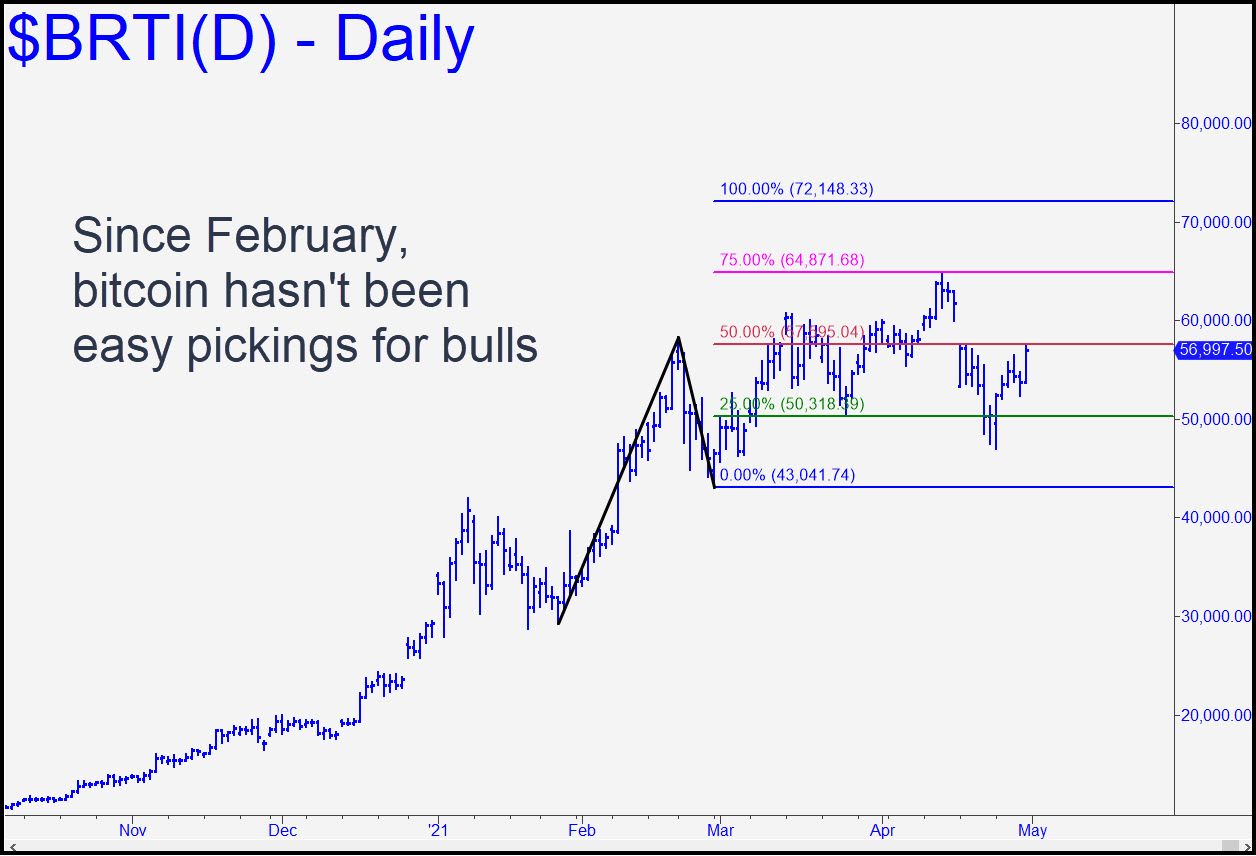

Friday’s surge to 57,421 effectively fulfilled a 57,595 target we’ve been using as a minimum upside projection for nearly a month. It also extended an unbroken string of profitable ‘mechanical’ trade recommendations in this vehicle stretching back to 2017 and sub-$4,000 prices. The still-unachieved ‘D’ target lies at 72,148, but it is not so certain a bet as it was five weeks ago, when this bitcoin proxy tripped a second ‘mechanical’ buy on a pullback to the green line. The first should have sent it to ‘D’ straightaway but instead produced a trend failure at p2=64,871 followed by a wicked dive. Although D still looks to me like an odds-on bet to be achieved, it is no longer the done deal that bitcoin puffery might assume, nor is the further prospect of much crazier heights certain. ______ UPDATE (May 4, 5:03): The bullish pattern begun in late March has yielded two profitable ‘mechanical’ trades on pullbacks to the green line (50,318). However, as I tried to make clear during today’s ‘requests’ session, I am not keen on trying this a third time.

Friday’s surge to 57,421 effectively fulfilled a 57,595 target we’ve been using as a minimum upside projection for nearly a month. It also extended an unbroken string of profitable ‘mechanical’ trade recommendations in this vehicle stretching back to 2017 and sub-$4,000 prices. The still-unachieved ‘D’ target lies at 72,148, but it is not so certain a bet as it was five weeks ago, when this bitcoin proxy tripped a second ‘mechanical’ buy on a pullback to the green line. The first should have sent it to ‘D’ straightaway but instead produced a trend failure at p2=64,871 followed by a wicked dive. Although D still looks to me like an odds-on bet to be achieved, it is no longer the done deal that bitcoin puffery might assume, nor is the further prospect of much crazier heights certain. ______ UPDATE (May 4, 5:03): The bullish pattern begun in late March has yielded two profitable ‘mechanical’ trades on pullbacks to the green line (50,318). However, as I tried to make clear during today’s ‘requests’ session, I am not keen on trying this a third time.

BRTI – CME Bitcoin Index (Last:54,763)

Posted on May 2, 2021, 5:16 pm EDT

Last Updated May 4, 2021, 5:03 pm EDT

Posted on May 2, 2021, 5:16 pm EDT

Last Updated May 4, 2021, 5:03 pm EDT

-

May 6, 2021, 3:55 pm

Please let me know if you are going to give regular CME Bitcoin Index trading advice.

Thank you