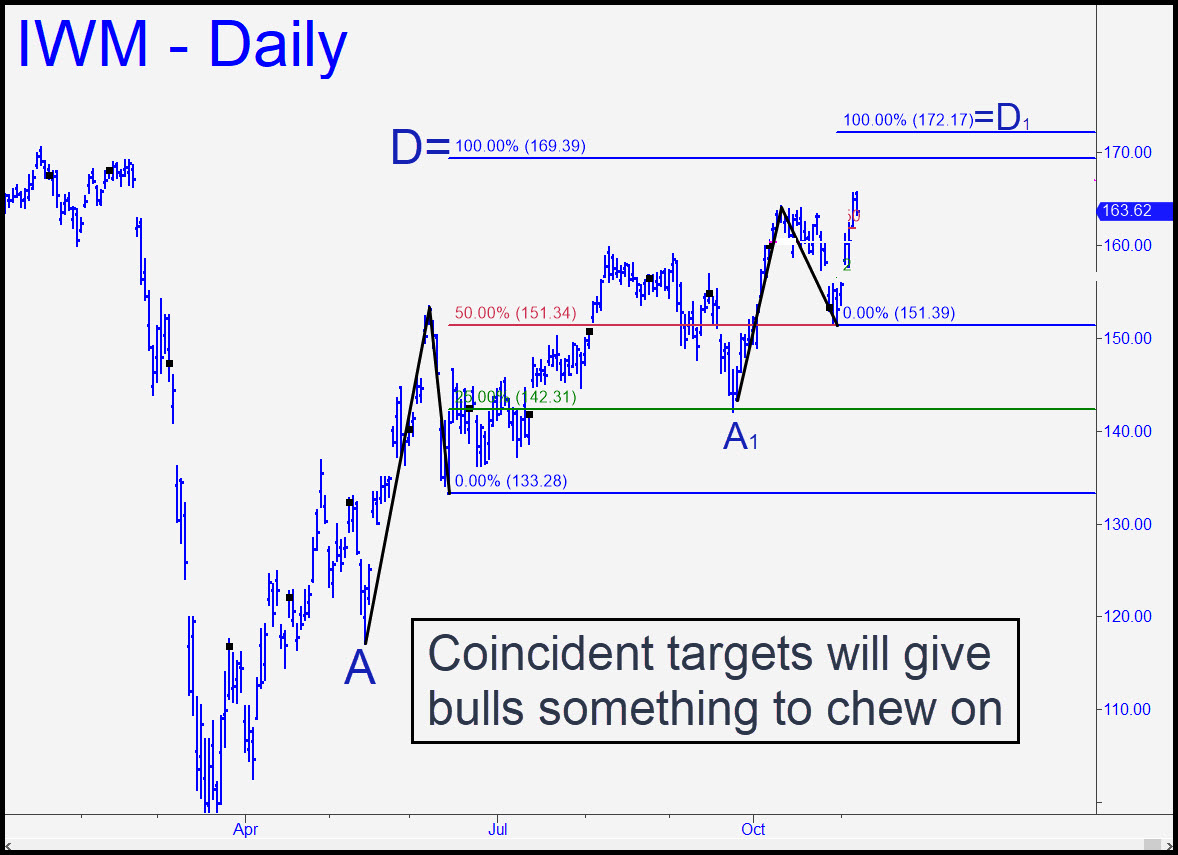

The 172.17 rally target we’ve been using to stay on the right side of the trend now has a companion target, a ‘D’ Hidden Pivot at 166.98. Together they should exert short-able stopping power, so we’ll be looking to lay ’em out when IWM reaches the lower end of their approximately 5-point range. We still hold some Nov 6 130 puts that are no longer even a distant longshot to pay off. However, observing an inviolate rule of the Hidden Pivot Method, we cashed out of half of them when their price doubled, allowing us to hold onto the remainder of the position with zero risk. Some subscribers were able to do even better, since the puts quadrupled in price before IWM took off. This happened when the portfolio chimps began to hype a quite bullish small-cap story, presumably after they’d front-run it to the extent possible. _______ UPDATE (Nov 9, 8:35 a.m. ET): The overnight high in the E-Mini futures equates to 175.81. The futures exceeded their target at 1741.90, putting an 1813.30 target in play that is all but certain to be reached. This is equivalent to 181.33 in IWM. _______ UPDATE (Nov 9, 6:54 p.m.): I’ve redrawn the pattern to show a 184.73 target that is somewhat more ambitious than the one proffered this morning. I regard it as likely to be reached, but the huge price reversal will have sapped bulls of confidence that will take at least a week or two to return. Look for the gap between 165 and 169 to be filled. If the pullback touches the red line (163.44), it would trigger an enticing ‘mechanical’ buy. _______ UPDATE (Nov 10, 7:38 p.m.): I’ll be interested myself to see who wins this one. On the one hand, Wall Street has been huckstering small-caps as the greatest thing since sliced bread; however, on the other, the strong bounce from just above Monday’s lunatic gap is just a little too devil-may-care to be credible. Wednesday’s price action should settle the question as to whether the bounce is a bluff. If the close is above Monday’s high, that would leave no doubt about whether bulls’ intentions are sincere. _______ UPDATE (Nov 11, 6:24 p.m.): Even though DaBoyz rigged the opening bar with enough weakness to shake out many bulls, the subsequent short squeeze was feeble. They will surely try again on Thursday, but you should treat (and trade) rallies with skepticism. _______ UPDATE (Nov 12, 9:24 p.m.): Like DIA, this vehicle has fallen into the gap created by Monday’s lunatic ‘vaccine leap’. The difference is that IWM has shown enough strength to turn around. I expect the effort to fail, which if correct would make this vehicle an interesting ‘jackpot’ option play for Friday. Accordingly, if the stock is up moderately in the first 15-30 minutes, trading in the approximate range 170.80 and 172, buy a few puts expiring on Nov 20 at whatever strike yields a price under 0.50. They will decay like crazy, so don’t risk more than you could lose painlessly.

