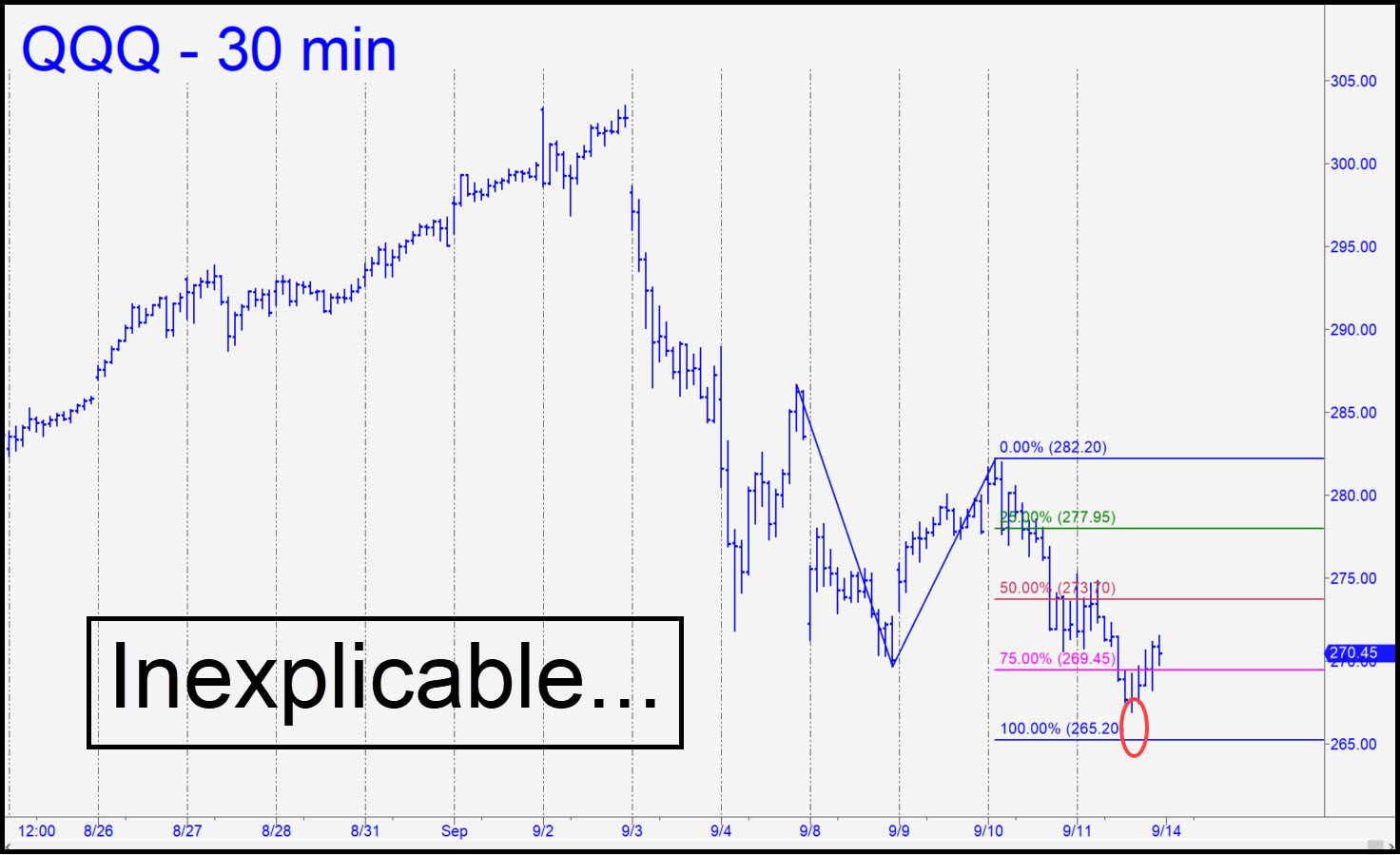

The Cubes’ failure to fall to the 265.20 target on Friday is dumbfounding, but there is no point in arguing with Mr. Market. The target remains valid nonetheless and could prove opportune for tightly-stopped bottom-fishing. This is notwithstanding the fact that Friday afternoon’s robust recovery seems a bit excessive to set up a plunge on Monday to a marginal new low less than two points beneath Friday’s bottom. If 265.20 gives way easily, I’ll recommend doubling down with a tightly stopped bid at 262.93. That’s the ‘D target of the same pattern, but with ‘A’ raised to 288.93 (9/4, 10:00 a.m.) _______ UPDATE (Sep 14, 8:20 p.m. ET): Nothing keeps this rabid beast down for long. A thrust exceeding 282.20 would negate the pattern on which the recommendations above were based. _______ UPDATE (Sep 15, 5:54 p.m.): Ordinarily a gap through p such as occurred here would guarantee ‘D’ will be reached. In this instance, however, the stench of distribution throughout the day was so powerful that I stop short of certifying the 281.93 target as a done deal. Let’s see how it goes. _______ UPDATE (Sep 16, 8:23 a.m.): An overnight short-squeeze got this gas-bag to 281.72, just 23 cents shy of the target. Buyers were back at it urgently following a fall of nearly $2, but their exceeding the Hidden Pivot should not be considered a done deal until it happens. _______ UPDATE (Sep 16, 5:14 p.m.): The 281.93 target caught the start of a $7.50 plunge within 21 cents. Since no one mentioned having taken advantage of this in the chat room, I have not established a tracking position. Reports? _______ UPDATE (Sep 17, 10:54 p.m.): One subscriber reported cashing out a winning option ticket in SQQQ. There is likely more where that came from, since SQQQ, currently trading for around 26.43, looks imminently bound for at least 29.60 (60-min, A= 19.55 on 9/2).

