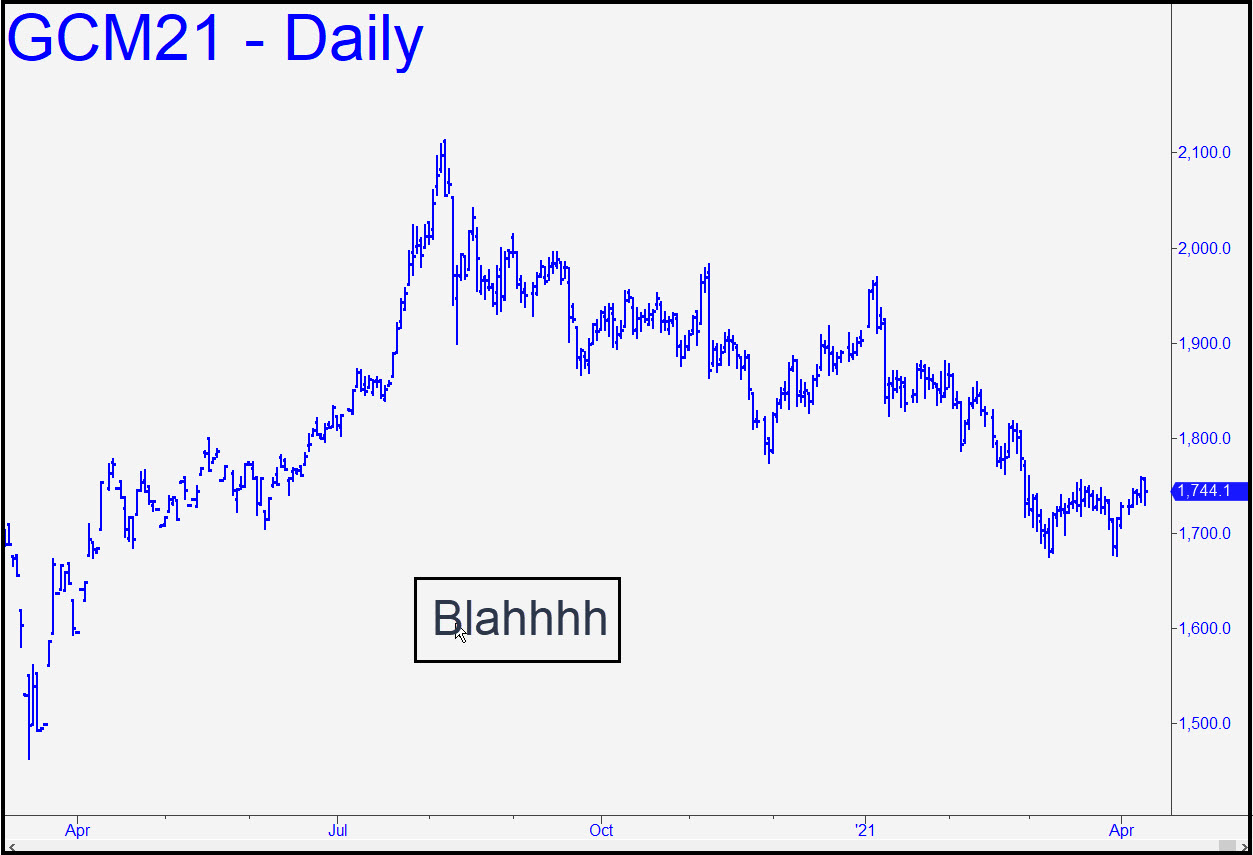

Although the current Silver tout enthuses about possible trading opportunities, Gold’s chart is about as appealing as warm beer. The most bullish thing you could say about the May contract is that it has so far avoided falling to a 1614.60 target that had looked magnetic. Last week’s feint slightly above the ‘C’ high of the bearish pattern that produced that target has negated it, but it would take a further push exceeding Feb 23’s ‘external’ high at 1817.60 to put the bear into hibernation. The lesser charts will be tradeable in either direction nonetheless, and we can use this big-picture view not only to board this vehicle ‘mechanically’, but to fantasize about its 2083.90 target. For now, let’s cross our fingers and see if the futures can get to x=1778.1. That would put p=1880.10 in play as a minimum upside objective. I don’t usually render unsignaled targets in green, but without a little added ‘color,’ gold’s chart is almost too dispiriting to contemplate.

Although the current Silver tout enthuses about possible trading opportunities, Gold’s chart is about as appealing as warm beer. The most bullish thing you could say about the May contract is that it has so far avoided falling to a 1614.60 target that had looked magnetic. Last week’s feint slightly above the ‘C’ high of the bearish pattern that produced that target has negated it, but it would take a further push exceeding Feb 23’s ‘external’ high at 1817.60 to put the bear into hibernation. The lesser charts will be tradeable in either direction nonetheless, and we can use this big-picture view not only to board this vehicle ‘mechanically’, but to fantasize about its 2083.90 target. For now, let’s cross our fingers and see if the futures can get to x=1778.1. That would put p=1880.10 in play as a minimum upside objective. I don’t usually render unsignaled targets in green, but without a little added ‘color,’ gold’s chart is almost too dispiriting to contemplate.

GCM21 – June Gold (Last:1763.40)

Posted on April 11, 2021, 5:11 pm EDT

Last Updated April 15, 2021, 9:16 pm EDT

Posted on April 11, 2021, 5:11 pm EDT

Last Updated April 15, 2021, 9:16 pm EDT