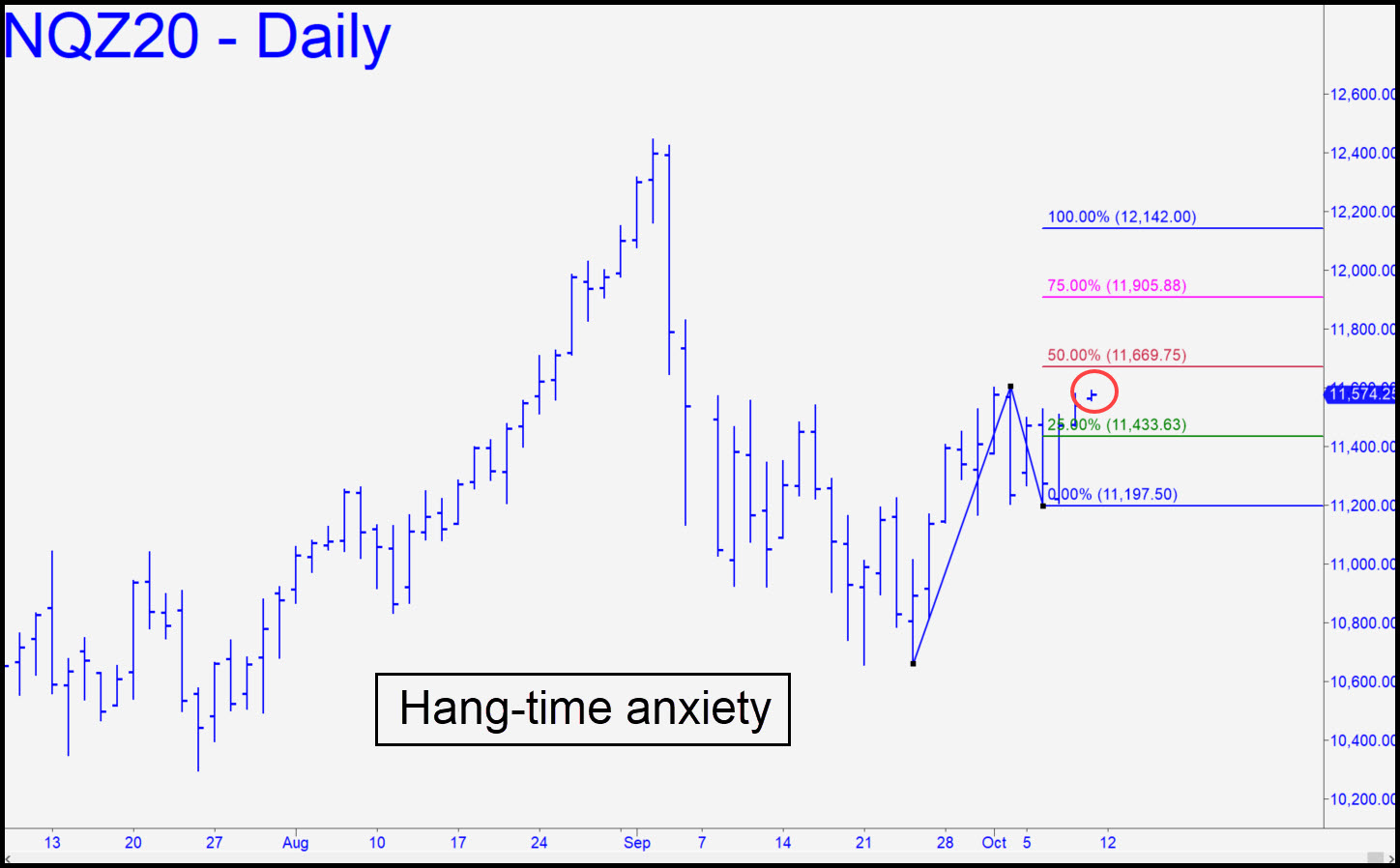

Thursday’s rally was not nearly strong enough to achieve escape velocity from a consolidation pattern the futures had traced out over the last week. If DaBoyz are unable to goose the stock higher as the week draws to a close, look for a pullback to start Sunday night. AAPL’s punk performance has kept the lunatic stocks relatively subdued, and the iPhone maker’s shares looks like they are about to roll over. If so, that will bring the Nasdaq 100 down hard, perhaps to test support at C=11,197 of the bullish pattern shown in the chart. ______ UPDATE (Oct 12, 6:43 p.m.): The maniacs who power this hoax were so revved up yesterday, and the p2 rally target at 12,271 so obvious, that I can only counsel caution when the futures get there. Short the pivot if you are familiar with ‘reverse ABC’ set-ups and can handle one on the 3-minute chart, or if you’ve made a few bucks on the way up. If bulls impale p2, and especially if they close above it for two straight days, consider D=12,808 a done deal. ______ UPDATE (Oct 13, 2:26 p.m.): The advice sent out last night proved prescient with respect to the rally’s failure, but getting short as I’d suggested would have been challenging. Here’s why: The futures missed touching p2 by a whisker, and although this would not have prevented one from initiating the trade with an rABC set-up, the entry trigger occurred more than two hours before the opening bell. Oh well. Here’s the graph. The futures look like they have farther to fall. _______ UPDATE (Oct 14, 8:08 p.m.): Here’s an 11,781 downside target you can use if sellers dominate for a third straight day. Your clue of more weakness to come would follow a decisive penetration of p=11,907.

Thursday’s rally was not nearly strong enough to achieve escape velocity from a consolidation pattern the futures had traced out over the last week. If DaBoyz are unable to goose the stock higher as the week draws to a close, look for a pullback to start Sunday night. AAPL’s punk performance has kept the lunatic stocks relatively subdued, and the iPhone maker’s shares looks like they are about to roll over. If so, that will bring the Nasdaq 100 down hard, perhaps to test support at C=11,197 of the bullish pattern shown in the chart. ______ UPDATE (Oct 12, 6:43 p.m.): The maniacs who power this hoax were so revved up yesterday, and the p2 rally target at 12,271 so obvious, that I can only counsel caution when the futures get there. Short the pivot if you are familiar with ‘reverse ABC’ set-ups and can handle one on the 3-minute chart, or if you’ve made a few bucks on the way up. If bulls impale p2, and especially if they close above it for two straight days, consider D=12,808 a done deal. ______ UPDATE (Oct 13, 2:26 p.m.): The advice sent out last night proved prescient with respect to the rally’s failure, but getting short as I’d suggested would have been challenging. Here’s why: The futures missed touching p2 by a whisker, and although this would not have prevented one from initiating the trade with an rABC set-up, the entry trigger occurred more than two hours before the opening bell. Oh well. Here’s the graph. The futures look like they have farther to fall. _______ UPDATE (Oct 14, 8:08 p.m.): Here’s an 11,781 downside target you can use if sellers dominate for a third straight day. Your clue of more weakness to come would follow a decisive penetration of p=11,907.

NQZ20 – Dec E-Mini Nasdaq (Last:11,958)

Posted on October 8, 2020, 8:49 pm EDT

Last Updated October 14, 2020, 8:08 pm EDT

Posted on October 8, 2020, 8:49 pm EDT

Last Updated October 14, 2020, 8:08 pm EDT