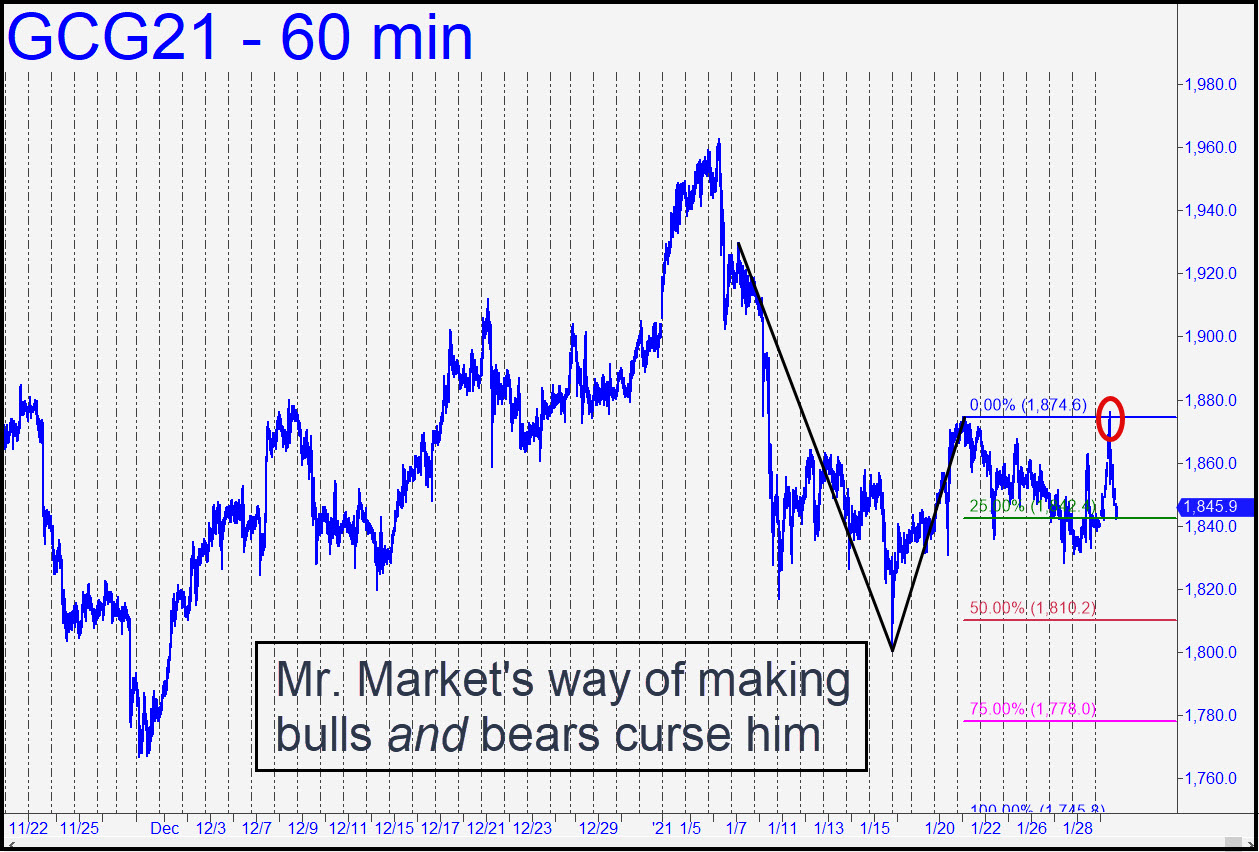

My outlook and trading advice for silver is more bullish than for gold at the moment due to the latter’s punk performance on the hourly chart. I tend to treat each separately in such instances rather than have feelings about one vehicle corrupt the accuracy of my forecast for the other. In this case, Silver looks primed to drag Gold higher. How’s that, you ask?? Well, the Reddit brats reportedly are intent on short-squeezing silver because they don’t like the way DaScumballs who rule precious-metals markets often manipulate bullion quotes lower to cover short positions at bargain prices. We sincerely wish the brats all possible success in this worthy venture, but they ought to read Bunky Hunt’s epitaph before they get carried away with themselves. Concerning Feb Gold, there is mild evidence to support the case for a fall to p=1811.60 of the pattern shown (using the circled peak as ‘C’), or even to D=1745.80. The equivalent numbers for the April contract are p=1814.40, and D=1749.80. Looking at the charts in toto, though, it’s clear that bears are not having any more success than bulls at profiting from bullion’s ups and downs. Under the circumstances, I am making no recommendation, nor even ballyhooing a target. It could go either way, and I’m having difficulty caring which right now. _______ UPDATE (Feb 4, 9:16 p.m. EST): Here’s the April chart, with a secondary (p2) HP support at 1782.10 that I didn’t mention earlier. I proffer it now to those clinging to the hope that this unwarranted and gratuitous shakeout won’t be quite as bad as it could get. ______ UPDATE (Feb 4, 9:25 p.m.): The little weasel plunged to 1784.60, an inch shy of the 1782.10 target flagged above, before rebounding moderately into the close. The rally will become more credible if it can get past some ‘external’ peaks on the intraday charts, the first of which lies at 1820.40. Regardless, the 1749.80 downside target will remain viable until such time as 1878.90 is exceeded to the upside.

My outlook and trading advice for silver is more bullish than for gold at the moment due to the latter’s punk performance on the hourly chart. I tend to treat each separately in such instances rather than have feelings about one vehicle corrupt the accuracy of my forecast for the other. In this case, Silver looks primed to drag Gold higher. How’s that, you ask?? Well, the Reddit brats reportedly are intent on short-squeezing silver because they don’t like the way DaScumballs who rule precious-metals markets often manipulate bullion quotes lower to cover short positions at bargain prices. We sincerely wish the brats all possible success in this worthy venture, but they ought to read Bunky Hunt’s epitaph before they get carried away with themselves. Concerning Feb Gold, there is mild evidence to support the case for a fall to p=1811.60 of the pattern shown (using the circled peak as ‘C’), or even to D=1745.80. The equivalent numbers for the April contract are p=1814.40, and D=1749.80. Looking at the charts in toto, though, it’s clear that bears are not having any more success than bulls at profiting from bullion’s ups and downs. Under the circumstances, I am making no recommendation, nor even ballyhooing a target. It could go either way, and I’m having difficulty caring which right now. _______ UPDATE (Feb 4, 9:16 p.m. EST): Here’s the April chart, with a secondary (p2) HP support at 1782.10 that I didn’t mention earlier. I proffer it now to those clinging to the hope that this unwarranted and gratuitous shakeout won’t be quite as bad as it could get. ______ UPDATE (Feb 4, 9:25 p.m.): The little weasel plunged to 1784.60, an inch shy of the 1782.10 target flagged above, before rebounding moderately into the close. The rally will become more credible if it can get past some ‘external’ peaks on the intraday charts, the first of which lies at 1820.40. Regardless, the 1749.80 downside target will remain viable until such time as 1878.90 is exceeded to the upside.

GCG21 – February Gold (Last:1796.60)

Posted on January 31, 2021, 5:14 pm EST

Last Updated February 6, 2021, 4:02 pm EST

Posted on January 31, 2021, 5:14 pm EST

Last Updated February 6, 2021, 4:02 pm EST

- February 1, 2021, 9:57 am

Real economy smashed by bureaucratic control freaks.

Deflationary bust probably to roll in followed by stagflation, when stimulus no longer stimulates.

Plenty of time to care about AU direction in the coming months- it may start to matter as these twits continue to blow up the world in service to their Globocorp masters- who are a pack of hubristic fools BTW