The Cubes’ failure to fall to the 265.20 target on Friday is dumbfounding, but there is no point in arguing with Mr. Market. The target remains valid nonetheless and could prove opportune for tightly-stopped bottom-fishing. This is notwithstanding the fact that Friday afternoon’s robust recovery seems a bit excessive to set up a plunge on Monday to a marginal new low less than two points beneath Friday’s bottom. If 265.20 gives way easily, I’ll recommend doubling down with a tightly stopped bid at 262.93. That’s the ‘D target of the same pattern, but with ‘A’ raised to 288.93 (9/4, 10:00 a.m.) _______ UPDATE (Sep 14, 8:20 p.m. ET): Nothing keeps this rabid beast down for long. A thrust exceeding 282.20 would negate the pattern on which the recommendations above were based. _______ UPDATE (Sep 15, 5:54 p.m.): Ordinarily a gap through p such as occurred here would guarantee ‘D’ will be reached. In this instance, however, the stench of distribution throughout the day was so powerful that I stop short of certifying the 281.93 target as a done deal. Let’s see how it goes. _______ UPDATE (Sep 16, 8:23 a.m.): An overnight short-squeeze got this gas-bag to 281.72, just 23 cents shy of the target. Buyers were back at it urgently following a fall of nearly $2, but their exceeding the Hidden Pivot should not be considered a done deal until it happens. _______ UPDATE (Sep 16, 5:14 p.m.): The 281.93 target caught the start of a $7.50 plunge within 21 cents. Since no one mentioned having taken advantage of this in the chat room, I have not established a tracking position. Reports? _______ UPDATE (Sep 17, 10:54 p.m.): One subscriber reported cashing out a winning option ticket in SQQQ. There is likely more where that came from, since SQQQ, currently trading for around 26.43, looks imminently bound for at least 29.60 (60-min, A= 19.55 on 9/2).

QQQ – Nasdaq ETF (Last:270.45)

Posted on September 13, 2020, 5:09 pm EDT

Last Updated September 17, 2020, 10:54 pm EDT

Posted on September 13, 2020, 5:09 pm EDT

Last Updated September 17, 2020, 10:54 pm EDT