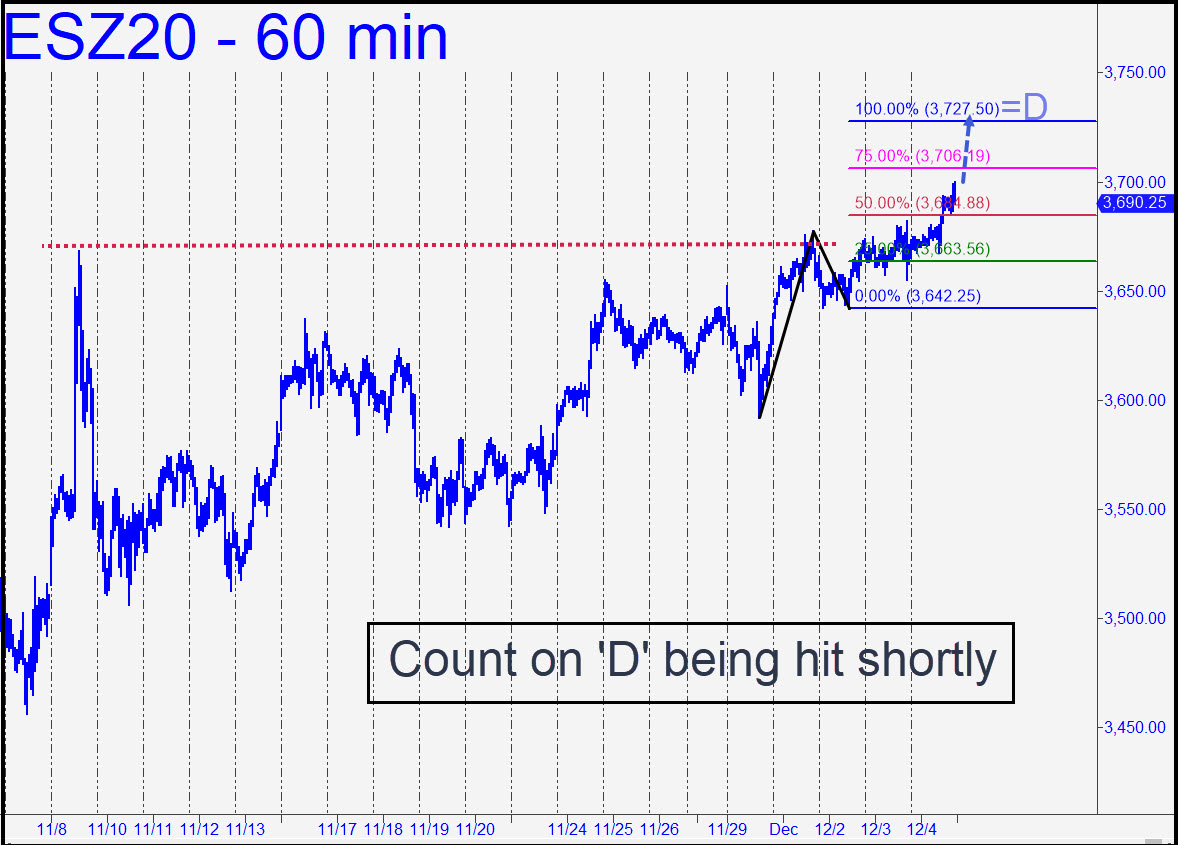

There are unfulfilled rally targets at 3769 and 3802 that have kept us confidently on the right side of the trend regardless of news or mood swings. More immediately, however, last week’s powerfully impulsive price action has created a lesser, bullish pattern with a 3727.50 target that is all but certain to be achieved, probably by no later than Wednesday. A tradeable stall at this Hidden Pivot seems likely, and I am therefore recommending a tightly stopped short to anyone who has made money on the way up. As always, an easy move through a target implies the trend is likely to continue, usually after a correction. _______ UPDATE (Dec 8, 5:03 p.m.): Time to start paying attention, since the futures are closing on p=3728.00 (slightly adjusted from above), the first place where a major trend failure could occur. Although I still believe the somewhat higher targets for the larger pattern cited above will be achieved, you can attempt a very tightly stopped (i.e., 1.25-2.00 points) short at 3728.00. Here’s the chart, and although it lacks a one-off ‘A’, the pattern otherwise is quite appealing. _______ UPDATE (Dec 9, 7:52 p.m.): The futures traded no higher than 3715, so we were unable to squeeze off a short on our terms. The downdraft created an impulse leg on the hourly chart, but let’s give it a day to see what bears can do with it. _______ UPDATE (Dec 19, 5:52): The selling turned gutless on day two and is struggling to reach a 3630.25 downside target. If DaBoyz can squeeze this hoax above 3681.25 overnight, they will likely be in charge as the week comes to an end. Here’s a fresh chart that shows everything. _______ UPDATE (Dec 11, 9:55 a.m.): The 3630.25 target came within two points of nailing a low that has given way to a so-far 25-point bounce. I am tempted to think that price action near the low was the work of the Goldman Sachs mole said to dwell in the Rick’s Picks chat room. That’s because the futures made a series of marginally lower lows that could have stopped out traders before finally touching, then slightly exceeding the target and turning around. This shows how difficult it can be to make money even when you are able to call the turns accurately. The pattern I used is not one that would have jumped out at amateurs. I’ll mention as well that the pattern would have worked even more accurately if I’d used the ‘Pontiac/Oldsmobile’ high at 2714.00 for a point ‘A’.

