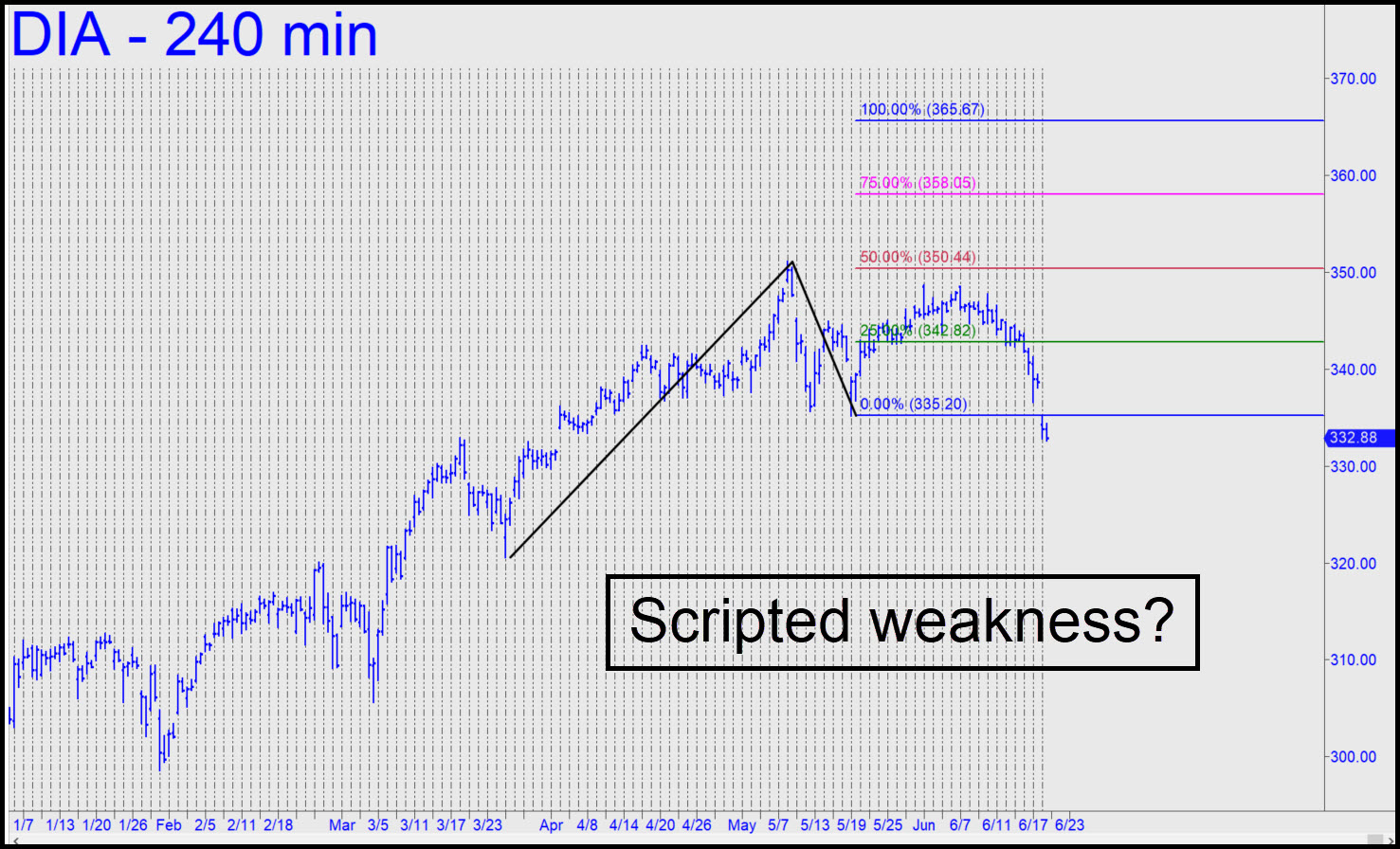

Elsewhere on the home page, I’ve suggested taking last week’s defenestration of the S&Ps and IWM with a grain of salt, since it is just the chimps shifting money amongst the various “themes” they determine with a toss of a dart each month. Even with the Guvmint force-feeding dollars into stocks, real estate and the consumer economy, it takes gargantuan sums to hold the shares of trillion-dollar companies like Apple, Amazon, Google and Microsoft continuously aloft, never mind move them higher. That’s why Friday’s breach of C=335.20 (see inset) is unlikely to be the start of a bear market, but rather a scripted way to economize on the continuation of a bull market whose demise is long overdue. Well, yes, it’s always possible a bear market has begun, but we’ll likely do better looking for DIA to recover its footing somewhere in the range 320-327. I am not using Hidden Pivots to project lows there, by the way, but rather the common-sense assumption that the important March 25 bottom at 320.62 is likely to hold. _______ UPDATE (Jun 22, 11:46 p.m. ET): After last week’s decisive breakdown, DIA has rallied to trip a ‘conventional’ buy signal at x=339.49 shown in this chart. I don’t much trust the signal, and so I am not recommending a trade. We rarely initiate one on this kind of signal, but I’ll warm to the idea if bulls take on midpoint resistance at p=347.92 [corrected] with gusto.

Elsewhere on the home page, I’ve suggested taking last week’s defenestration of the S&Ps and IWM with a grain of salt, since it is just the chimps shifting money amongst the various “themes” they determine with a toss of a dart each month. Even with the Guvmint force-feeding dollars into stocks, real estate and the consumer economy, it takes gargantuan sums to hold the shares of trillion-dollar companies like Apple, Amazon, Google and Microsoft continuously aloft, never mind move them higher. That’s why Friday’s breach of C=335.20 (see inset) is unlikely to be the start of a bear market, but rather a scripted way to economize on the continuation of a bull market whose demise is long overdue. Well, yes, it’s always possible a bear market has begun, but we’ll likely do better looking for DIA to recover its footing somewhere in the range 320-327. I am not using Hidden Pivots to project lows there, by the way, but rather the common-sense assumption that the important March 25 bottom at 320.62 is likely to hold. _______ UPDATE (Jun 22, 11:46 p.m. ET): After last week’s decisive breakdown, DIA has rallied to trip a ‘conventional’ buy signal at x=339.49 shown in this chart. I don’t much trust the signal, and so I am not recommending a trade. We rarely initiate one on this kind of signal, but I’ll warm to the idea if bulls take on midpoint resistance at p=347.92 [corrected] with gusto.

DIA – Dow Industrials ETF (Last:339.44)

Posted on June 20, 2021, 5:06 pm EDT

Last Updated June 30, 2021, 8:47 pm EDT

Posted on June 20, 2021, 5:06 pm EDT

Last Updated June 30, 2021, 8:47 pm EDT