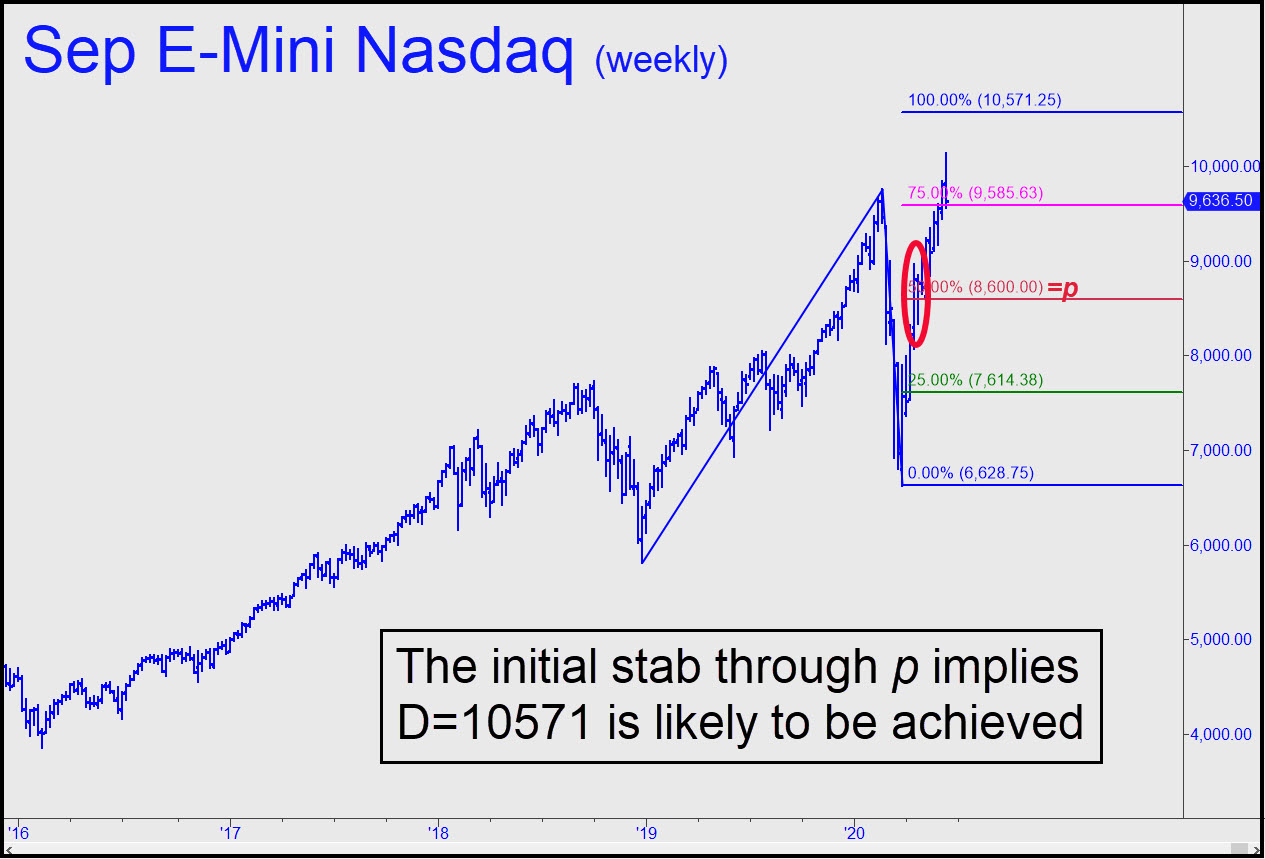

Bears had better not break out the bubbly yet, since Thursday’s powerful selloff did not disturb the 10571 rally target first disseminated here two weeks ago. The key feature in the chart is the April 17 spike through the red line, a midpoint Hidden Pivot at 8600.00. Usually, when a clear midpoint resistance is so easily and decisively penetrated it means the D target with which it is associated is likely to be achieved. That doesn’t mean the futures can’t get pummeled all the way back down to p=8600 in the meantime, or even to x=7614, before they reverse and head for their fated rendezvous with 10,571. However, we would be ‘mechanical’ buyers at either level, based on the way buyers speared the midpoint pivot. Please note that the pattern shown in the chart, with A-B shifted downward to the 2016-2018 bull cycle, came within 0.7% of nailing the then-record high of 9763 achieved in mid-February. This suggests the pattern is a good one for predicting key turning points. ______ UPDATE (Jun 15, 8:35 p.m.): Short-covering psychotics are back in the driver’s seat, headed most immediately to the 10341 target shown. Consider it a lock-up if the futures pop through p=9854 decisively or close above it for two consecutive days. As for the bigger-picture target at 10571, as recent touts made clear there was never a reason to doubt it would be reached, least of all when stocks were freefalling last week. ______ UPDATE (Jun 17, 9:31 p.m.): With AAPL and the E-Mini S&Ps mildly in retreat Thursday night, and this vehicle unable to muster a push to an unchallenging ‘secondary pivot’ at 10,098, we should expect sellers to dominate into week’s end. A moderate rally on the opening bell should be shorted, since it would imply DaBoyz are getting ready to pull the plug following a last-ditch attempt at distribution.

Bears had better not break out the bubbly yet, since Thursday’s powerful selloff did not disturb the 10571 rally target first disseminated here two weeks ago. The key feature in the chart is the April 17 spike through the red line, a midpoint Hidden Pivot at 8600.00. Usually, when a clear midpoint resistance is so easily and decisively penetrated it means the D target with which it is associated is likely to be achieved. That doesn’t mean the futures can’t get pummeled all the way back down to p=8600 in the meantime, or even to x=7614, before they reverse and head for their fated rendezvous with 10,571. However, we would be ‘mechanical’ buyers at either level, based on the way buyers speared the midpoint pivot. Please note that the pattern shown in the chart, with A-B shifted downward to the 2016-2018 bull cycle, came within 0.7% of nailing the then-record high of 9763 achieved in mid-February. This suggests the pattern is a good one for predicting key turning points. ______ UPDATE (Jun 15, 8:35 p.m.): Short-covering psychotics are back in the driver’s seat, headed most immediately to the 10341 target shown. Consider it a lock-up if the futures pop through p=9854 decisively or close above it for two consecutive days. As for the bigger-picture target at 10571, as recent touts made clear there was never a reason to doubt it would be reached, least of all when stocks were freefalling last week. ______ UPDATE (Jun 17, 9:31 p.m.): With AAPL and the E-Mini S&Ps mildly in retreat Thursday night, and this vehicle unable to muster a push to an unchallenging ‘secondary pivot’ at 10,098, we should expect sellers to dominate into week’s end. A moderate rally on the opening bell should be shorted, since it would imply DaBoyz are getting ready to pull the plug following a last-ditch attempt at distribution.

NQU20 – Sep E-Mini Nasdaq (Last:9908.75)

Posted on June 11, 2020, 9:16 pm EDT

Last Updated June 18, 2020, 7:51 pm EDT

Posted on June 11, 2020, 9:16 pm EDT

Last Updated June 18, 2020, 7:51 pm EDT