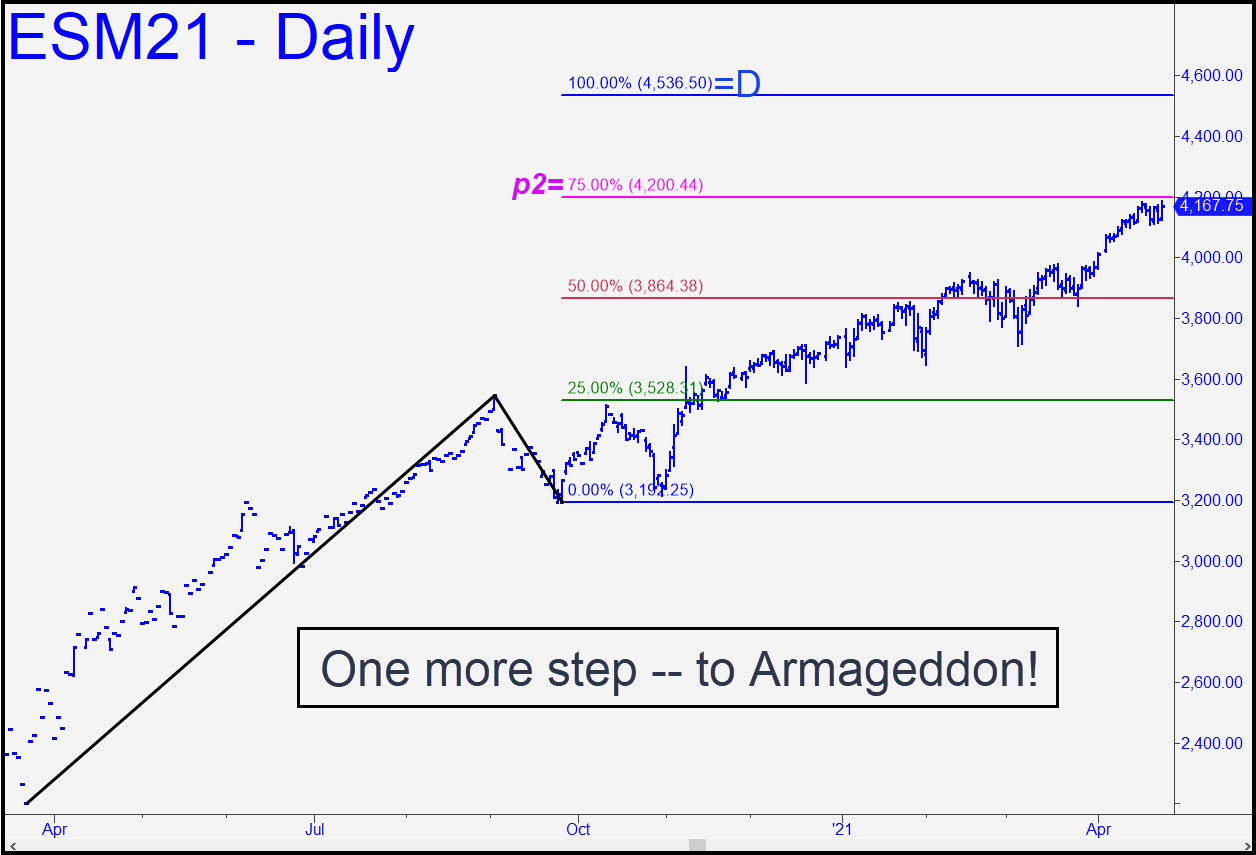

I’ve identified bull market targets as high as 4905.75, but let’s use the pattern shown for now, with a less ambitious objective at 4536.50, since the futures are a millimeter from a related, and potentially crucial, benchmark. They traded as high as 4187 on Friday, just 13 points from the secondary Hidden Pivot at 4200.44 shown in the chart. We shouldn’t be surprised to see a tradeable pullback from it, but if buyers blow past or close above it for two straight days, that would put the 4536.50 target well in play. There is one other ‘hidden’ obstacle noted here earlier: 4222.82, the p2 pivot of the pattern associated with D=4905.75, but we’ll ignore it for now to keep things simple. It may be possible to get short with risk tightly controlled on Monday or Tuesday using a small-degree ‘reverse’ ABC set-up, but let’s play it by ear. Chat-roomers, stay tuned! _______ UPDATE (Apr 29, 10:13 p.m. ET): Failures precisely at the secondary pivot are especially concerning, so we’ll be watching 4200.44 closely. Today’s microscopic poke above the line was not enough for us to draw any conclusions, but bulls will need to power decisively above the line to avoid the suspicion of fatal weakness.

I’ve identified bull market targets as high as 4905.75, but let’s use the pattern shown for now, with a less ambitious objective at 4536.50, since the futures are a millimeter from a related, and potentially crucial, benchmark. They traded as high as 4187 on Friday, just 13 points from the secondary Hidden Pivot at 4200.44 shown in the chart. We shouldn’t be surprised to see a tradeable pullback from it, but if buyers blow past or close above it for two straight days, that would put the 4536.50 target well in play. There is one other ‘hidden’ obstacle noted here earlier: 4222.82, the p2 pivot of the pattern associated with D=4905.75, but we’ll ignore it for now to keep things simple. It may be possible to get short with risk tightly controlled on Monday or Tuesday using a small-degree ‘reverse’ ABC set-up, but let’s play it by ear. Chat-roomers, stay tuned! _______ UPDATE (Apr 29, 10:13 p.m. ET): Failures precisely at the secondary pivot are especially concerning, so we’ll be watching 4200.44 closely. Today’s microscopic poke above the line was not enough for us to draw any conclusions, but bulls will need to power decisively above the line to avoid the suspicion of fatal weakness.

ESM21 – June E-Mini S&PS (Last:4192.75)

Posted on April 25, 2021, 5:18 pm EDT

Last Updated April 30, 2021, 11:44 am EDT

Posted on April 25, 2021, 5:18 pm EDT

Last Updated April 30, 2021, 11:44 am EDT