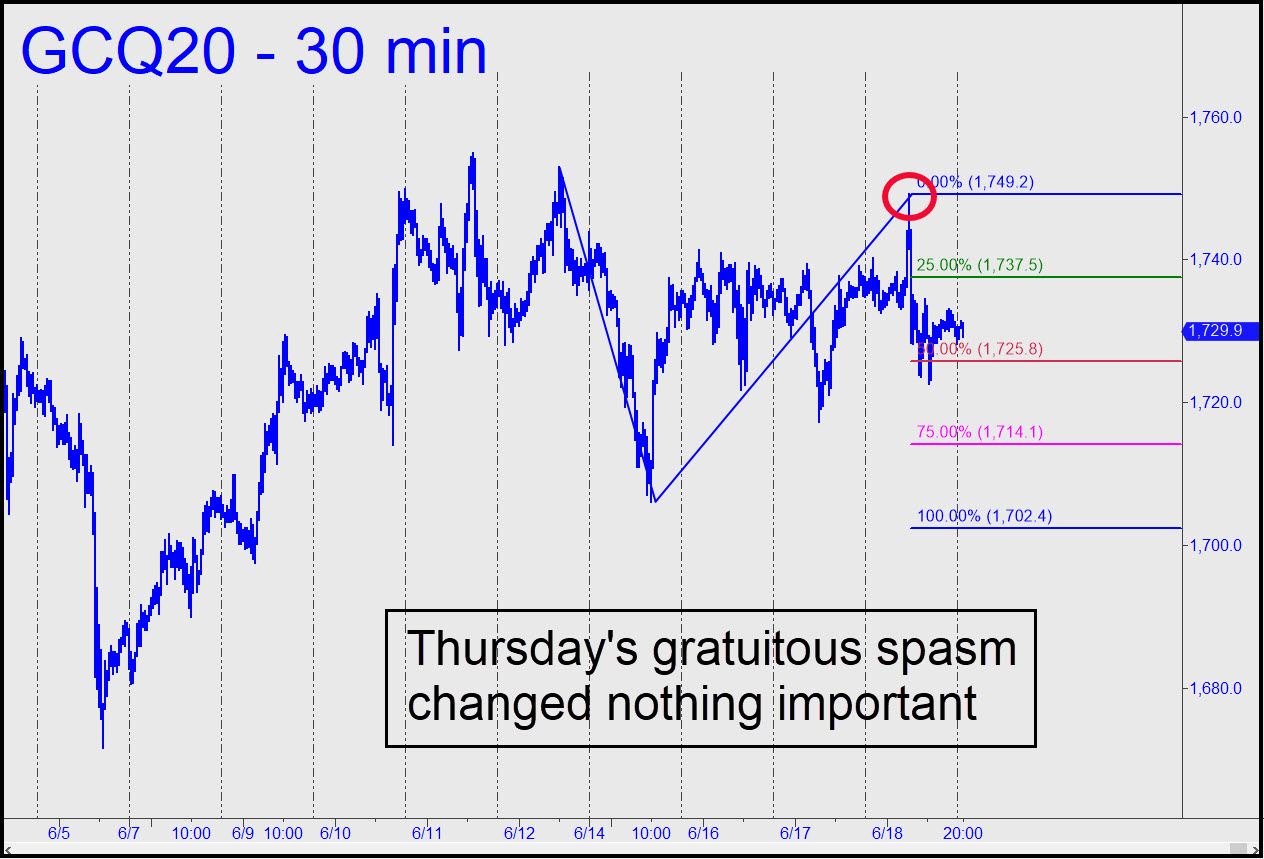

The psychotic pre-dawn spasm shown in the chart did nothing to alter an unexciting picture. As I have have said here repeatedly, gold is not in a bull market, but a bullish one. The former produces relentless rallies, with occasional swoons that are quickly recouped. Gold has done no such thing. It continues to mark time with little institutional support, unable to compete for attention with the Mother of All Short Squeeze Rallies. For now, we’ll consider gold’s prospects one day at a time. The slight breach of the 1725.80 midpoint support suggests bears will have an edge over the near term. Even so, if you are comfortable with rABC trades and their ability to limit risk significantly, bottom-fishing at p2=1714.10 looks like a potential winner. Any significant slippage below this threshold would open a path to D=1702.40. Alternatively, if the futures unexpectedly move higher, a push past 1748.40 would imply more upside to at least 1762.40, a Hidden Pivot that could show some stopping power. ______ UPDATE (Jun 23, 9:15 EDT): In after-hours trading the futures have speared a 1790 target I posted in the chat room this afternoon. Traders who got short there should have covered half of it around 1786.40, since the pullback to that number is equal to three times what was risked at the 1791.80 top. For now, I’d suggest a 1790.50 stop-loss for the remaining half, o-c-o with an order to cover another 25% of the position at 1785.80.

The psychotic pre-dawn spasm shown in the chart did nothing to alter an unexciting picture. As I have have said here repeatedly, gold is not in a bull market, but a bullish one. The former produces relentless rallies, with occasional swoons that are quickly recouped. Gold has done no such thing. It continues to mark time with little institutional support, unable to compete for attention with the Mother of All Short Squeeze Rallies. For now, we’ll consider gold’s prospects one day at a time. The slight breach of the 1725.80 midpoint support suggests bears will have an edge over the near term. Even so, if you are comfortable with rABC trades and their ability to limit risk significantly, bottom-fishing at p2=1714.10 looks like a potential winner. Any significant slippage below this threshold would open a path to D=1702.40. Alternatively, if the futures unexpectedly move higher, a push past 1748.40 would imply more upside to at least 1762.40, a Hidden Pivot that could show some stopping power. ______ UPDATE (Jun 23, 9:15 EDT): In after-hours trading the futures have speared a 1790 target I posted in the chat room this afternoon. Traders who got short there should have covered half of it around 1786.40, since the pullback to that number is equal to three times what was risked at the 1791.80 top. For now, I’d suggest a 1790.50 stop-loss for the remaining half, o-c-o with an order to cover another 25% of the position at 1785.80.

GCQ20 – August Gold (Last:1788.30)

Posted on June 18, 2020, 8:19 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT

Posted on June 18, 2020, 8:19 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT