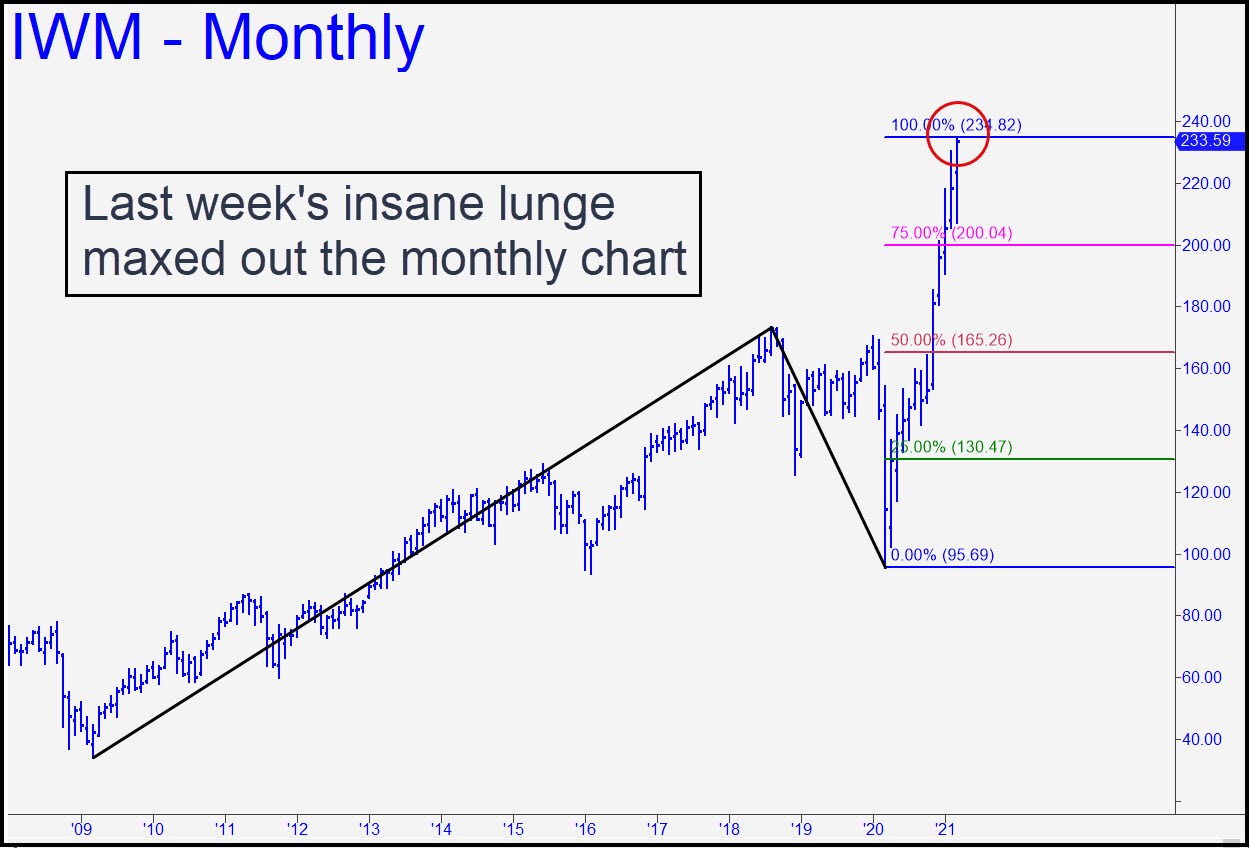

Last week’s steep vertical climb came within 0.67, or less than two-tenths of a percentage point, of a longstanding target at 234.82, maxing out the monthly chart. I’d suggested getting short in TZA to leverage a possible top, but it never made it down to the 28.86-28.91 level where subscribers were instructed to place a bid. The order will remain viable on Monday, but because odds are heavily against it, you should maintain a tight stop-loss initially at 28.69. Here’s a TZA chart with a downtrending ABC pattern that corresponds inversely to IWM’s bullish move. _______ UPDATE (Mar 16, 6:15 p.m.): Playing cat-and-mouse with TZA wore me out, but some subscribers reported getting aboard near Monday’s low based on my downside target at 28.86. If so, take a small partial-profit so you can hold what remains without risking a loss. I cannot say with confidence whether TZA is at a major bottom, but IWM’s so-far infinitesimally small undershoot of a corresponding rally target, a very major one at 234.82, suggests it’s at least possible. ______ UPDATE (Mar 18, 5:38 p.m.): Finally, a day that bears could enjoy! The reversal in the early afternoon from a slight gain could spell trouble for the herd if it picks up speed and power ahead of the weekend.

Last week’s steep vertical climb came within 0.67, or less than two-tenths of a percentage point, of a longstanding target at 234.82, maxing out the monthly chart. I’d suggested getting short in TZA to leverage a possible top, but it never made it down to the 28.86-28.91 level where subscribers were instructed to place a bid. The order will remain viable on Monday, but because odds are heavily against it, you should maintain a tight stop-loss initially at 28.69. Here’s a TZA chart with a downtrending ABC pattern that corresponds inversely to IWM’s bullish move. _______ UPDATE (Mar 16, 6:15 p.m.): Playing cat-and-mouse with TZA wore me out, but some subscribers reported getting aboard near Monday’s low based on my downside target at 28.86. If so, take a small partial-profit so you can hold what remains without risking a loss. I cannot say with confidence whether TZA is at a major bottom, but IWM’s so-far infinitesimally small undershoot of a corresponding rally target, a very major one at 234.82, suggests it’s at least possible. ______ UPDATE (Mar 18, 5:38 p.m.): Finally, a day that bears could enjoy! The reversal in the early afternoon from a slight gain could spell trouble for the herd if it picks up speed and power ahead of the weekend.

IWM – Russell 2000 ETF (Last:225.85)

Posted on March 14, 2021, 5:16 pm EDT

Last Updated March 18, 2021, 5:39 pm EDT

Posted on March 14, 2021, 5:16 pm EDT

Last Updated March 18, 2021, 5:39 pm EDT