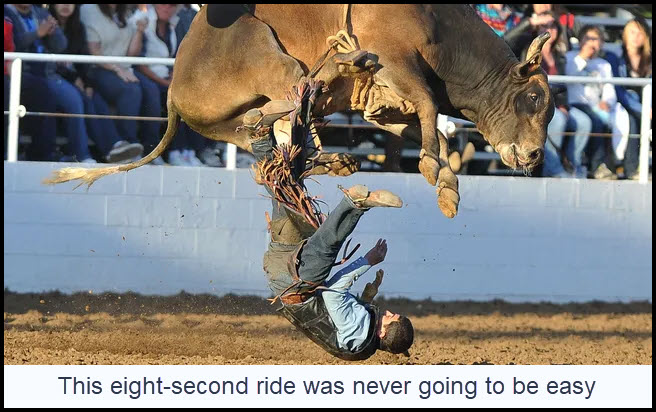

No one said it would be easy to get short at the top. This bull market is proving especially challenging to fade because the herd knows how grotesquely overvalued stocks are. With so many traders eager to bet the ‘don’t’ line, the broad averages have started to behave like El Diablo (see photo above). The Dow has staged three 600-point-plus rallies-to-nowhere since peaking two weeks ago, but none lasted for more than a day. Although bull riders must hang on for eight seconds to claim a prize, traders could conceivably have to endure weeks or even months of loco price action to hit it big. Many will get busted up badly trying.

No one said it would be easy to get short at the top. This bull market is proving especially challenging to fade because the herd knows how grotesquely overvalued stocks are. With so many traders eager to bet the ‘don’t’ line, the broad averages have started to behave like El Diablo (see photo above). The Dow has staged three 600-point-plus rallies-to-nowhere since peaking two weeks ago, but none lasted for more than a day. Although bull riders must hang on for eight seconds to claim a prize, traders could conceivably have to endure weeks or even months of loco price action to hit it big. Many will get busted up badly trying.

The ‘everything bubble’, as it is called, is wherever one looks: stocks, bonds, real estate, art…African American Barbie dolls. There are more homes listed for $5 million and up than there are Smiths in the Manhattan phone directory. Ironically, gold and silver are among the few investable assets that are not in a bubble. That tells you how badly the players have misjudged the risks of a financial cataclysm. They’ve gone all-in on bitcoin instead, as though scarcity alone could make cryptocurrency money, a store of value or a hedge against the crash that is coming.

Fed Quackery

Fed Chairman Powell’s every utterance has been the obsessive focus of economists and pundits who make their living taking the central bank’s monetary quackery seriously. Does anyone actually believe that credit stimulus will produce an economy healthy enough to service the trillions of dollars in debt we’ve accumulated desperately trying to keep an asset bubble from deflating? The effort is not only doomed, it is likely to to produce a deflationary collapse featuring a strong dollar and crushing real rates of interest. Sound impossible? Not with everyone on the ‘inflation’ side of the bet, it isn’t. Even $10Tr-$20Tr of helicopter money is just a drop in the bucket compared to the deflationary juggernaut represented by global trade in financial derivatives. It is $2 quadrillion in size, every penny of it effectively a short position against the dollar. If you think the short-squeeze run-up in Gamestop shares was crazy, wait till you see the world’s desperate bet on inflation unwind.

Rick, totally agree with Wait till you see the world’s desperate bet on inflation unwind.

On 22 and 23 March 2021, Fed Chair Jerome Powell addresses the Bank for International Settlements, the central bankers central bank.

Is something afoot now that gold is a Tier One asset used for margin reserves ?

BIS set up in 1930 to handle NJ Guv, Princeton and US President WW Personal Treaty of Versailles Dictated German Reparation payments from WWI that preceded deliberate hyperinflation by German Banks in 1923. Woodrow stroked out in the Lincoln Bedroom in 1919 and his wife ran the country until 1921. Dr Jill or Kamala Rice ?

BIS enjoyed exemption from laws and taxes similar to the Fed.

Hoover ended WW’s German Reparations plan and BIS became the Bank for Nazi loot with Walther Funk, Emil Puhl, Baron von Shroeder, Herman Schmitz convicted of war crimes against humanity.

In March 1939 BIS transferred 23 tons of Czech gold to the Nazi Reichsbank when Hitler invaded Czechoslovakia. BIS also accepted purloined art treasures and melted dental gold from concentration camp victims.

The 1944 Bretton Woods NH monetary conference recommended liquidation of BIS ASAP, but Eton Cambridge Kings College Fabian Socialist Mathematician turned Economist turned Closet Politician 1st Baron Keynes and US President Truman stopped that.

Kings College, founded in 1441 by King Henry VI, had some of the largest ag land holdings in England, predating William Gates III in the USA. Rents fluctuated up and down, more down with depression and expropriation, despite switching from long term below market beneficial leases to short term market rack rents.

In 1920 First Bursar Keynes began selling one third of King’s real estate portfolio into strength.

From 1924 to 1946, Keynes lost money in bonds, commodities, currencies and 1929 for himself and various Insurance Companies. He made a fortune from small cap value stocks yielding 6 % dividends with his annualised return of 16 % vs 7.1 % for UK Government Bonds with a deflation rate of – 1.1 % adding a tailwind to real returns.

In 1905 Keynes wrote,

I want to manage a railway or organise a Trust, or at least swindle

the investing public.

He followed that with,

I work for a Government I despise for ends I think criminal.

BIS provides a semi-annual OTC Derivatives report that most recently indicated $607 Trillion face value in June 2020. This including $405 T in Interest Rate Contracts.

Consider the destabilizing institutional consequences of sudden large interest rate moves on unregulated counter-parties long Treasuries, as prices fall with higher interest rates. Not everyone can buy derivatives without maintaining margin like Uncle Warren or the big banks.

Currently Big4 are short all Treasury maturities but 5 and 15 year maturity artifacts.

If exchange listed Derivatives add another $1.4 T to the open market mix, that can amplify the real risk of institutional defaults with sudden severe deflation or inflation without adequate bailouts.

Recall the great Liar’s Dice Tournament of 1977 at Harringtons and Royal Exchange.

(The Pandemic Lockdown closed 85 year old Harringtons in 2020.

Frost thought the world ended in fire, not ice.

https://amzn.to/3tamGzE