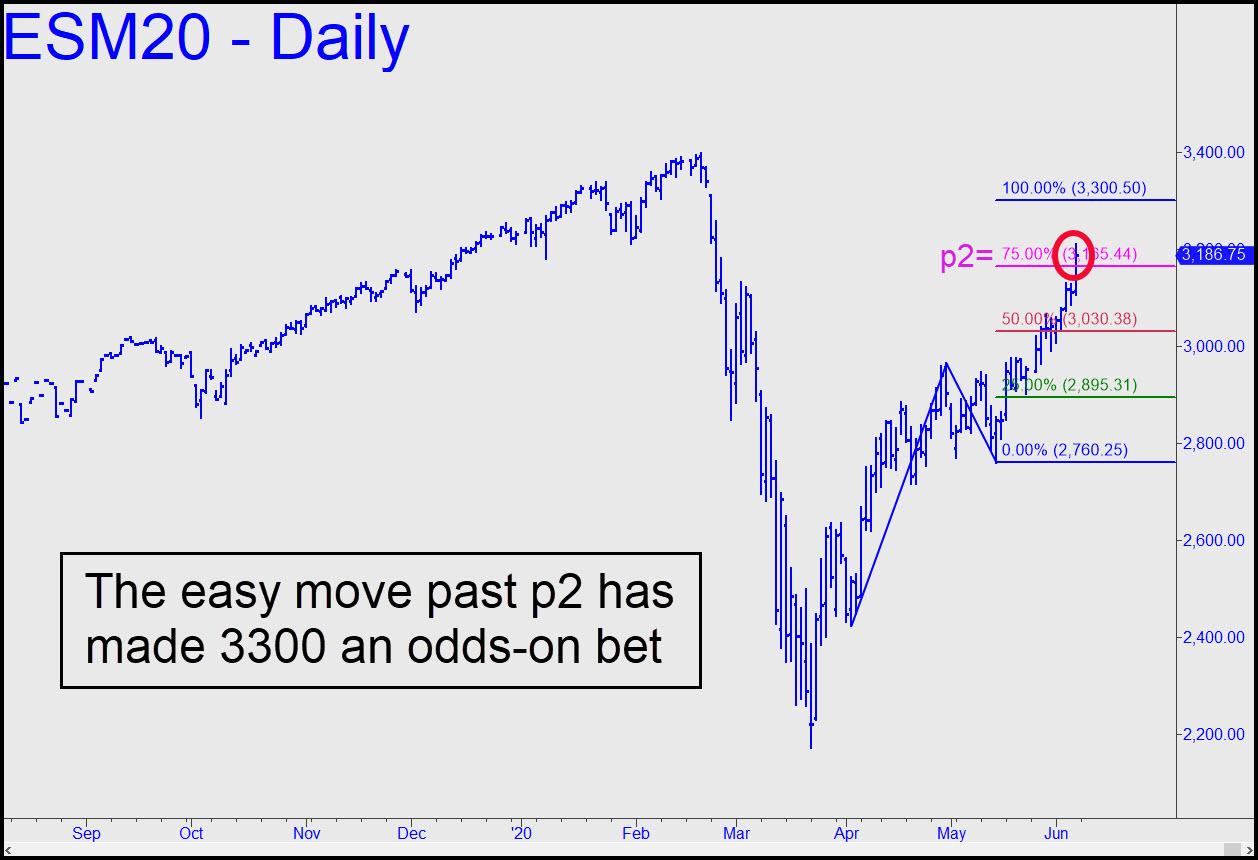

Bulls faced two daunting Hidden Pivot obstacles on Friday, demolishing both with little effort. They’d been well advertised here, making them less than ideal as places to get short. Fortunately, they appear to have kept some subscribers who’ve had trouble believing this absurd rally from getting short prematurely. You should prepare yourselves now for upside to at least 3300.50, the Hidden pivot shown in the chart. Judging from the way the uptrend has impaled the secondary pivot at 3165.44, the June contract should have little difficulty getting there. We’ll want to squeeze off a short at that point, but as usual, I am recommending the trade mainly to those of you who have made some money — at least $1000 in this case — on the way up. Please note that the equivalent target for the September contract, which will become active the week of June 15, is 3285.50. Here is the chart. _______ UPDATE (June 8, 9:28 p.m. EDT): Use this pattern to trade the little monsters en route to the bigger-picture target at 3300.50 noted above. It projects to 3259.50, and all levels — x. p and p2 — can be used to position a ‘mechanical’ bid that meets the criteria of the Hidden Pivot Method. As always, seek real-tie guidance in the Trading Room if you are interested._______ UPDATE (June 9, 10:22 p.m.): You’re up $5200 at the moment if you used the pattern linked in the previous update to stage a ‘mechanical’ bid at the green line. The set-up was textbook-perfect, although it took the futures six hours to get airborne after they tripped a buy signal at 4:30 a.m. Eastern. Here’s the chart. If I hear from two subscribers who are still in the trade, I’ll establish a tracking position. ______ UPDATE (June 10, 10:22 p.m.): No one took the trade, apparently, but it should have been exited on a ‘dynamic’ trailing stop at around 3225 for a gain of around $5100.

Bulls faced two daunting Hidden Pivot obstacles on Friday, demolishing both with little effort. They’d been well advertised here, making them less than ideal as places to get short. Fortunately, they appear to have kept some subscribers who’ve had trouble believing this absurd rally from getting short prematurely. You should prepare yourselves now for upside to at least 3300.50, the Hidden pivot shown in the chart. Judging from the way the uptrend has impaled the secondary pivot at 3165.44, the June contract should have little difficulty getting there. We’ll want to squeeze off a short at that point, but as usual, I am recommending the trade mainly to those of you who have made some money — at least $1000 in this case — on the way up. Please note that the equivalent target for the September contract, which will become active the week of June 15, is 3285.50. Here is the chart. _______ UPDATE (June 8, 9:28 p.m. EDT): Use this pattern to trade the little monsters en route to the bigger-picture target at 3300.50 noted above. It projects to 3259.50, and all levels — x. p and p2 — can be used to position a ‘mechanical’ bid that meets the criteria of the Hidden Pivot Method. As always, seek real-tie guidance in the Trading Room if you are interested._______ UPDATE (June 9, 10:22 p.m.): You’re up $5200 at the moment if you used the pattern linked in the previous update to stage a ‘mechanical’ bid at the green line. The set-up was textbook-perfect, although it took the futures six hours to get airborne after they tripped a buy signal at 4:30 a.m. Eastern. Here’s the chart. If I hear from two subscribers who are still in the trade, I’ll establish a tracking position. ______ UPDATE (June 10, 10:22 p.m.): No one took the trade, apparently, but it should have been exited on a ‘dynamic’ trailing stop at around 3225 for a gain of around $5100.

ESM20 – June E-Mini S&Ps (Last:3190.00)

Posted on June 7, 2020, 5:30 pm EDT

Last Updated June 10, 2020, 10:21 pm EDT

Posted on June 7, 2020, 5:30 pm EDT

Last Updated June 10, 2020, 10:21 pm EDT