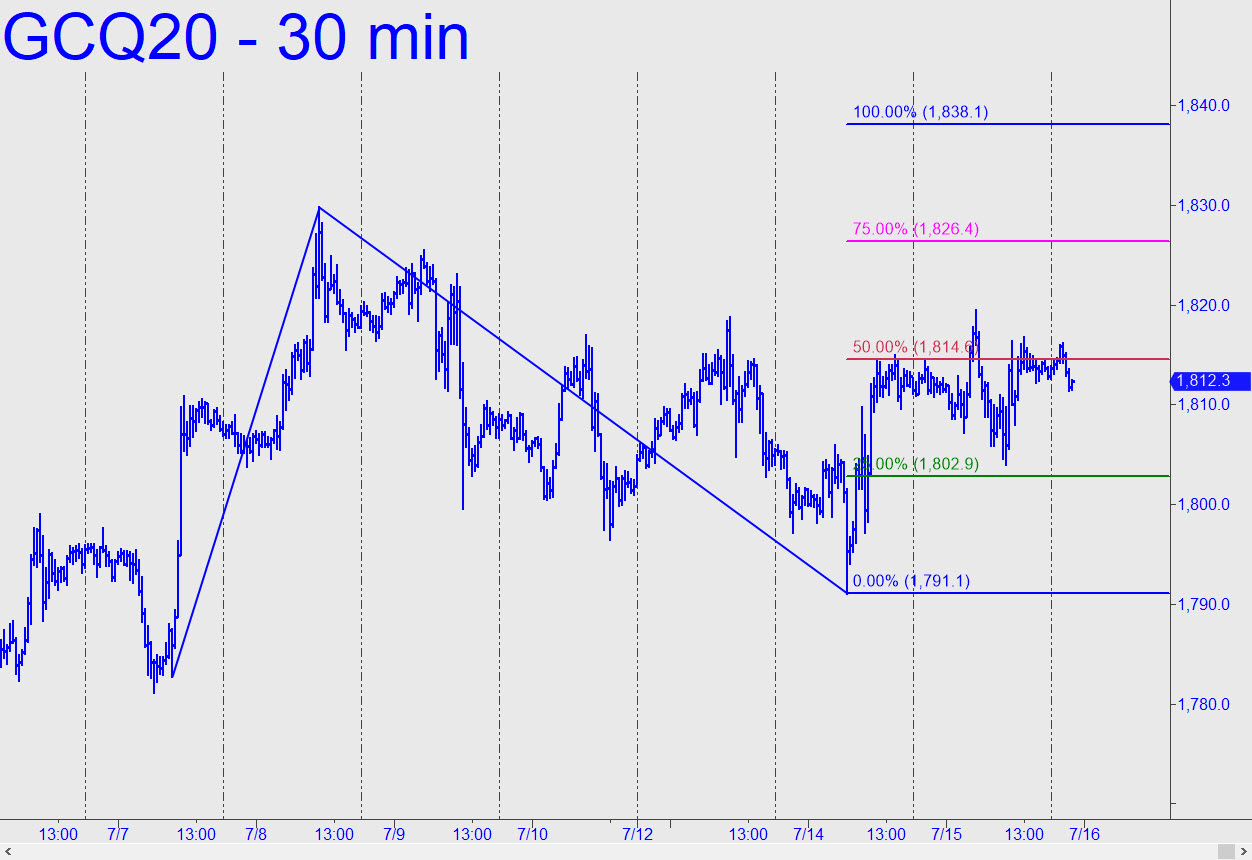

Wacky price action can be leveraged using mechanical entries based on the pattern show in the chart. Wednesday’s low missed filling a bid at the green line, but if the futures return there it would still be a decent bet, stop 1791.00. The implied entry risk is more than $4000 on four contracts, so we’ll want to cut it down to size using the lesser charts ‘camouflage’-style if the opportunity arises. The 1875.20 target of a larger pattern remains viable, but we’re taking it one step at a time since gold has shown no signs of becoming a friendly buy-and-hold. More like Chinese water-torture, actually. _______ UPDATE (July 16, 8:50 p.m. EDT): Gold was more than mildly disappointing today, although its mini-plunge failed to stop out the mechanical bid I’d noted above. With no drama indicated on the chart, I’ll suggest watching from the sidelines for now. I’ll be curious myself to see whether the trade works. The tactic is geared to exploiting violent swings, not the kind of gratuitous, sloppy meandering we’ve become used to in gold.

Wacky price action can be leveraged using mechanical entries based on the pattern show in the chart. Wednesday’s low missed filling a bid at the green line, but if the futures return there it would still be a decent bet, stop 1791.00. The implied entry risk is more than $4000 on four contracts, so we’ll want to cut it down to size using the lesser charts ‘camouflage’-style if the opportunity arises. The 1875.20 target of a larger pattern remains viable, but we’re taking it one step at a time since gold has shown no signs of becoming a friendly buy-and-hold. More like Chinese water-torture, actually. _______ UPDATE (July 16, 8:50 p.m. EDT): Gold was more than mildly disappointing today, although its mini-plunge failed to stop out the mechanical bid I’d noted above. With no drama indicated on the chart, I’ll suggest watching from the sidelines for now. I’ll be curious myself to see whether the trade works. The tactic is geared to exploiting violent swings, not the kind of gratuitous, sloppy meandering we’ve become used to in gold.

GCQ20 – August Gold (Last:1798.70)

Posted on July 15, 2020, 9:44 pm EDT

Last Updated July 16, 2020, 9:00 pm EDT

Posted on July 15, 2020, 9:44 pm EDT

Last Updated July 16, 2020, 9:00 pm EDT