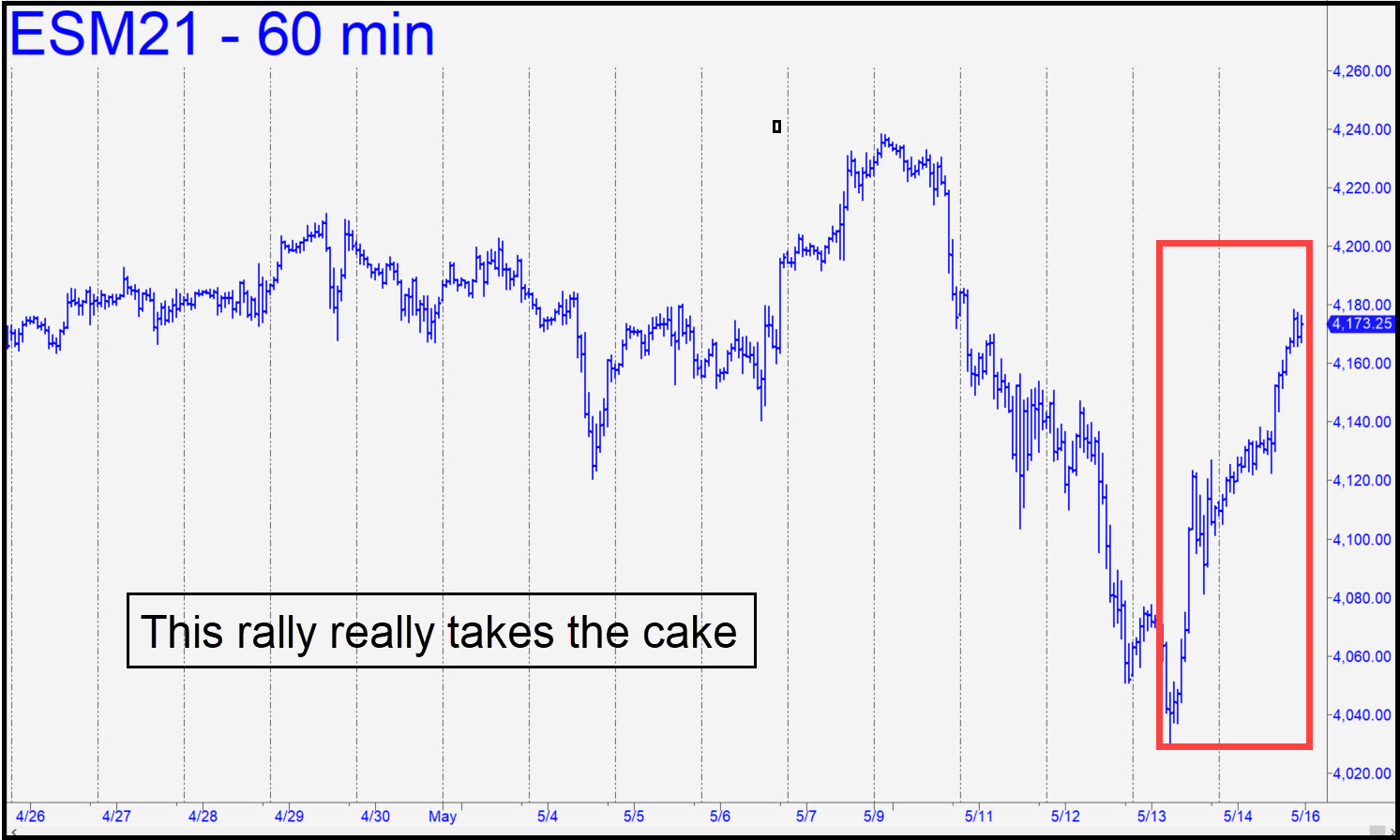

For sheer arrogance and effrontery, the steep rally that ended the week really takes the cake. Granted, short-covering bears supplied most of the fuel, but the news environment was as discouraging of speculation as we’ve seen in a while. Consumer inflation was exploding, putting pressure on the Fed to tighten; America’s fuel supply had been hijacked by cybercriminals, and the wildly bullish nuttiness in bitcoin was getting quashed by Elon Musk’s change of heart. And yet, here were the S&P futures, in a 150-point rally that not only flouted reality, logic and common sense, but which threatened to achieve even loonier new heights.

For sheer arrogance and effrontery, the steep rally that ended the week really takes the cake. Granted, short-covering bears supplied most of the fuel, but the news environment was as discouraging of speculation as we’ve seen in a while. Consumer inflation was exploding, putting pressure on the Fed to tighten; America’s fuel supply had been hijacked by cybercriminals, and the wildly bullish nuttiness in bitcoin was getting quashed by Elon Musk’s change of heart. And yet, here were the S&P futures, in a 150-point rally that not only flouted reality, logic and common sense, but which threatened to achieve even loonier new heights.

This should tell bears what they are up against: practically unlimited quantities of risk-on capital, much of it supplied in the form of corporate buybacks by companies that can imagine no better use for the money. No one seems to lose as long as this fusion reactor is humming. But because the buybacks produce virtually no real economic growth, it’s hardly rocket science to predict that the inflationary spiral of stocks will not end well. For now, I’ll eschew new rally targets and simply watch in amazement as the futures ascend to probable new all-time highs. One marginally above last week’s record 4238.25 would not be a go-ahead signal as far as I’m concerned, but rather a reason for the utmost caution. It would also put the futures perfectly in our ‘discomfort zone’, giving us reason to look for ways to get short with our powerful new tool, the ‘reverse ABC pattern. Stay tuned if you care. _______ UPDATE (May 18, 10:54 p.m. ET): Use p=4079 as a minimum downside projection. You can bottom-fish there as well, but if you use the rabc pattern shown in this chart, please note that the entry risk would be around $550 per contract. As always, a decisive penetration of p on first contact would imply more slippage down to the ‘D’ target — in this case 3978.50. ______ UPDATE (May 19, 10:30 a.m. ET): How lovely this is! There’s an alternative target at 3979.50 if we don’t use a one-off A. The more important thing is that the selloff has crushed the midpoint support, meaning it is all but certain to reach one target or the other. Bottom-fish there aggressively only if you’ve made money on the way down. ‘Mechanically’ speaking, a rally now to x=4127.25 would make for a fetching short, stop 4180.