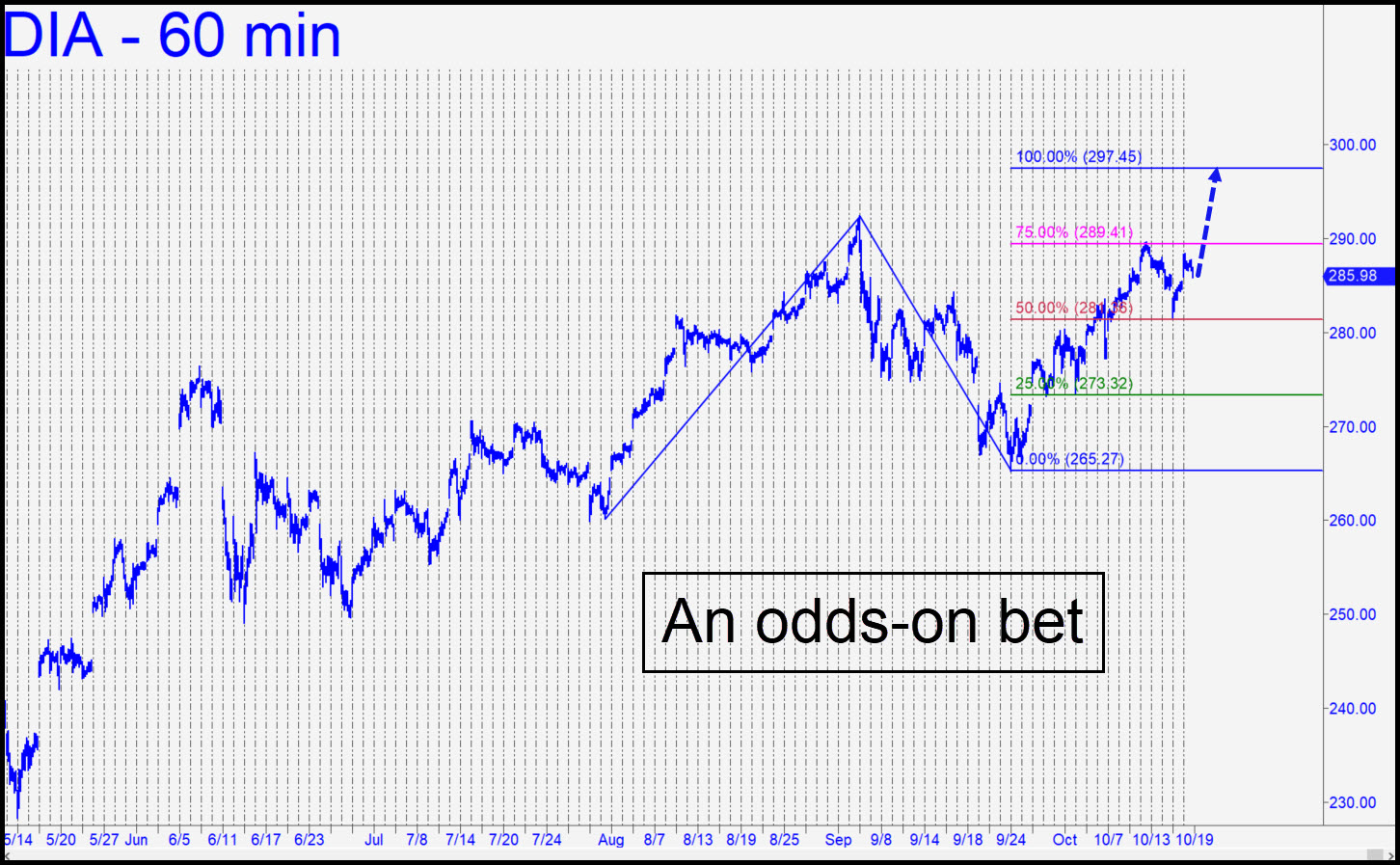

After triggering a ‘mechanical’ buy last week on a pullback to the red line (see inset), DIA turned the trade into an instant winner by surging straightaway to the next level, p2=289.41. It didn’t quite get there, but unless news over the weekend is exceedingly grim, short-covering will complete the job. In the meantime, the 297.45 ‘D’ rally target that’s been in play for more than two weeks can be used as a minimum upside objective for the week ahead. If and when DIA gets there, you can get short using out-of-the-money put options with a tight stop-loss. Stay tuned to the chat room at the appropriate time for more-specific guidance. _______ UPDATE (Oct 19, 9:08 p.m.): It appears some subscribers may have used p=281.36 to get long on DIA’s second dip to it. Since this Hidden Pivot caught the intraday low almost exactly, and because the subsequent bounce hit 282.51, you should have taken at least a partial profit. In any event, you’re on your own if you still hold a position. ______ UPDATE (Oct 20, 6:07 p.m.): A couple of subscribers reported nailing down profits as DIA rallied a further 3.53 points before pulling back into the close. This seems wise at the moment. ______ UPDATE (Oct 21, 11:45 p.m.): You can use this pattern, which projects minimum downside to 279.88, as a road map for Thursday. For the nimble shooter, bottom-fishing is recommended there via cheap (i.e., under 0.60) soon-to-expire calls, tightly stopped. This is a scalp-trade, so don’t be shooting for the moon if it goes your way. ______ UPDATE (Oct 22, 4:41 p.m.): The Dow dove early in the session, but the 280.30 low missed hitting our bid by a significant 0.42 points. I see no comparable opportunities for Friday, but you should stay tuned to the chat room in case one develops.

After triggering a ‘mechanical’ buy last week on a pullback to the red line (see inset), DIA turned the trade into an instant winner by surging straightaway to the next level, p2=289.41. It didn’t quite get there, but unless news over the weekend is exceedingly grim, short-covering will complete the job. In the meantime, the 297.45 ‘D’ rally target that’s been in play for more than two weeks can be used as a minimum upside objective for the week ahead. If and when DIA gets there, you can get short using out-of-the-money put options with a tight stop-loss. Stay tuned to the chat room at the appropriate time for more-specific guidance. _______ UPDATE (Oct 19, 9:08 p.m.): It appears some subscribers may have used p=281.36 to get long on DIA’s second dip to it. Since this Hidden Pivot caught the intraday low almost exactly, and because the subsequent bounce hit 282.51, you should have taken at least a partial profit. In any event, you’re on your own if you still hold a position. ______ UPDATE (Oct 20, 6:07 p.m.): A couple of subscribers reported nailing down profits as DIA rallied a further 3.53 points before pulling back into the close. This seems wise at the moment. ______ UPDATE (Oct 21, 11:45 p.m.): You can use this pattern, which projects minimum downside to 279.88, as a road map for Thursday. For the nimble shooter, bottom-fishing is recommended there via cheap (i.e., under 0.60) soon-to-expire calls, tightly stopped. This is a scalp-trade, so don’t be shooting for the moon if it goes your way. ______ UPDATE (Oct 22, 4:41 p.m.): The Dow dove early in the session, but the 280.30 low missed hitting our bid by a significant 0.42 points. I see no comparable opportunities for Friday, but you should stay tuned to the chat room in case one develops.

DIA – Dow Industrials ETF (Last:283.72)

Posted on October 18, 2020, 5:16 pm EDT

Last Updated October 22, 2020, 4:40 pm EDT

Posted on October 18, 2020, 5:16 pm EDT

Last Updated October 22, 2020, 4:40 pm EDT