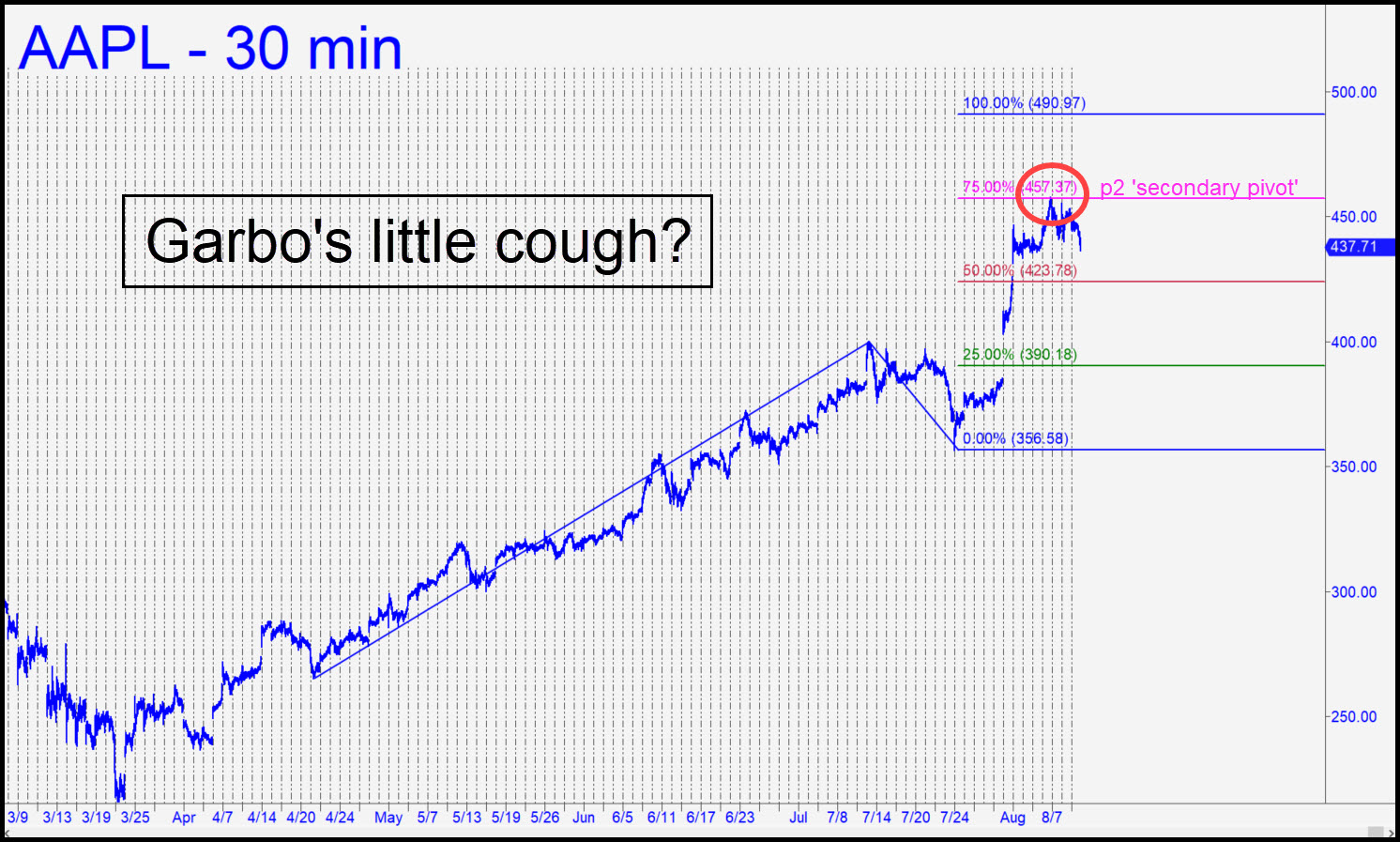

Although I’m confident today’s vicious selloff in bullion, the worst in more than seven years, will prove to be merely corrective, I’m not so sure about the selling that has hit the institutionally blessed ‘lunatic’ stocks, AAPL in particular. The iPhone seller recently achieved a valuation of nearly $2 trillion, putting it well above Aramco and every other company whose shares have been traded on an exchange. The bearish case is not based on valuations, however, but on the fact that the stock’s recent top occurred precisely at the ‘secondary Hidden Pivot’ of a major uptrend. This is shown in the chart as a stall at p2, the pink line at 457.37.

Trend failures that occur exactly at this line are notoriously dangerous, although I aired my doubts at the time that this particular stall would prove fatal. The downtrend has since lengthened as AAPL has fallen on three of the last four days. A 490.97 rally target still outstanding is valid and will remain so unless the stock plummets to $355, a 20% decline from here. However, we should be on our guard and open-minded to the possibility that the most grandiose, delusional rally ever has come to a quiet end. It is not quite as ominous as that cough in the second reel of a melodrama, but neither should we assume that it is just Garbo with a touch of hay fever.