The 172.17 rally target we’ve been using to stay on the right side of the trend now has a companion target, a ‘D’ Hidden Pivot at 166.98. Together they should exert short-able stopping power, so we’ll be looking to lay ’em out when IWM reaches the lower end of their approximately 5-point range. We still hold some Nov 6 130 puts that are no longer even a distant longshot to pay off. However, observing an inviolate rule of the Hidden Pivot Method, we cashed out of half of them when their price doubled, allowing us to hold onto the remainder of the position with zero risk. Some subscribers were able to do even better, since the puts quadrupled in price before IWM took off. This happened when the portfolio chimps began to hype a quite bullish small-cap story, presumably after they’d front-run it to the extent possible. _______ UPDATE (Nov 9, 8:35 a.m. ET): The overnight high in the E-Mini futures equates to 175.81. The futures exceeded their target at 1741.90, putting an 1813.30 target in play that is all but certain to be reached. This is equivalent to 181.33 in IWM. _______ UPDATE (Nov 9, 6:54 p.m.): I’ve redrawn the pattern to show a 184.73 target that is somewhat more ambitious than the one proffered this morning. I regard it as likely to be reached, but the huge price reversal will have sapped bulls of confidence that will take at least a week or two to return. Look for the gap between 165 and 169 to be filled. If the pullback touches the red line (163.44), it would trigger an enticing ‘mechanical’ buy. _______ UPDATE (Nov 10, 7:38 p.m.): I’ll be interested myself to see who wins this one. On the one hand, Wall Street has been huckstering small-caps as the greatest thing since sliced bread; however, on the other, the strong bounce from just above Monday’s lunatic gap is just a little too devil-may-care to be credible. Wednesday’s price action should settle the question as to whether the bounce is a bluff. If the close is above Monday’s high, that would leave no doubt about whether bulls’ intentions are sincere. _______ UPDATE (Nov 11, 6:24 p.m.): Even though DaBoyz rigged the opening bar with enough weakness to shake out many bulls, the subsequent short squeeze was feeble. They will surely try again on Thursday, but you should treat (and trade) rallies with skepticism. _______ UPDATE (Nov 12, 9:24 p.m.): Like DIA, this vehicle has fallen into the gap created by Monday’s lunatic ‘vaccine leap’. The difference is that IWM has shown enough strength to turn around. I expect the effort to fail, which if correct would make this vehicle an interesting ‘jackpot’ option play for Friday. Accordingly, if the stock is up moderately in the first 15-30 minutes, trading in the approximate range 170.80 and 172, buy a few puts expiring on Nov 20 at whatever strike yields a price under 0.50. They will decay like crazy, so don’t risk more than you could lose painlessly.

IWM – Russell 2000 ETF (Last:169.96)

Posted on November 8, 2020, 5:05 pm EST

Last Updated November 12, 2020, 9:29 pm EST

Posted on November 8, 2020, 5:05 pm EST

Last Updated November 12, 2020, 9:29 pm EST