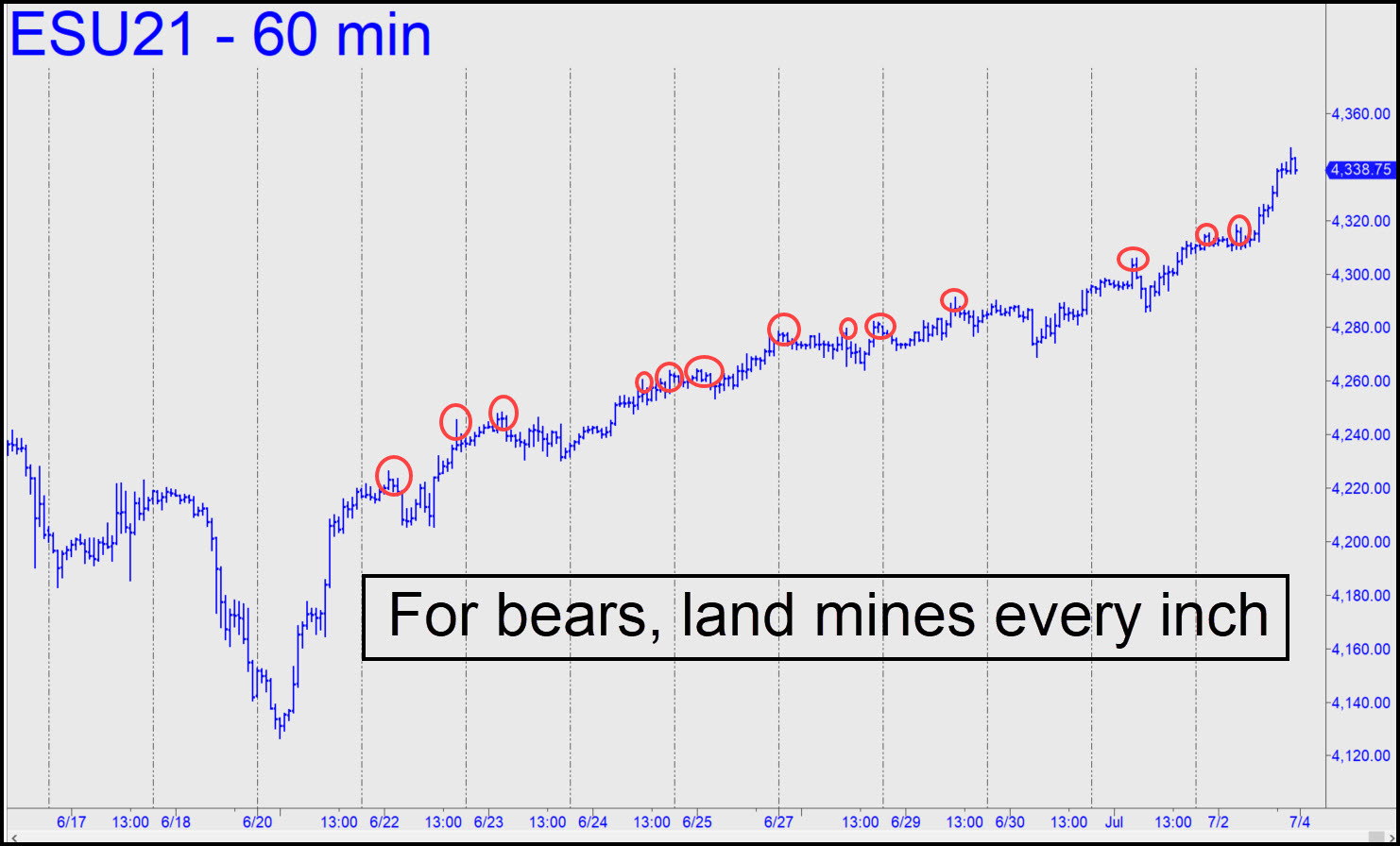

The bull market’s relentless ascent has settled into a short-squeeze groove that is duplicating the steep, ratcheting trajectory of April. There is bullish buying power behind it, but the rally’s main driver is short-covering by traders who quite evidently have been trying to pick tops every millimeter of the way. That’s apparent in the inset chart, which highlights a protracted series of very minor tops. Notice that there are relatively few dramatic upward spikes, other than the occasional goosing needed to trigger explosive bear panics. Your editor and a subscriber whose chat room handle is ‘Som’ were among those trying to pick a top on Friday with technically derived targets at, respectively, 4341.75 and 4342.75. The subscriber’s short alone survived because it was judiciously tied to a closing-basis stop-loss above where the futures settled. Whether it survives holiday trading Sunday evening and Monday remains to be seen, but the trade will have been a game try in any event. If it is stopped out, here’s a chart with a new rally target at 4413.75 that would become our minimum upside objective for the near term. The pattern is gnarly-beautiful enough that we should expect it to work well for purposes of trading or forecasting. However, I will be on the alert for a possible reversal from around 4365. That is not a Hidden Pivot, but rather the visual middle of the void between p2 and D. We are doing more and more trades using this ‘discomfort zone’, simply because the quants, yahoos and reprobates we compete against for profits have taken too avidly to the more obvious ABCD patterns. ______ UPDATE (Jul 6, 5:13 p.m. EDT): The short position entered Friday at 4343.75 was showing a profit of about $2000 at the low of today’s swoon. I posted informal guidance and will recommend that you nail down a partial profit if you haven’t done so already. However, since this trade is Som’s baby, I’ve asked him for specific risk-management details, which you should look for in the Trading Room. Since $500 was the initial risk based on Som’s 4353 stop-loss, covering half of the position for a profit of 3 times the initial risk (i.e., $1500) was what I typically advise. _______ UPDATE (Jul 7, 1:10 a.m.): In the chat room a short while ago, Som weighed in with a recommendation that the position be covered at 4265. He expects the implied, large drop to occur before Thursday afternoon. This guidance implies that the position will ultimately be closed out for either a loss of $500 per contract, or a gain of $3900. ______ UPDATE (Jul 7, 10:29): The futures came within two ticks of the stop-loss and spent much of the day frolicking menacinly just inches from it. The short position looks unlikely to be closed out with a profit, but you should check the chat room anyway for further guidance from Som, who said he will turn buyer of the S&Ps around mid-session Thursday. ______ UPDATE (Jul 8, 10:54 p.m.): I’ve had just about enough of Mr Market’s games over the last week, toying with every Hidden Pivot I’ve advertised. Here’s a chart for the rABC-savvy that probably gives too little away to get us jacked. If you understand what it says and think it’s as pretty as I do, then go for it! It could trigger before dawn, so night owls take heed. _______ UPDATE (Jul 9, 8:16 a.m.): The futures took off overnight without having gotten any closer than 4293 to my intended launchpad at p=4285.75, so there was no trade. You can cancel this one now.

