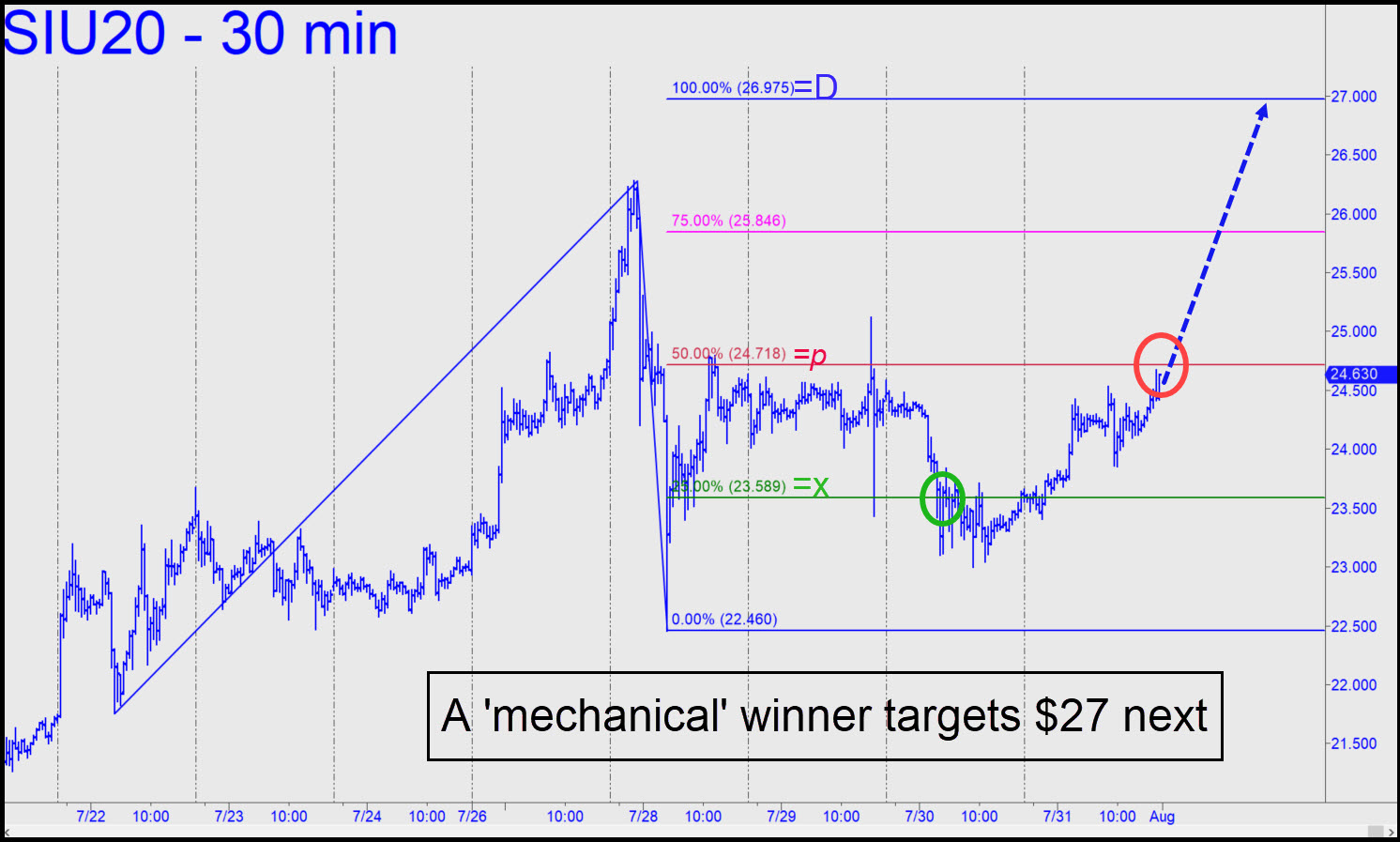

The mechanical buy triggered last Thursday lengthened our impressive winning streak, but also demonstrated that these trades are often scary. They are designed to exploit violent swings, and that is why placing one’s bid at the green line often feels like trying to catch a falling piano. The theoretical gain on the trade so far would have been around $5500 per contract, with a shot now at an additional $11,000 per contract if the futures reach the D target at 26.975. That was the assumption at the time the trade triggered, although we typically take a profit on half of a four-contract position when it gets to the red line line. (The midpoint Hidden Pivot lies at 24.718 in this case, a millimeter above Friday’s end-of-day high). Although the remaining $2.34 to be traversed cannot yet be considered a certainty, odds would shorten considerably on a decisive push past p, but even moreso on a two-day close above that resistance. _______ UPDATE (Aug 4, 6:56 p.m.) The last $2 of Silver’s ascent have come so easily that I’ve switched to a bigger picture with a 31.560 target. First the futures will need to reach p=27.010, my minimum upside objective, but a decisive stab through it, or a two day close above it, would put the 31.560 Hidden pivot well in play. Here’s the chart. _______ UPDATE (Aug 5, 5:28 p.m.): Bulls toyed with the 27.010 midpoint pivot as though it were a speed bag, implying they can easily take this vehicle higher when the feel like it. The next Hidden Pivot benchmark on the way to 31.560 is p2=29.285, so we’ll make that our minimum upside objective for now. It seems likely to be reached by no later than Friday. ______ UPDATE (Aug 6, 10:39 p.m.): The futures came within 8 cents of the psychologically important $30 level before retreating moderately. Even so, the way the rally impaled the 29.285 ‘secondary’ pivot implies bulls remain sufficiently energized for a further move to the 31.560 target.

The mechanical buy triggered last Thursday lengthened our impressive winning streak, but also demonstrated that these trades are often scary. They are designed to exploit violent swings, and that is why placing one’s bid at the green line often feels like trying to catch a falling piano. The theoretical gain on the trade so far would have been around $5500 per contract, with a shot now at an additional $11,000 per contract if the futures reach the D target at 26.975. That was the assumption at the time the trade triggered, although we typically take a profit on half of a four-contract position when it gets to the red line line. (The midpoint Hidden Pivot lies at 24.718 in this case, a millimeter above Friday’s end-of-day high). Although the remaining $2.34 to be traversed cannot yet be considered a certainty, odds would shorten considerably on a decisive push past p, but even moreso on a two-day close above that resistance. _______ UPDATE (Aug 4, 6:56 p.m.) The last $2 of Silver’s ascent have come so easily that I’ve switched to a bigger picture with a 31.560 target. First the futures will need to reach p=27.010, my minimum upside objective, but a decisive stab through it, or a two day close above it, would put the 31.560 Hidden pivot well in play. Here’s the chart. _______ UPDATE (Aug 5, 5:28 p.m.): Bulls toyed with the 27.010 midpoint pivot as though it were a speed bag, implying they can easily take this vehicle higher when the feel like it. The next Hidden Pivot benchmark on the way to 31.560 is p2=29.285, so we’ll make that our minimum upside objective for now. It seems likely to be reached by no later than Friday. ______ UPDATE (Aug 6, 10:39 p.m.): The futures came within 8 cents of the psychologically important $30 level before retreating moderately. Even so, the way the rally impaled the 29.285 ‘secondary’ pivot implies bulls remain sufficiently energized for a further move to the 31.560 target.

SIU20 – Sep Silver (Last:29.005)

Posted on August 2, 2020, 5:14 pm EDT

Last Updated August 6, 2020, 10:39 pm EDT

Posted on August 2, 2020, 5:14 pm EDT

Last Updated August 6, 2020, 10:39 pm EDT