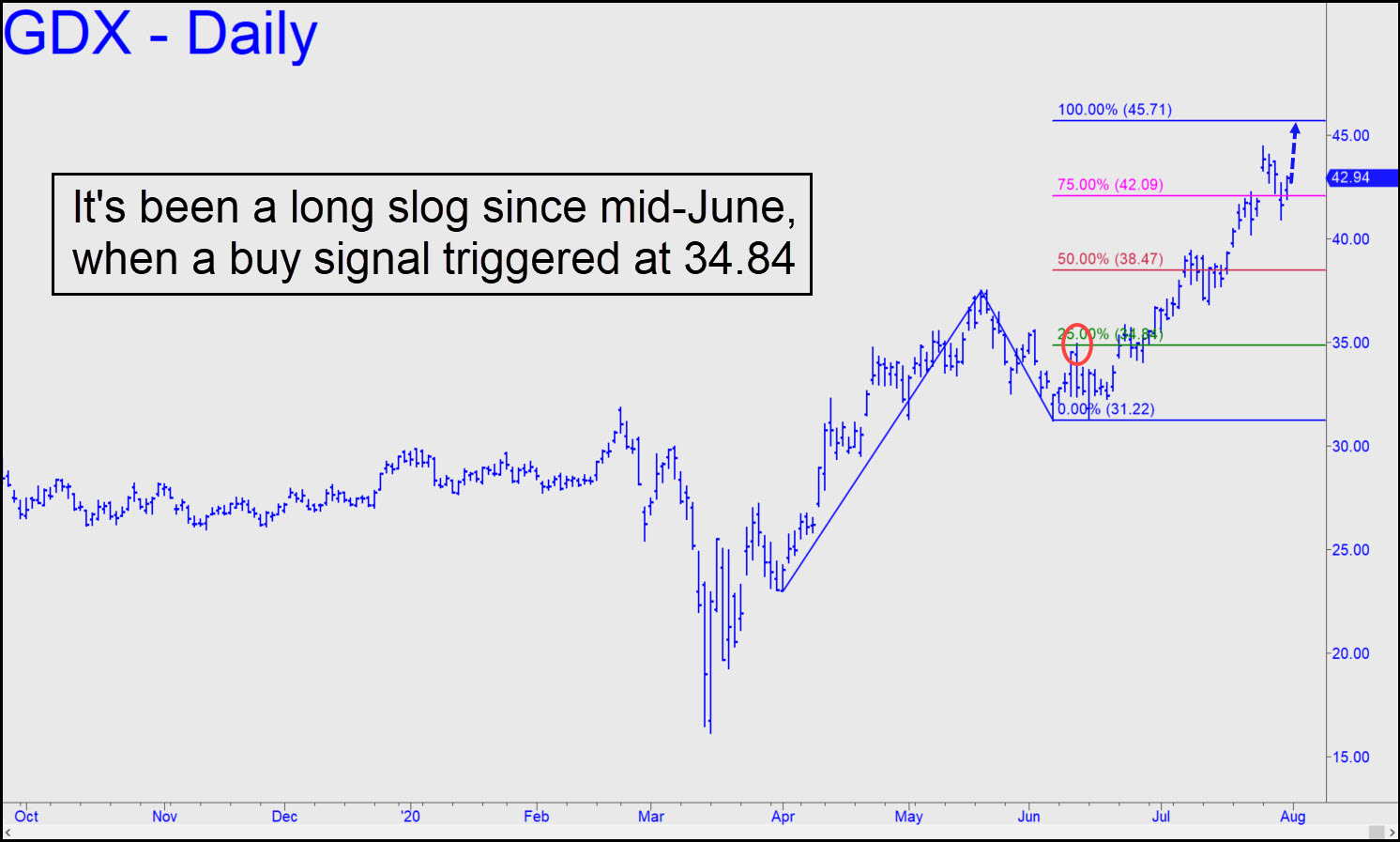

It’s been a long slog to the 45.71 target since GDX tripped a ‘buy’ signal back in mid-June at 34.84. I crowd-sourced the trading of the stock because it became too much of a headache to do so myself, especially during the grinding, two-month consolidation begun in late April. In retrospect, the rally could have been positioned as a buy-and-hold, since the pullbacks that punctuated the steep July uptrend were not too painful in comparison to the gains racked up from one peak to the next. We’ll have to see what happens after 45.71 is achieved, but, as always, a decisive push past it on initial contact would be bullish. Regardless, if you’ve held a long position all the way up, I’d suggesting lightening up, possibly with some just-in-the-money covered writes. Above 45.71, the weekly chart allows for more progress to as high as 51.72. ______ UPDATE (Aug 5, 6:14 p.m.): Numerous subscribers reported using my longstanding rally target at 45.71 to exit long positions or lighten up within pennies of what could turn out to be an important top. They sidestepped considerable pain in the process, since GDX subsequently fell $1.76 to 44.02 before staging a modest bounce into the close. I don’t expect bulls to come roaring back, at least not right away, but if they do, use this 48.55 target as a lodestar, and thence 51.72 (as noted above).

It’s been a long slog to the 45.71 target since GDX tripped a ‘buy’ signal back in mid-June at 34.84. I crowd-sourced the trading of the stock because it became too much of a headache to do so myself, especially during the grinding, two-month consolidation begun in late April. In retrospect, the rally could have been positioned as a buy-and-hold, since the pullbacks that punctuated the steep July uptrend were not too painful in comparison to the gains racked up from one peak to the next. We’ll have to see what happens after 45.71 is achieved, but, as always, a decisive push past it on initial contact would be bullish. Regardless, if you’ve held a long position all the way up, I’d suggesting lightening up, possibly with some just-in-the-money covered writes. Above 45.71, the weekly chart allows for more progress to as high as 51.72. ______ UPDATE (Aug 5, 6:14 p.m.): Numerous subscribers reported using my longstanding rally target at 45.71 to exit long positions or lighten up within pennies of what could turn out to be an important top. They sidestepped considerable pain in the process, since GDX subsequently fell $1.76 to 44.02 before staging a modest bounce into the close. I don’t expect bulls to come roaring back, at least not right away, but if they do, use this 48.55 target as a lodestar, and thence 51.72 (as noted above).

GDX – Gold Miners ETF (Last:44.50)

Posted on August 2, 2020, 5:05 pm EDT

Last Updated August 5, 2020, 6:23 pm EDT

Posted on August 2, 2020, 5:05 pm EDT

Last Updated August 5, 2020, 6:23 pm EDT