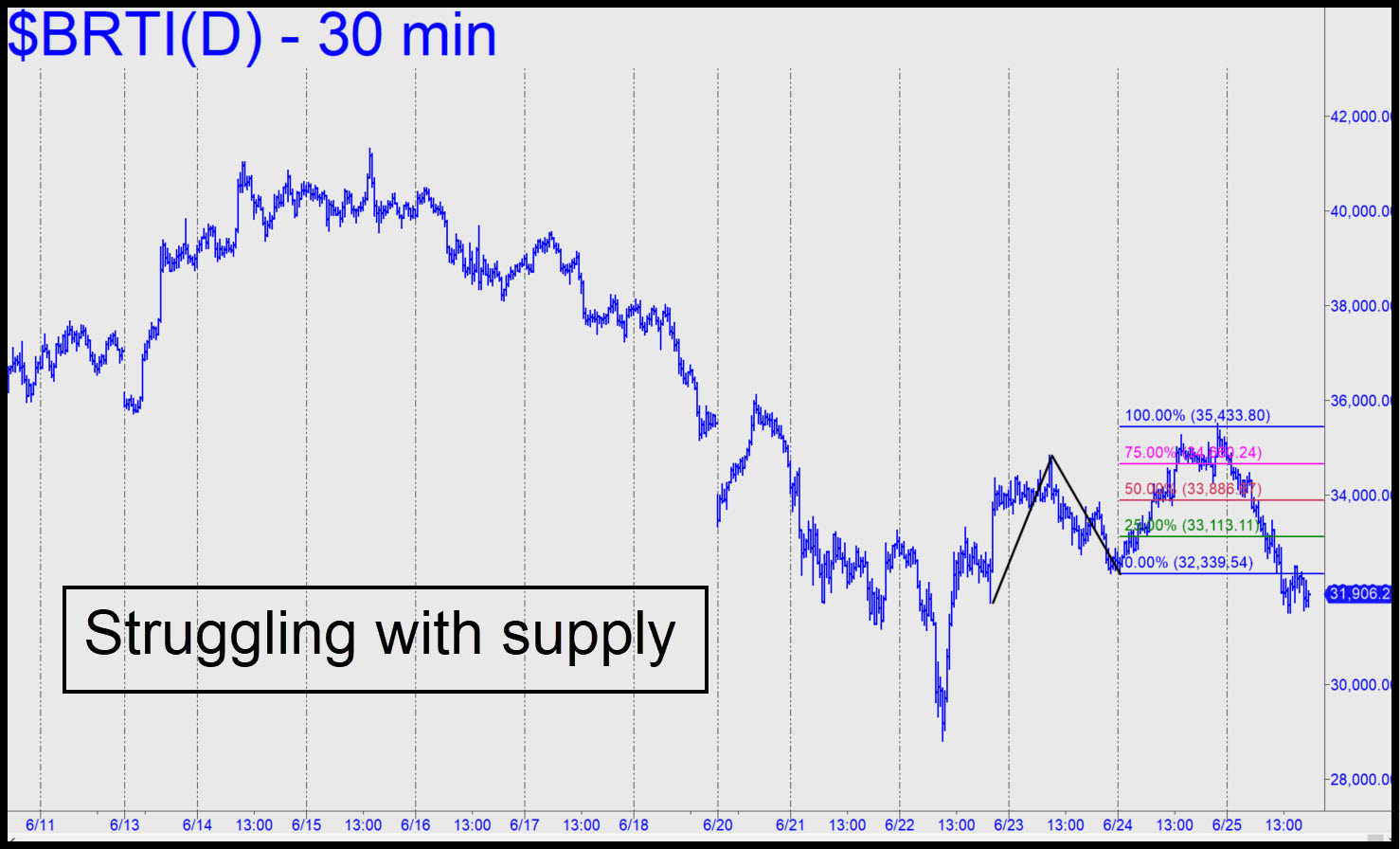

Quite a few who were late to the party are now bag holders who paid $45k, $50k, $60k or more for a piece of the action in the hottest speculative vehicle of them all. Now a good many of them must be praying for an opportunity to escape significant loss. It is their desperation that will congeal and harden into thick layers of supply between here mid-April’s record high near 64,000. My gut feeling is that bitcoin will have to punish bulls for yet more weeks, or even months, with a dip into the low 20,000s to set up the next big rally. It will be supported not so much by wild-eyed buyers, whose ranks will have been thinned by May-June’s 54% plunge, but by the reluctance of those who got on board for relatively small change to sell an investment they confidently believe will trade for $100,000 or more. Whatever happens, calling the swings in this banshee has not been rocket science. This was demonstrated last week when a 35,433 correction-rally target disseminated to subscribers Sunday evening came within 1/100th of a percentage point of nailing the exact high of last week’s nearly $4000 plunge. Skeptical? Spend some time in the Trading Room and monitor the targets yourself. _______ UPDATE (Jun 30, 8:44 p.m. ET): A feeble blip tripped a feeble buy signal predicated on minimum upside to p=36,129, shown in this chart. As always, an easy move through it would portend more strength to p2, in this case 37,164. ______ UPDATE (Jul 1, 6:52 p.m.): Bulls squandered a promising impulse leg, hinting that they are too weak to deliver. I’m still as bearish as I was above, but too bored with bitcoin’s pointless antics to elucidate why, let alone waste time calculating minor targets.

Quite a few who were late to the party are now bag holders who paid $45k, $50k, $60k or more for a piece of the action in the hottest speculative vehicle of them all. Now a good many of them must be praying for an opportunity to escape significant loss. It is their desperation that will congeal and harden into thick layers of supply between here mid-April’s record high near 64,000. My gut feeling is that bitcoin will have to punish bulls for yet more weeks, or even months, with a dip into the low 20,000s to set up the next big rally. It will be supported not so much by wild-eyed buyers, whose ranks will have been thinned by May-June’s 54% plunge, but by the reluctance of those who got on board for relatively small change to sell an investment they confidently believe will trade for $100,000 or more. Whatever happens, calling the swings in this banshee has not been rocket science. This was demonstrated last week when a 35,433 correction-rally target disseminated to subscribers Sunday evening came within 1/100th of a percentage point of nailing the exact high of last week’s nearly $4000 plunge. Skeptical? Spend some time in the Trading Room and monitor the targets yourself. _______ UPDATE (Jun 30, 8:44 p.m. ET): A feeble blip tripped a feeble buy signal predicated on minimum upside to p=36,129, shown in this chart. As always, an easy move through it would portend more strength to p2, in this case 37,164. ______ UPDATE (Jul 1, 6:52 p.m.): Bulls squandered a promising impulse leg, hinting that they are too weak to deliver. I’m still as bearish as I was above, but too bored with bitcoin’s pointless antics to elucidate why, let alone waste time calculating minor targets.

BRTI – CME Bitcoin Index (Last:34,827)

Posted on June 27, 2021, 5:08 pm EDT

Last Updated July 1, 2021, 10:59 pm EDT

Posted on June 27, 2021, 5:08 pm EDT

Last Updated July 1, 2021, 10:59 pm EDT