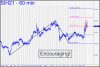

Silver continues to outperform gold in subtle technical ways that are encouraging. On Friday, for instance, the March contract blew past a midpoint Hidden Pivot associated with a D target at 30.10. This implies the target is probably no worse than a 60% shot to be achieved. It also makes a pullback to the green line (x=25.55) an enticing spot for a ‘mechanical’ bid with a stop-loss at 24.03. (It may be possible to pare the entry risk by as much 90% using an rABC set-up, so stay tuned.) We might not be gifted with a nasty correction to x; regardless, price action in the chart supports a more bullish bias than we’ve allowed since late December. ______ UPDATE (Feb 1, 11:45 a.m. EST): Wowee! The strongest leap in 11 years has pushed the futures past my target, somewhat exceeding a revised target at 30.18 that I posted in the chat room. The ferocity with which the rally has impaled p=28.30 of a larger pattern is quite bullish and has raised the odds of more upside to at least D=34.675 to around 75%. Here’s the chart. _______ UPDATE (Feb 1, 9:31 p.m.): The pullback has further to go, presumably to at least 27.77, where it would fill a gap created by the powerful leap begun three days ago from 24.71. ____UPDATE (Feb 2, 6:08): The correction from the top of Monday’s exuberant spike to 30.35 has been brutal, erasing nearly two thirds of the substantial gains achieved since last Wednesday. Even so, because the spike impaled the 28.30 midpoint pivot, odds are still good that the 34.675 target will eventually be achieved with or without the support of the Reddit crowd. _______ UPDATE (Feb 4, 9:46 p.m.): The futures would become a fetching ‘mechanical’ buy at x=25.11. I’d have to concede, however, that the required 21.92 stop-loss, risking an initial $15,950 per contract, is somewhat off-putting. Stay tuned to the chat room if you’re interested nonetheless , since there may be an opportunity to pare the entry risk down to manageable.

Silver continues to outperform gold in subtle technical ways that are encouraging. On Friday, for instance, the March contract blew past a midpoint Hidden Pivot associated with a D target at 30.10. This implies the target is probably no worse than a 60% shot to be achieved. It also makes a pullback to the green line (x=25.55) an enticing spot for a ‘mechanical’ bid with a stop-loss at 24.03. (It may be possible to pare the entry risk by as much 90% using an rABC set-up, so stay tuned.) We might not be gifted with a nasty correction to x; regardless, price action in the chart supports a more bullish bias than we’ve allowed since late December. ______ UPDATE (Feb 1, 11:45 a.m. EST): Wowee! The strongest leap in 11 years has pushed the futures past my target, somewhat exceeding a revised target at 30.18 that I posted in the chat room. The ferocity with which the rally has impaled p=28.30 of a larger pattern is quite bullish and has raised the odds of more upside to at least D=34.675 to around 75%. Here’s the chart. _______ UPDATE (Feb 1, 9:31 p.m.): The pullback has further to go, presumably to at least 27.77, where it would fill a gap created by the powerful leap begun three days ago from 24.71. ____UPDATE (Feb 2, 6:08): The correction from the top of Monday’s exuberant spike to 30.35 has been brutal, erasing nearly two thirds of the substantial gains achieved since last Wednesday. Even so, because the spike impaled the 28.30 midpoint pivot, odds are still good that the 34.675 target will eventually be achieved with or without the support of the Reddit crowd. _______ UPDATE (Feb 4, 9:46 p.m.): The futures would become a fetching ‘mechanical’ buy at x=25.11. I’d have to concede, however, that the required 21.92 stop-loss, risking an initial $15,950 per contract, is somewhat off-putting. Stay tuned to the chat room if you’re interested nonetheless , since there may be an opportunity to pare the entry risk down to manageable.

SIH21 – March Silver (Last:26.32)

Posted on January 31, 2021, 5:01 pm EST

Last Updated February 4, 2021, 9:46 pm EST

Posted on January 31, 2021, 5:01 pm EST

Last Updated February 4, 2021, 9:46 pm EST