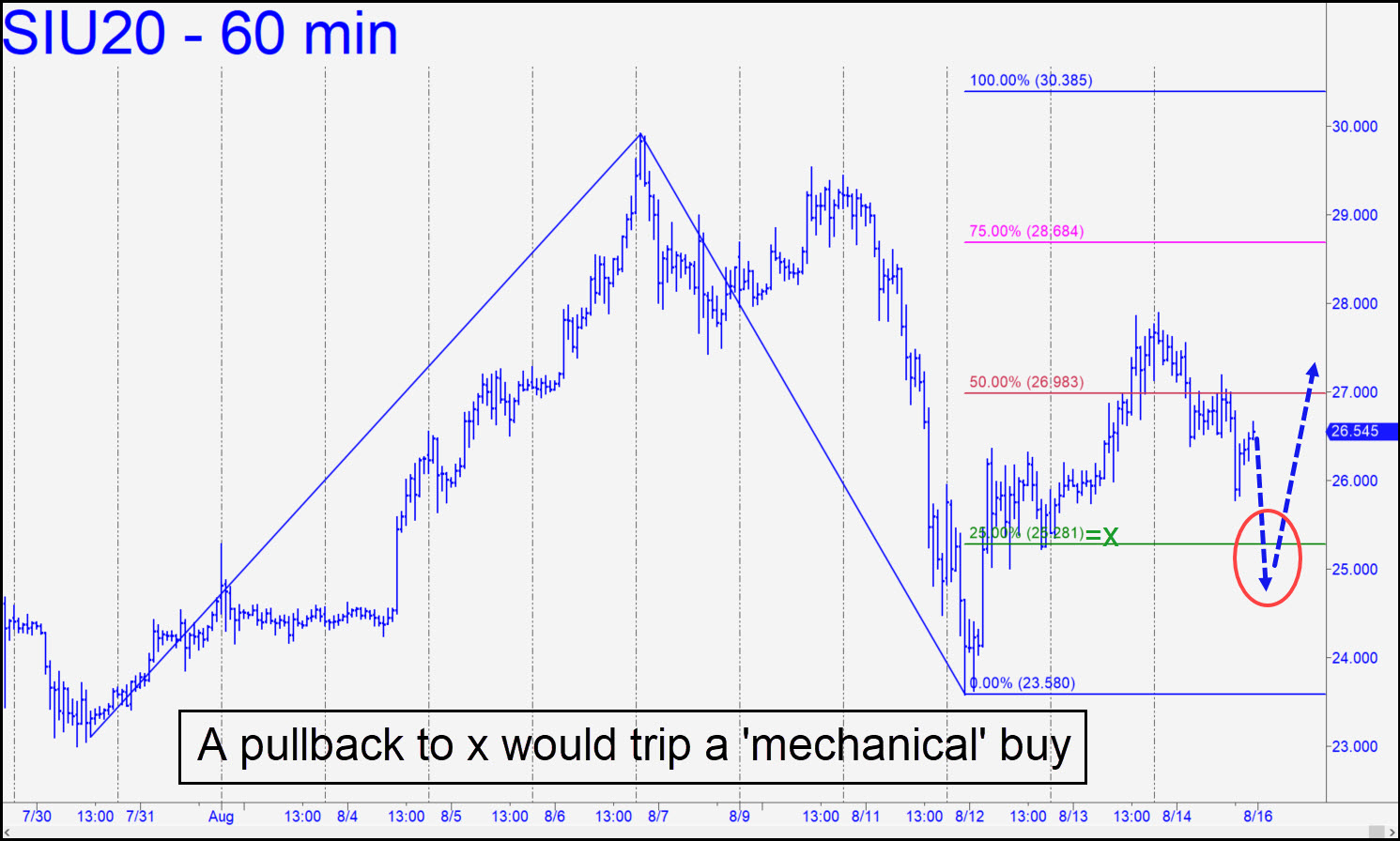

A fall to x=25.281 would trigger a ‘mechanical’ buy, stop 23.575, but if we are not gifted with such a juicy opportunity, we could try again at p or even p2 on a future retracement. In any event, the pattern’s D target at 30.385 is in play following last week’s decisive push past p=26.983.The futures slumped moderately on Friday, but this was before Buffett’s apparently newfound interest in bullion was divulged after the close. Berkshire has taken a $563 million stake in Barrick, and this cannot but put a spring in the step of gold and silver for the foreseeable future. _______ UPDATE (Aug 18, 6:03 p.m.): A pullback to p=26.983 would trigger a ‘mechanical’ buy, stop 25.850. ______ UPDATE (Aug 19, 8:40 p.m.): Anyone do the trade? _______ UPDATE (Aug 20, 6:25 p.m.): It turns out that a few subscribers actually did take the trade. All would have made money, but I closed it out myself for a profit of around $3,100, notifying the room of this at 9:53 a.m. The trade is currently showing a profit of about $2,300 per contract for anyone still holding a position. My decision to exit was based on the strong look of the dollar’s hourly chart. It could go either way, but the trade was predicated on a ride to p2=28.684, for a theoretical gain of about $8,500 per contract. For those of you who still hold a position, a stop-loss should be maintained at 25.840. This would yield a loss of about $5,200 per contract, excluding any offset from profits already taken.

A fall to x=25.281 would trigger a ‘mechanical’ buy, stop 23.575, but if we are not gifted with such a juicy opportunity, we could try again at p or even p2 on a future retracement. In any event, the pattern’s D target at 30.385 is in play following last week’s decisive push past p=26.983.The futures slumped moderately on Friday, but this was before Buffett’s apparently newfound interest in bullion was divulged after the close. Berkshire has taken a $563 million stake in Barrick, and this cannot but put a spring in the step of gold and silver for the foreseeable future. _______ UPDATE (Aug 18, 6:03 p.m.): A pullback to p=26.983 would trigger a ‘mechanical’ buy, stop 25.850. ______ UPDATE (Aug 19, 8:40 p.m.): Anyone do the trade? _______ UPDATE (Aug 20, 6:25 p.m.): It turns out that a few subscribers actually did take the trade. All would have made money, but I closed it out myself for a profit of around $3,100, notifying the room of this at 9:53 a.m. The trade is currently showing a profit of about $2,300 per contract for anyone still holding a position. My decision to exit was based on the strong look of the dollar’s hourly chart. It could go either way, but the trade was predicated on a ride to p2=28.684, for a theoretical gain of about $8,500 per contract. For those of you who still hold a position, a stop-loss should be maintained at 25.840. This would yield a loss of about $5,200 per contract, excluding any offset from profits already taken.

SIU20 – Sep Silver (Last:27.450)

Posted on August 16, 2020, 5:09 pm EDT

Last Updated August 20, 2020, 11:41 pm EDT

Posted on August 16, 2020, 5:09 pm EDT

Last Updated August 20, 2020, 11:41 pm EDT