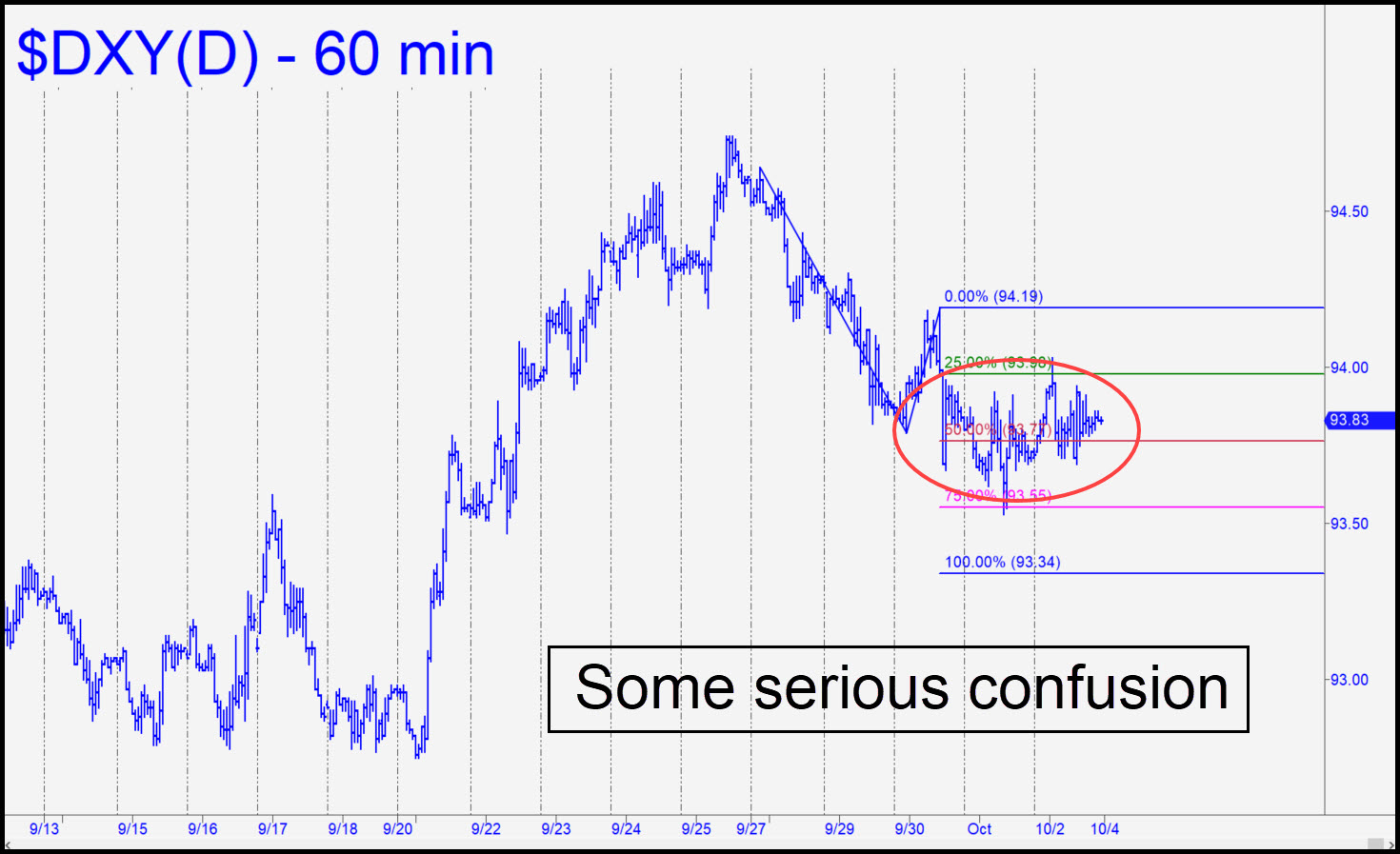

Traders spent the last half of the week torturing each other for who-knows-what reasons. The downtrending pattern is too ugly, and the one-off ‘A’ too puny, for a precise call on further weakness, but we can still use the 93.34 target, since it is good enough for government work. That means Friday’s fleeting rally to the green line was a ‘mechanical’ shorting opportunity, which further implies that 93.34 is likely to be achieved. If so, this would give bullion at least a little buoyancy early in the week. I wouldn’t count on much more than that, however. _______ UPDATE (Oct 5, 5:40 p.m.): The bounce came from three cents above my 93.34 target, but it was not sufficiently robust for us to presume the correction begun from 94.61 on 9/25 is over. Set an alert at 94.04 if you want to be confident the trend is changing. _______ UPDATE (Oct 6, 8:40 p.m.): DXY took a strong leap from 93.34 on a retest, sparing anyone who was long in gold or silver a nasty surprise. The rally would need to pop above 94.34 to turn the chart bullish again and put a 95.33 target in play. Here’s the graph.

Traders spent the last half of the week torturing each other for who-knows-what reasons. The downtrending pattern is too ugly, and the one-off ‘A’ too puny, for a precise call on further weakness, but we can still use the 93.34 target, since it is good enough for government work. That means Friday’s fleeting rally to the green line was a ‘mechanical’ shorting opportunity, which further implies that 93.34 is likely to be achieved. If so, this would give bullion at least a little buoyancy early in the week. I wouldn’t count on much more than that, however. _______ UPDATE (Oct 5, 5:40 p.m.): The bounce came from three cents above my 93.34 target, but it was not sufficiently robust for us to presume the correction begun from 94.61 on 9/25 is over. Set an alert at 94.04 if you want to be confident the trend is changing. _______ UPDATE (Oct 6, 8:40 p.m.): DXY took a strong leap from 93.34 on a retest, sparing anyone who was long in gold or silver a nasty surprise. The rally would need to pop above 94.34 to turn the chart bullish again and put a 95.33 target in play. Here’s the graph.

DXY – NYBOT Dollar Index (Last:93.83)

Posted on October 4, 2020, 3:10 pm EDT

Last Updated October 8, 2020, 8:33 pm EDT

Posted on October 4, 2020, 3:10 pm EDT

Last Updated October 8, 2020, 8:33 pm EDT