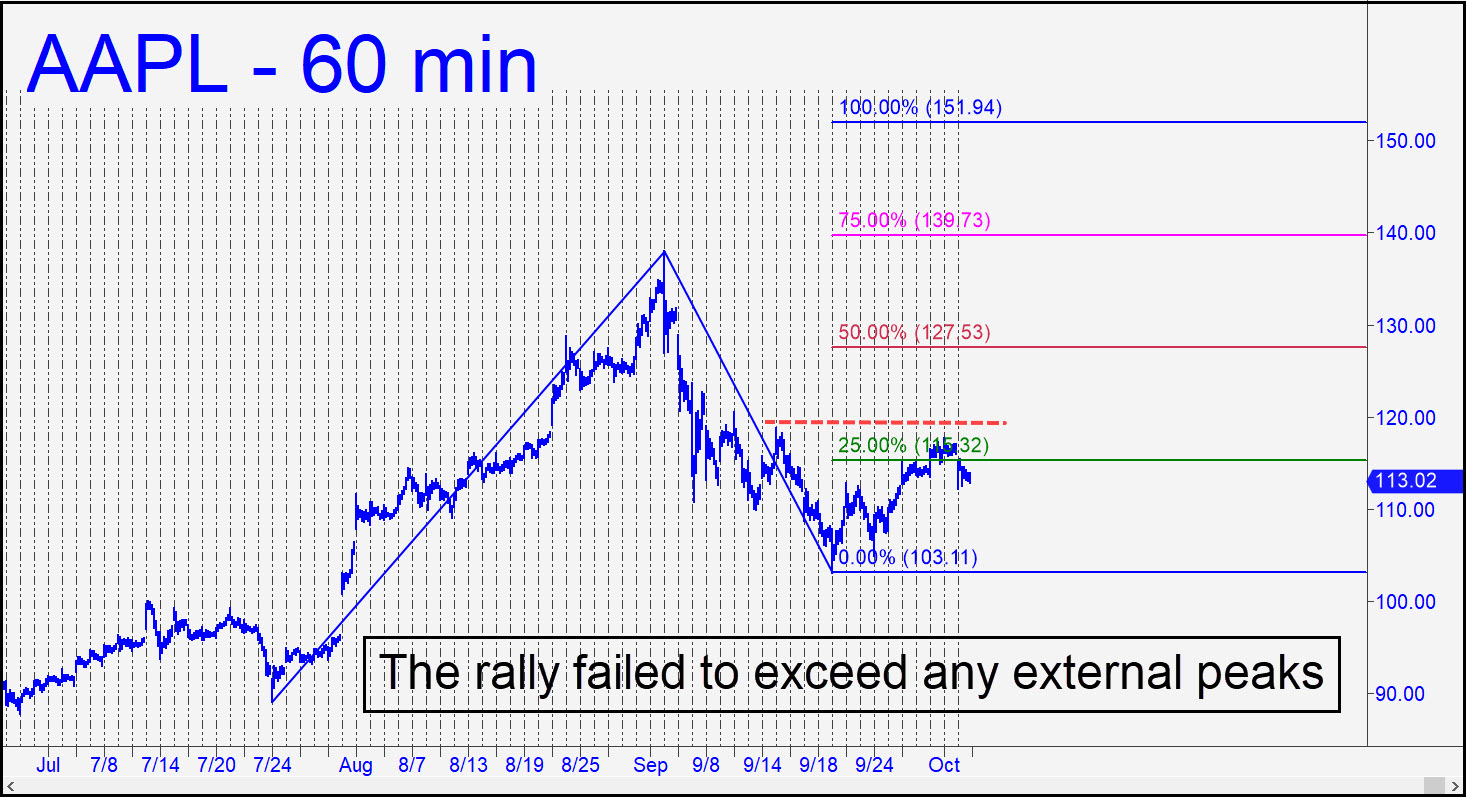

We hold sixteen Nov 20 140/150/160 call butterflies for an average 0.36, based on an idea posted in the trading room a week ago. The stock turned mushy at the end of last week, causing the bull spread to fill for as little as 0.32. However, I am using a higher cost basis because several subscribers reported paying more. Do nothing further for now and cancel any orders that were not filled. The most we can lose on this trade is $36 per four-option spread, but it has the potential in theory to produce a profit of as much as $1,000 per. That would occur if the stock were to rally to 150 between now and November 20, when the options expire. We are getting 20-to-1 odds on this, and you can judge for yourself if you’d lay that bet. Practically speaking, we would be doing well to exit for $700 if everything goes right, but we’ll still have opportunities to cash out for a profit on the way up if AAPL rallies. For now, as is customary, I’ll suggest offering half of your spreads to close to 0.72, twice what we paid, good till canceled. If the order fills, the remainder of our position will effectively have cost us nothing. Our actual rally target, a Hidden Pivot, lies at 151.94. _______ UPDATE (Pct 5, 4:04 p.m.): With AAPL trading for 116.47 at the closing bell, the spread settled at 0.39 and carried a delta value of 3. This implies the spread will increase in value by 3 cents for every $1 increase in the price of the underlying shares. The spread is ‘positive-gamma’, meaning we will automatically pick up deltas and get ‘longer’ as AAPL moves toward 150. Above 150, we’ll lose deltas and become ‘delta neutral’ near and above 160.

We hold sixteen Nov 20 140/150/160 call butterflies for an average 0.36, based on an idea posted in the trading room a week ago. The stock turned mushy at the end of last week, causing the bull spread to fill for as little as 0.32. However, I am using a higher cost basis because several subscribers reported paying more. Do nothing further for now and cancel any orders that were not filled. The most we can lose on this trade is $36 per four-option spread, but it has the potential in theory to produce a profit of as much as $1,000 per. That would occur if the stock were to rally to 150 between now and November 20, when the options expire. We are getting 20-to-1 odds on this, and you can judge for yourself if you’d lay that bet. Practically speaking, we would be doing well to exit for $700 if everything goes right, but we’ll still have opportunities to cash out for a profit on the way up if AAPL rallies. For now, as is customary, I’ll suggest offering half of your spreads to close to 0.72, twice what we paid, good till canceled. If the order fills, the remainder of our position will effectively have cost us nothing. Our actual rally target, a Hidden Pivot, lies at 151.94. _______ UPDATE (Pct 5, 4:04 p.m.): With AAPL trading for 116.47 at the closing bell, the spread settled at 0.39 and carried a delta value of 3. This implies the spread will increase in value by 3 cents for every $1 increase in the price of the underlying shares. The spread is ‘positive-gamma’, meaning we will automatically pick up deltas and get ‘longer’ as AAPL moves toward 150. Above 150, we’ll lose deltas and become ‘delta neutral’ near and above 160.

AAPL – Apple Computer (Last:116.47)

Posted on October 4, 2020, 7:37 pm EDT

Last Updated October 5, 2020, 4:48 pm EDT

Posted on October 4, 2020, 7:37 pm EDT

Last Updated October 5, 2020, 4:48 pm EDT