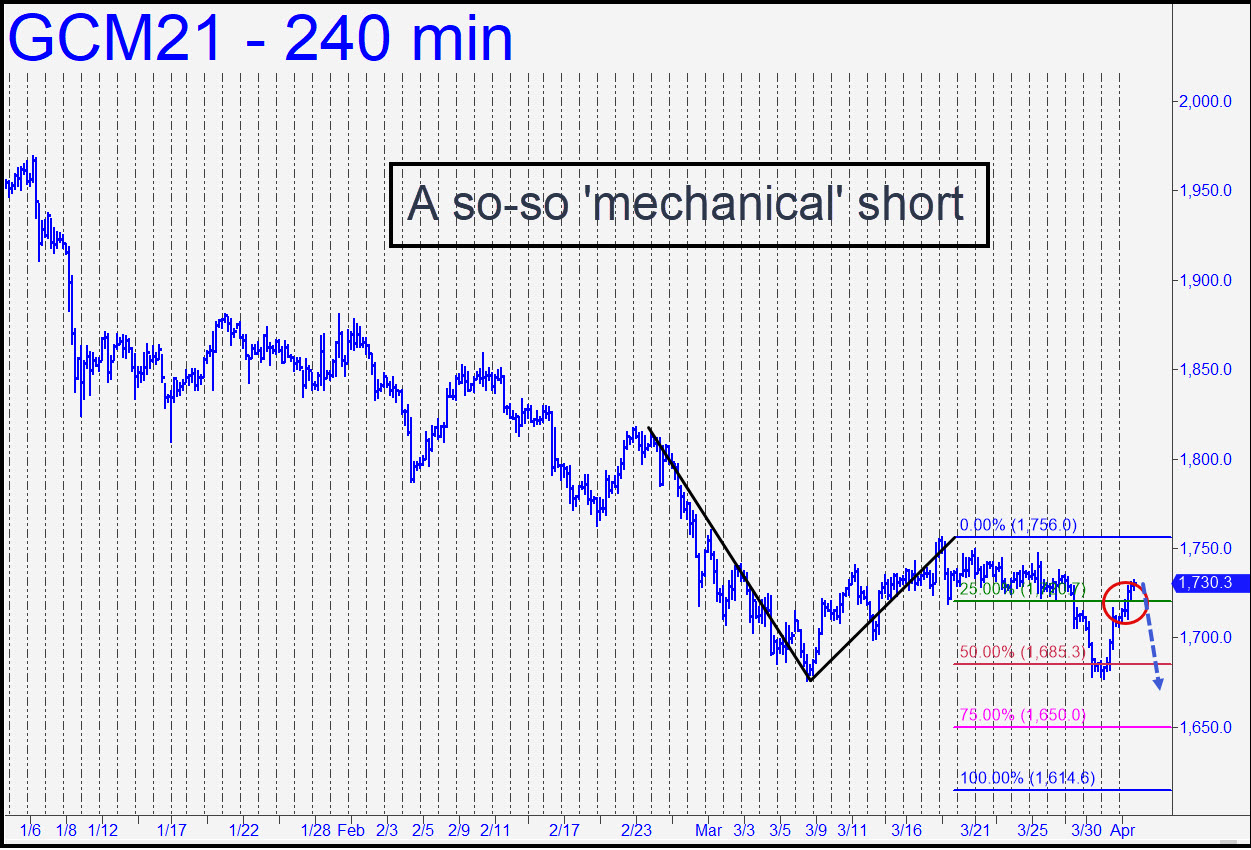

Gold tripped a so-so mechanical short Thursday when it rallied to 1730.70, the green line. When I mentioned this in the chat room, I rated the trade a 7.0; however, on closer inspection it is not quite so appealing. For one, the three legs of the pattern are too mellow; and for two, the rally to ‘x’ began above the sweet spot. Because of the $14,000 initial risk on four contracts, I advised initiating the trade with an ‘reverse ABC ‘pattern on the hourly chart that has yet to trigger. It would reduce theoretical risk to around $1000. I am now suggesting that you cancel the trade until we’ve seen how gold opens following a three-day weekend. If the June contract pushes above C=1756.00 it would be as bullish a sign as we’ve seen in bullion in a while. Alternatively, if the futures relapse you can use 1614.60 as a downside target. That would be a back-up-the-truck opportunity to get long, as far as I’m concerned. _______ UPDATE (Apr 5, 6:45 p.m. EDT): This rally looks like doo-doo, with upthrusts that are failing to surpass prior peaks on the hourly chart. I’ll take this as mildly bullish, since gold has a nasty habit of reversing when it looks worst, and of dying just when one feels encouraged.

Gold tripped a so-so mechanical short Thursday when it rallied to 1730.70, the green line. When I mentioned this in the chat room, I rated the trade a 7.0; however, on closer inspection it is not quite so appealing. For one, the three legs of the pattern are too mellow; and for two, the rally to ‘x’ began above the sweet spot. Because of the $14,000 initial risk on four contracts, I advised initiating the trade with an ‘reverse ABC ‘pattern on the hourly chart that has yet to trigger. It would reduce theoretical risk to around $1000. I am now suggesting that you cancel the trade until we’ve seen how gold opens following a three-day weekend. If the June contract pushes above C=1756.00 it would be as bullish a sign as we’ve seen in bullion in a while. Alternatively, if the futures relapse you can use 1614.60 as a downside target. That would be a back-up-the-truck opportunity to get long, as far as I’m concerned. _______ UPDATE (Apr 5, 6:45 p.m. EDT): This rally looks like doo-doo, with upthrusts that are failing to surpass prior peaks on the hourly chart. I’ll take this as mildly bullish, since gold has a nasty habit of reversing when it looks worst, and of dying just when one feels encouraged.

GCM21 – June Gold (Last:1729.50)

Posted on April 4, 2021, 5:09 pm EDT

Last Updated April 5, 2021, 7:23 pm EDT

Posted on April 4, 2021, 5:09 pm EDT

Last Updated April 5, 2021, 7:23 pm EDT