The bull market’s relentless ascent has settled into a short-squeeze groove that is duplicating the steep, ratcheting trajectory of April. There is bullish buying power behind it, but the rally’s main driver is short-covering by traders who quite evidently have been trying to pick tops every millimeter of the way. That’s apparent in the inset chart, which highlights a protracted series of very minor tops. Notice that there are relatively few dramatic upward spikes, other than the occasional goosing needed to trigger explosive bear panics. Your editor and a subscriber whose chat room handle is ‘Som’ were among those trying to pick a top on Friday with technically derived targets at, respectively, 4341.75 and 4342.75. The subscriber’s short alone survived because it was judiciously tied to a closing-basis stop-loss above where the futures settled. Whether it survives holiday trading Sunday evening and Monday remains to be seen, but the trade will have been a game try in any event. If it is stopped out, here’s a chart with a new rally target at 4413.75 that would become our minimum upside objective for the near term. The pattern is gnarly-beautiful enough that we should expect it to work well for purposes of trading or forecasting. However, I will be on the alert for a possible reversal from around 4365. That is not a Hidden Pivot, but rather the visual middle of the void between p2 and D. We are doing more and more trades using this ‘discomfort zone’, simply because the quants, yahoos and reprobates we compete against for profits have taken too avidly to the more obvious ABCD patterns. ______ UPDATE (Jul 6, 5:13 p.m. EDT): The short position entered Friday at 4343.75 was showing a profit of about $2000 at the low of today’s swoon. I posted informal guidance and will recommend that you nail down a partial profit if you haven’t done so already. However, since this trade is Som’s baby, I’ve asked him for specific risk-management details, which you should look for in the Trading Room. Since $500 was the initial risk based on Som’s 4353 stop-loss, covering half of the position for a profit of 3 times the initial risk (i.e., $1500) was what I typically advise. _______ UPDATE (Jul 7, 1:10 a.m.): In the chat room a short while ago, Som weighed in with a recommendation that the position be covered at 4265. He expects the implied, large drop to occur before Thursday afternoon. This guidance implies that the position will ultimately be closed out for either a loss of $500 per contract, or a gain of $3900. ______ UPDATE (Jul 7, 10:29): The futures came within two ticks of the stop-loss and spent much of the day frolicking menacinly just inches from it. The short position looks unlikely to be closed out with a profit, but you should check the chat room anyway for further guidance from Som, who said he will turn buyer of the S&Ps around mid-session Thursday. ______ UPDATE (Jul 8, 10:54 p.m.): I’ve had just about enough of Mr Market’s games over the last week, toying with every Hidden Pivot I’ve advertised. Here’s a chart for the rABC-savvy that probably gives too little away to get us jacked. If you understand what it says and think it’s as pretty as I do, then go for it! It could trigger before dawn, so night owls take heed. _______ UPDATE (Jul 9, 8:16 a.m.): The futures took off overnight without having gotten any closer than 4293 to my intended launchpad at p=4285.75, so there was no trade. You can cancel this one now.

ESU21 – Sep E-Mini S&P (Last:4301.75)

Posted on July 4, 2021, 5:00 pm EDT

Last Updated July 9, 2021, 8:15 am EDT

Posted on July 4, 2021, 5:00 pm EDT

Last Updated July 9, 2021, 8:15 am EDT