There are unfulfilled rally targets at 3769 and 3802 that have kept us confidently on the right side of the trend regardless of news or mood swings. More immediately, however, last week’s powerfully impulsive price action has created a lesser, bullish pattern with a 3727.50 target that is all but certain to be achieved, probably by no later than Wednesday. A tradeable stall at this Hidden Pivot seems likely, and I am therefore recommending a tightly stopped short to anyone who has made money on the way up. As always, an easy move through a target implies the trend is likely to continue, usually after a correction. _______ UPDATE (Dec 8, 5:03 p.m.): Time to start paying attention, since the futures are closing on p=3728.00 (slightly adjusted from above), the first place where a major trend failure could occur. Although I still believe the somewhat higher targets for the larger pattern cited above will be achieved, you can attempt a very tightly stopped (i.e., 1.25-2.00 points) short at 3728.00. Here’s the chart, and although it lacks a one-off ‘A’, the pattern otherwise is quite appealing. _______ UPDATE (Dec 9, 7:52 p.m.): The futures traded no higher than 3715, so we were unable to squeeze off a short on our terms. The downdraft created an impulse leg on the hourly chart, but let’s give it a day to see what bears can do with it. _______ UPDATE (Dec 19, 5:52): The selling turned gutless on day two and is struggling to reach a 3630.25 downside target. If DaBoyz can squeeze this hoax above 3681.25 overnight, they will likely be in charge as the week comes to an end. Here’s a fresh chart that shows everything. _______ UPDATE (Dec 11, 9:55 a.m.): The 3630.25 target came within two points of nailing a low that has given way to a so-far 25-point bounce. I am tempted to think that price action near the low was the work of the Goldman Sachs mole said to dwell in the Rick’s Picks chat room. That’s because the futures made a series of marginally lower lows that could have stopped out traders before finally touching, then slightly exceeding the target and turning around. This shows how difficult it can be to make money even when you are able to call the turns accurately. The pattern I used is not one that would have jumped out at amateurs. I’ll mention as well that the pattern would have worked even more accurately if I’d used the ‘Pontiac/Oldsmobile’ high at 2714.00 for a point ‘A’.

ESZ20 – December E-Mini S&P (Last:3675.25)

Posted on December 6, 2020, 5:18 pm EST

Last Updated December 12, 2020, 2:55 pm EST

Posted on December 6, 2020, 5:18 pm EST

Last Updated December 12, 2020, 2:55 pm EST