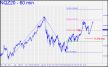

The 12,808 rally target that we used last week is still in play even though bulls couldn’t push this hoax to the secondary pivot at 12,271. The futures got close enough, however, to warrant a ‘mechanical’ bid at 11,734. A low on Thursday at 11,736 could have been used for this purpose, and a trade initiated there went on to produce a hypothetical gain of about $1200 per contract. We’d be getting sloppy seconds if the December contract revisits the red line, but my gut feeling is that any overshoot would not reach the stop-loss at 11,376. Even so, I’ll suggest using an rABC set-up on the five-minute chart or less to trigger the trade. The ‘A-B’ segment should be between 200-250 points. _______ UPDATE (Oct 19, 1:05 p.m. ET): The downtrend is closing on p=11,734, where it would trigger a ‘mechanical’ buy. Here’s the rABC I’d suggest using to initiate the trade once p has been touched. Attempt this trade only if you understand why the initial theoretical risk per contract would be around $628; and at what level you would take a partial profit. ______ UPDATE (Oct 19, 8:45 p.m.): The trade detailed in the update above included a graph with the precise rABC set-up to use, and it could not have worked out more perfectly. This gambit produced a gain of $780 per contract in less than 30 minutes for anyone who followed my simple advice. That is the profit on just one contract acquired at the green line and exited at the red. If you’d held four contracts as we often do, and exited at the pattern’s D target (where the move topped precisely), your profit on the position would have been $9440. Since no one mentioned this trade in the chat room, I assume that interest in the vehicle has fallen to nil. Unless I hear from a few subscribers who want to keep it, I will drop coverage at week’s end. Here’s the chart. ______ UPDATE (Oct 21, 8:57 p.m.): The vote is in, and it has been determined that this vehicle will remain on the front page. It may be rolling over, by the way, but technical signs are not so ominous as those I’ve flagged in IWM, an ETF proxy for the Russell 2000. ______ UPDATE (Oct 22, 4:20 p.m.): Hard to predict whether freaky Friday will disrupt this vehicle’s placid downtrend, but here’s a chart with an 11,432 downside target and some HP levels that should handle things if more mildly bearish tedium ensues.

The 12,808 rally target that we used last week is still in play even though bulls couldn’t push this hoax to the secondary pivot at 12,271. The futures got close enough, however, to warrant a ‘mechanical’ bid at 11,734. A low on Thursday at 11,736 could have been used for this purpose, and a trade initiated there went on to produce a hypothetical gain of about $1200 per contract. We’d be getting sloppy seconds if the December contract revisits the red line, but my gut feeling is that any overshoot would not reach the stop-loss at 11,376. Even so, I’ll suggest using an rABC set-up on the five-minute chart or less to trigger the trade. The ‘A-B’ segment should be between 200-250 points. _______ UPDATE (Oct 19, 1:05 p.m. ET): The downtrend is closing on p=11,734, where it would trigger a ‘mechanical’ buy. Here’s the rABC I’d suggest using to initiate the trade once p has been touched. Attempt this trade only if you understand why the initial theoretical risk per contract would be around $628; and at what level you would take a partial profit. ______ UPDATE (Oct 19, 8:45 p.m.): The trade detailed in the update above included a graph with the precise rABC set-up to use, and it could not have worked out more perfectly. This gambit produced a gain of $780 per contract in less than 30 minutes for anyone who followed my simple advice. That is the profit on just one contract acquired at the green line and exited at the red. If you’d held four contracts as we often do, and exited at the pattern’s D target (where the move topped precisely), your profit on the position would have been $9440. Since no one mentioned this trade in the chat room, I assume that interest in the vehicle has fallen to nil. Unless I hear from a few subscribers who want to keep it, I will drop coverage at week’s end. Here’s the chart. ______ UPDATE (Oct 21, 8:57 p.m.): The vote is in, and it has been determined that this vehicle will remain on the front page. It may be rolling over, by the way, but technical signs are not so ominous as those I’ve flagged in IWM, an ETF proxy for the Russell 2000. ______ UPDATE (Oct 22, 4:20 p.m.): Hard to predict whether freaky Friday will disrupt this vehicle’s placid downtrend, but here’s a chart with an 11,432 downside target and some HP levels that should handle things if more mildly bearish tedium ensues.

NQZ20 – Dec E-Mini Nasdaq (Last:11647)

Posted on October 18, 2020, 5:18 pm EDT

Last Updated October 23, 2020, 12:48 pm EDT

Posted on October 18, 2020, 5:18 pm EDT

Last Updated October 23, 2020, 12:48 pm EDT