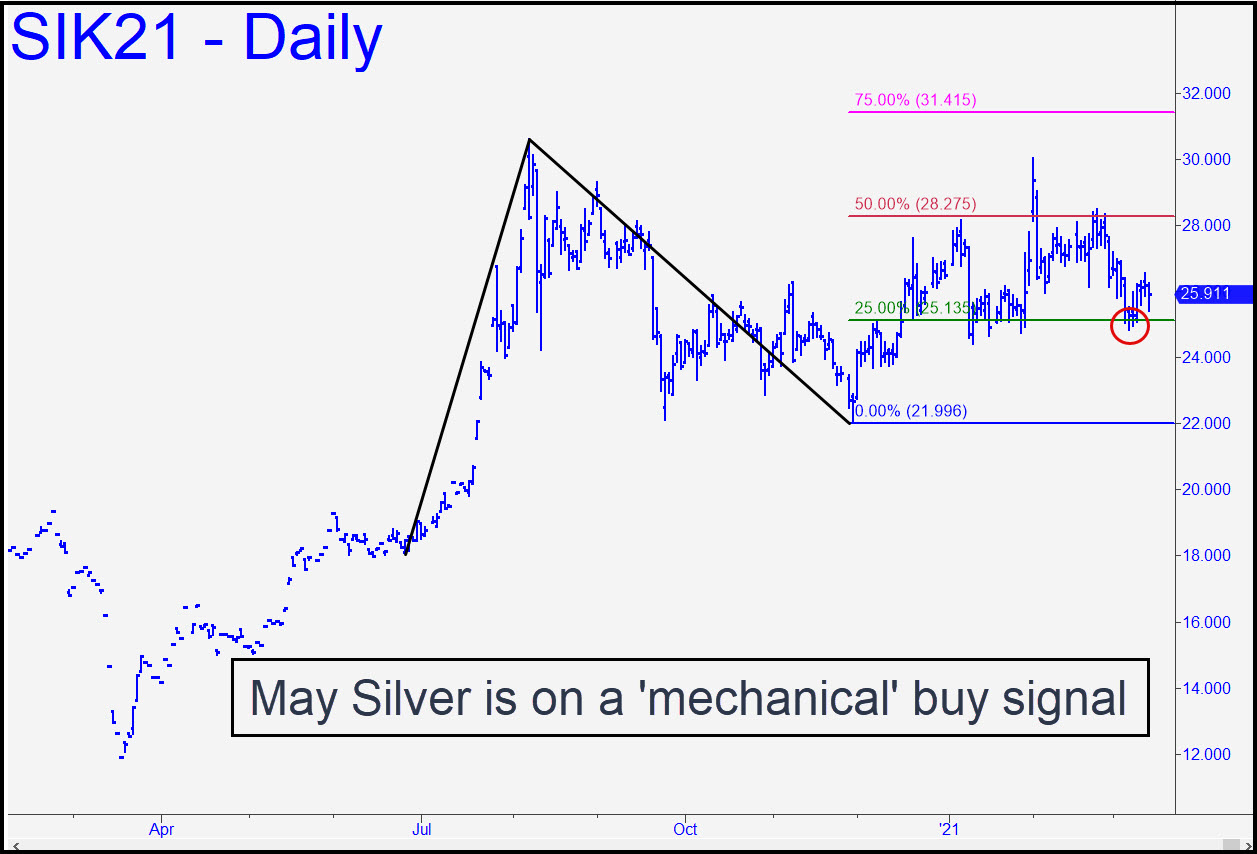

May Silver is on a buy signal triggered March 4, when the futures touched the green line (see inset) after having popped ever-so-briefly above the red one a month earlier. The price spike was caused by an effusion of Reddit/Robinhoodie hubris; however, the short squeeze they’d intended did not get very far. In retrospect, it is clear that they misjudged the heft of commodity silver as well as the fact that bullion’s lazy bull market is on its own schedule and cannot be hastened with mere talk. Given the artificial nature of the February 1 spike, I suggested paper-trading the ‘mechanical’ buy when it triggered at 25.12. The position required a stop-loss just below C=21.99, implying initial risk of more than $15,000 per contract. In any event, the trade would be a winner if the futures reach p=28.27 without having dipped first below C=21.99. I have my doubts this will occur because a recalcitrant gold has been exerting downward pull on silver, but we should keep an open mind in any event. A two-day close above p=28.275 would indicate bulls have regained their mojo and are capable of pushing this vehicle to D=34.55.

May Silver is on a buy signal triggered March 4, when the futures touched the green line (see inset) after having popped ever-so-briefly above the red one a month earlier. The price spike was caused by an effusion of Reddit/Robinhoodie hubris; however, the short squeeze they’d intended did not get very far. In retrospect, it is clear that they misjudged the heft of commodity silver as well as the fact that bullion’s lazy bull market is on its own schedule and cannot be hastened with mere talk. Given the artificial nature of the February 1 spike, I suggested paper-trading the ‘mechanical’ buy when it triggered at 25.12. The position required a stop-loss just below C=21.99, implying initial risk of more than $15,000 per contract. In any event, the trade would be a winner if the futures reach p=28.27 without having dipped first below C=21.99. I have my doubts this will occur because a recalcitrant gold has been exerting downward pull on silver, but we should keep an open mind in any event. A two-day close above p=28.275 would indicate bulls have regained their mojo and are capable of pushing this vehicle to D=34.55.

SIK21 – May Silver (Last:25.91)

Posted on March 14, 2021, 5:08 pm EDT

Last Updated March 13, 2021, 11:10 am EST

Posted on March 14, 2021, 5:08 pm EDT

Last Updated March 13, 2021, 11:10 am EST