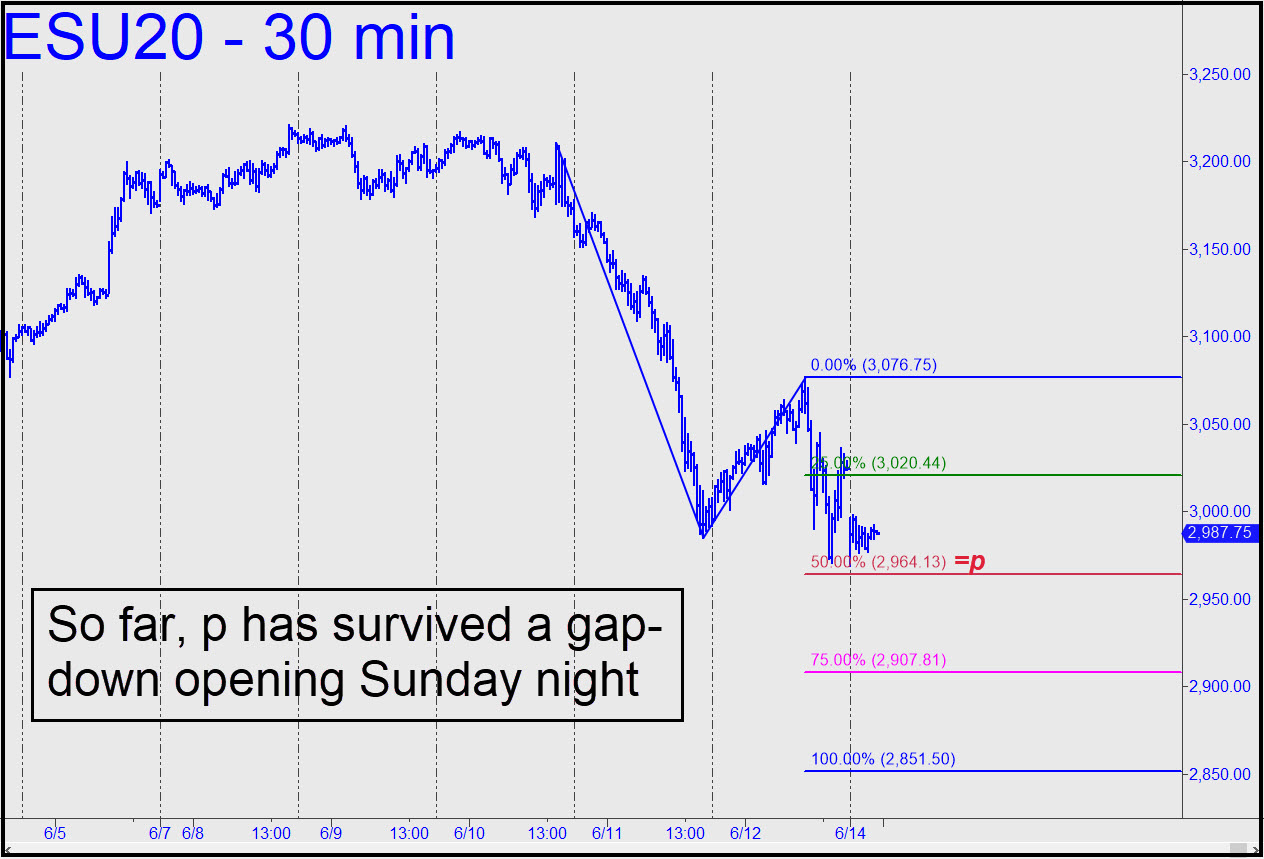

A gap-down opening Sunday night that was intended to exhaust sellers has left a crucial midpoint support at 2964 untouched. If it is decisively penetrated, that would put the 2851.50 target theoretically in play and also set up a ‘mechanical’ short on a rally back up to the green line. Although the opening bar necessarily achieved its purpose, the shallow bounce so far suggests that a second wave of selling is coming. Any further analysis will have to wait until liquidity shows up at the opening bell. _______ UPDATE (June 15, 8:22 p.m. EDT): Some subscribers got in front of a speeding projectile today, shorting at the green line without a game plan. Check out my posts in the Trading Room between 12:19 and 12:56 for some helpful hints. I put out a wide range of recommendations suited to all levels of experience, but the ones intended for relative novices or those unfamiliar with the Hidden Pivot Method usually contain explicitly detailed instructions. In general, if the instructions do not tell you everything you (personally) need to know to do the trade, you should pass it up. There will always be another opportunity. If a trade recommendation lacks such details, it is not an oversight; rather, it is because tactical clarity was not possible at the time the guidance was formulated. ______UPDATE (June 16, 10:27 p.m.) The rally stalled almost precisely at the 3158.25 midpoint pivot shown here. Given my bullish outlook for AAPL, however, we can expect buyers to surpass the resistance and climb to at least p2=3275.50, if not necessarily to D=3392.75.

A gap-down opening Sunday night that was intended to exhaust sellers has left a crucial midpoint support at 2964 untouched. If it is decisively penetrated, that would put the 2851.50 target theoretically in play and also set up a ‘mechanical’ short on a rally back up to the green line. Although the opening bar necessarily achieved its purpose, the shallow bounce so far suggests that a second wave of selling is coming. Any further analysis will have to wait until liquidity shows up at the opening bell. _______ UPDATE (June 15, 8:22 p.m. EDT): Some subscribers got in front of a speeding projectile today, shorting at the green line without a game plan. Check out my posts in the Trading Room between 12:19 and 12:56 for some helpful hints. I put out a wide range of recommendations suited to all levels of experience, but the ones intended for relative novices or those unfamiliar with the Hidden Pivot Method usually contain explicitly detailed instructions. In general, if the instructions do not tell you everything you (personally) need to know to do the trade, you should pass it up. There will always be another opportunity. If a trade recommendation lacks such details, it is not an oversight; rather, it is because tactical clarity was not possible at the time the guidance was formulated. ______UPDATE (June 16, 10:27 p.m.) The rally stalled almost precisely at the 3158.25 midpoint pivot shown here. Given my bullish outlook for AAPL, however, we can expect buyers to surpass the resistance and climb to at least p2=3275.50, if not necessarily to D=3392.75.

ESU20 – Sep E-Mini S&P (Last:3105.75)

Posted on June 14, 2020, 10:46 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT

Posted on June 14, 2020, 10:46 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT