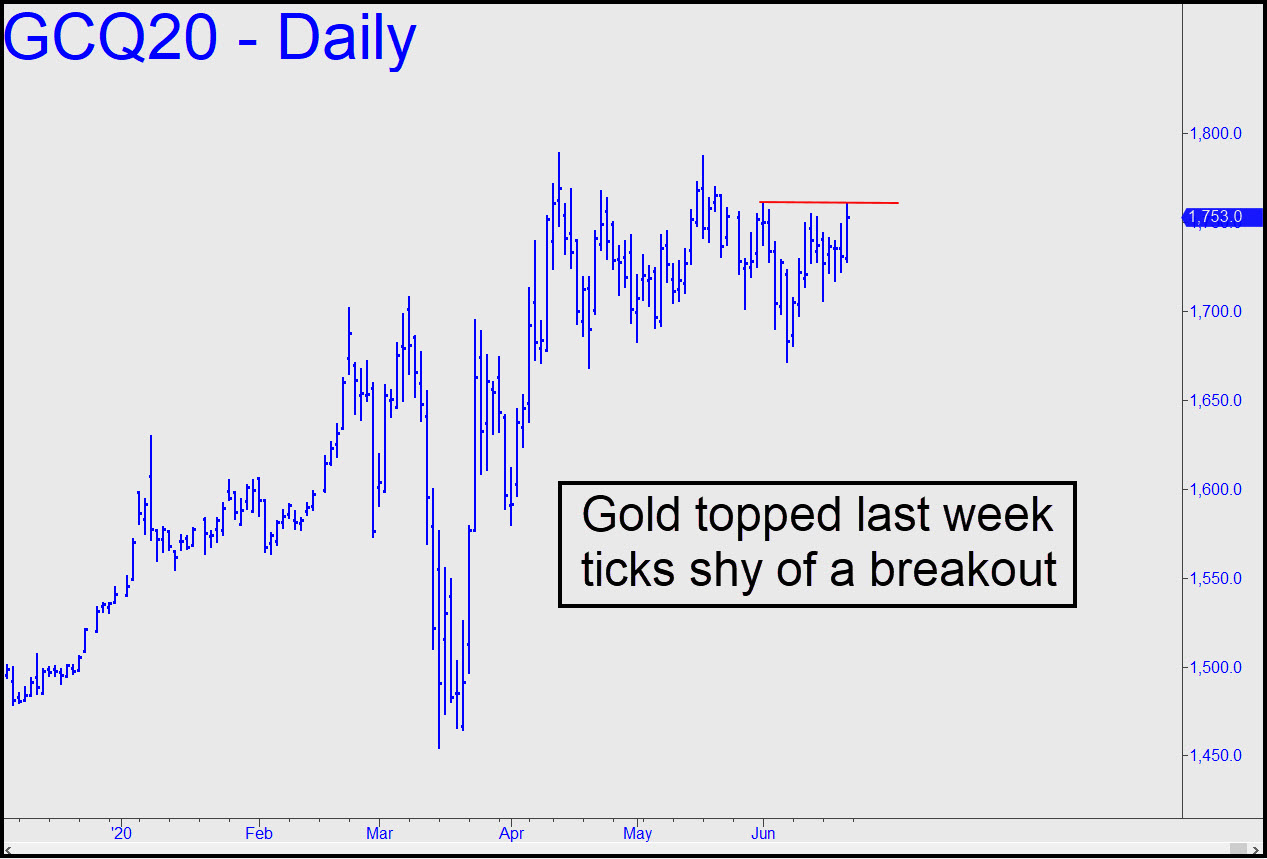

August gold rallied on Friday to within a millimeter of a 1762.40 Hidden Pivot that I’d said would show stopping power. The 1760.90 high was also a single tick shy of an external peak recorded on June 1. The shallow retracement that followed is encouraging on the question of whether a breakout is coming, but it would take a strong follow-through surpassing p=1772.90 in this chart to put the 1877.40 target seriously in play. Mechanical trades initiated using the pattern have entry risk approaching $2500 per contract, but we may be able to use smaller patterns to get it done. As always, you should tune to the Trading Room if you’re interested. _______ UPDATE (June 22, 8:49 p.m.EDT): The futures poked above 1772.90 (see above) for a moment but closed below it. This is encouraging but not quite sufficient to lock up a moon shot to the 1877.40 target. There are probably too many rightly enthusiastic buyers at this point for the futures to pull back to x=1721, but if they do, consider it a gift to traders looking for a high-odds mechanical entry, stop 1668.30. _______ UPDATE (Jun 24, 8:07): A head-fake to 1796 before DaBoyz pulled the plug would have stopped out any shorts from the 1790 level I’d flagged. All bullish targets above remain valid in theory, but we’ll wait and see what the little POS does on Thursday before we try anything new. ______ UPDATE (Jun 25, 6:30 p.m.): A day of tedium reiterated a ‘mechanical’ buy at x=1772.40 triggered Wednesday morning. We’re not officially in the trade, but 50% should be exited at p=1786.50, worked against a stop-loss at 1758.30.

August gold rallied on Friday to within a millimeter of a 1762.40 Hidden Pivot that I’d said would show stopping power. The 1760.90 high was also a single tick shy of an external peak recorded on June 1. The shallow retracement that followed is encouraging on the question of whether a breakout is coming, but it would take a strong follow-through surpassing p=1772.90 in this chart to put the 1877.40 target seriously in play. Mechanical trades initiated using the pattern have entry risk approaching $2500 per contract, but we may be able to use smaller patterns to get it done. As always, you should tune to the Trading Room if you’re interested. _______ UPDATE (June 22, 8:49 p.m.EDT): The futures poked above 1772.90 (see above) for a moment but closed below it. This is encouraging but not quite sufficient to lock up a moon shot to the 1877.40 target. There are probably too many rightly enthusiastic buyers at this point for the futures to pull back to x=1721, but if they do, consider it a gift to traders looking for a high-odds mechanical entry, stop 1668.30. _______ UPDATE (Jun 24, 8:07): A head-fake to 1796 before DaBoyz pulled the plug would have stopped out any shorts from the 1790 level I’d flagged. All bullish targets above remain valid in theory, but we’ll wait and see what the little POS does on Thursday before we try anything new. ______ UPDATE (Jun 25, 6:30 p.m.): A day of tedium reiterated a ‘mechanical’ buy at x=1772.40 triggered Wednesday morning. We’re not officially in the trade, but 50% should be exited at p=1786.50, worked against a stop-loss at 1758.30.

GCQ20 – August Gold (Last:1774.70)

Posted on June 21, 2020, 5:10 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT

Posted on June 21, 2020, 5:10 pm EDT

Last Updated July 7, 2020, 1:27 pm EDT