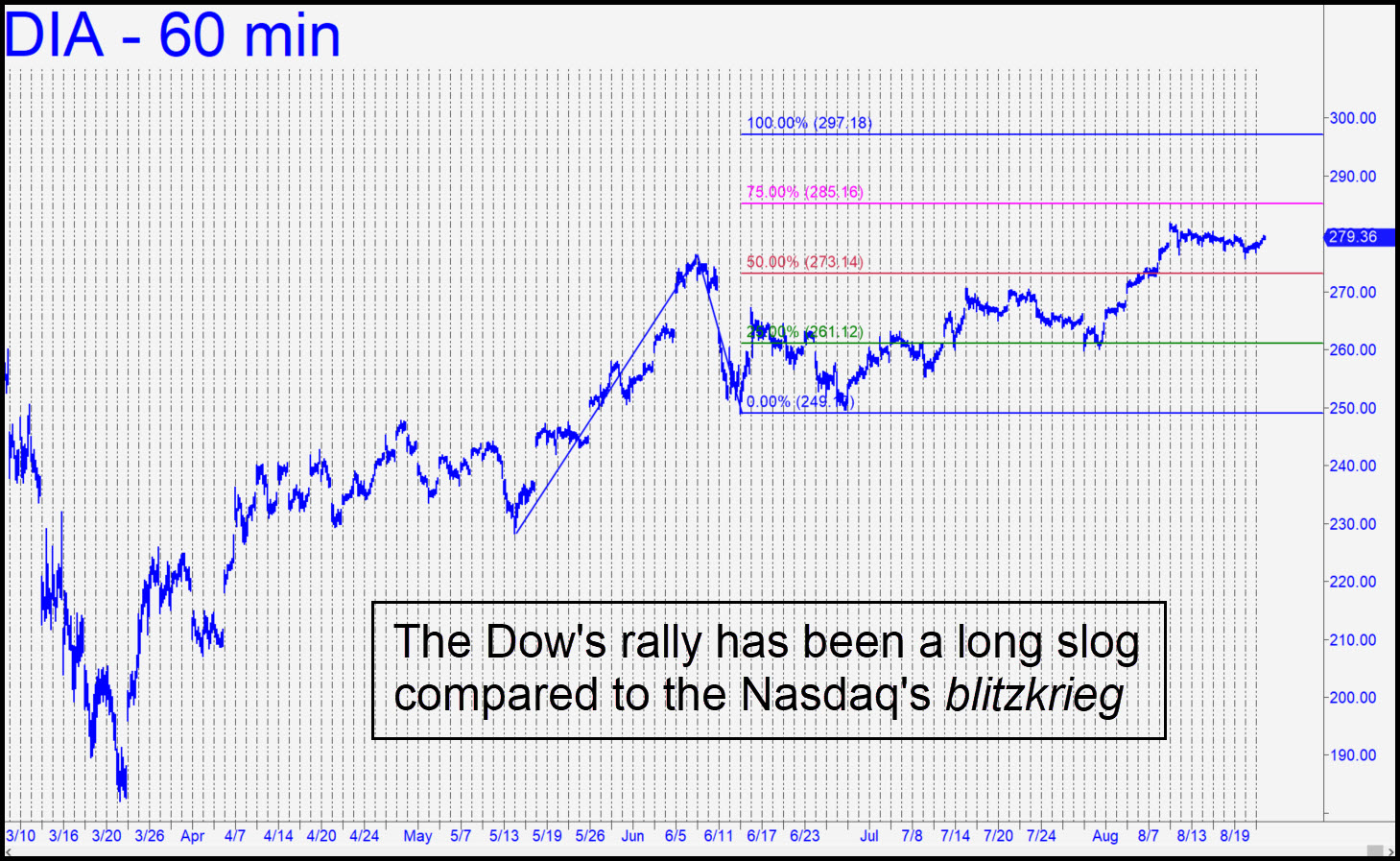

We’ve been using a 285.16 price objective for months, but it is not even a ‘D’ target, just the secondary pivot of an unambitious pattern that projects to 297.18. It has been a long slog — one not particularly well suited to naked-call strategies. A perfectly timed bet on Aug 28 280 calls would have made you a few bucks, but not much more. As always, the key was to have taken off half of the position after the options doubled in price early on. The ride to 285.16 from here is a no-brainer, and DIA could eventually make it to 297.18, but I have no simple option strategies to recommend. Here’s one that sounds harder to do than it is — a call butterfly centered on the 295 strike: Buy the Oct 2 295/300/305 ‘fly for around 0.20. This implies shorting two 300 calls and buying a 295 call and a 305 call for a net debit of 20 cents ($20). The most you can lose is $20 per spread, but if the stock is trading near 300 at expiration, you could make as much as $500 per spread (although $260-$320 would be more realistic). Work out the value of the options in this position with DIA trading at various prices between 250 and 350 if you want to understand exactly how butterfly spreads work.

We’ve been using a 285.16 price objective for months, but it is not even a ‘D’ target, just the secondary pivot of an unambitious pattern that projects to 297.18. It has been a long slog — one not particularly well suited to naked-call strategies. A perfectly timed bet on Aug 28 280 calls would have made you a few bucks, but not much more. As always, the key was to have taken off half of the position after the options doubled in price early on. The ride to 285.16 from here is a no-brainer, and DIA could eventually make it to 297.18, but I have no simple option strategies to recommend. Here’s one that sounds harder to do than it is — a call butterfly centered on the 295 strike: Buy the Oct 2 295/300/305 ‘fly for around 0.20. This implies shorting two 300 calls and buying a 295 call and a 305 call for a net debit of 20 cents ($20). The most you can lose is $20 per spread, but if the stock is trading near 300 at expiration, you could make as much as $500 per spread (although $260-$320 would be more realistic). Work out the value of the options in this position with DIA trading at various prices between 250 and 350 if you want to understand exactly how butterfly spreads work.

You could also do a ‘rolling’ calendar spread, buying Oct 16 300 calls for 1.25 while shorting Sep 4 300 calls against them for 0.10. When the latter expire, you would short Sep 11 calls; then, the next Friday, Sep 18 calls. If DIA continues to move higher, the premium you would take in for each successive short sale would continue to increase. Ideally, DIA would be trading for around 300 on Oct 16, and the premium you’ve received for shorting 300-strike calls against them in calendar succession will exceed what you paid for the Oct 16 300s. You will own them for a net credit, that is, with no loss possible and a gain equal to their value. It is a very low-risk way to play a stock that is moving slowly toward a target you are confident in. _______ UPDATE (Aug 25, 8:10 p.m.): Any reports? I’ll need to hear from at least three subscribers to determine whether to establish a tracking position. ______ UPDATE (Aug 26, 1022 p.m.): Nothing doing, it would seem.