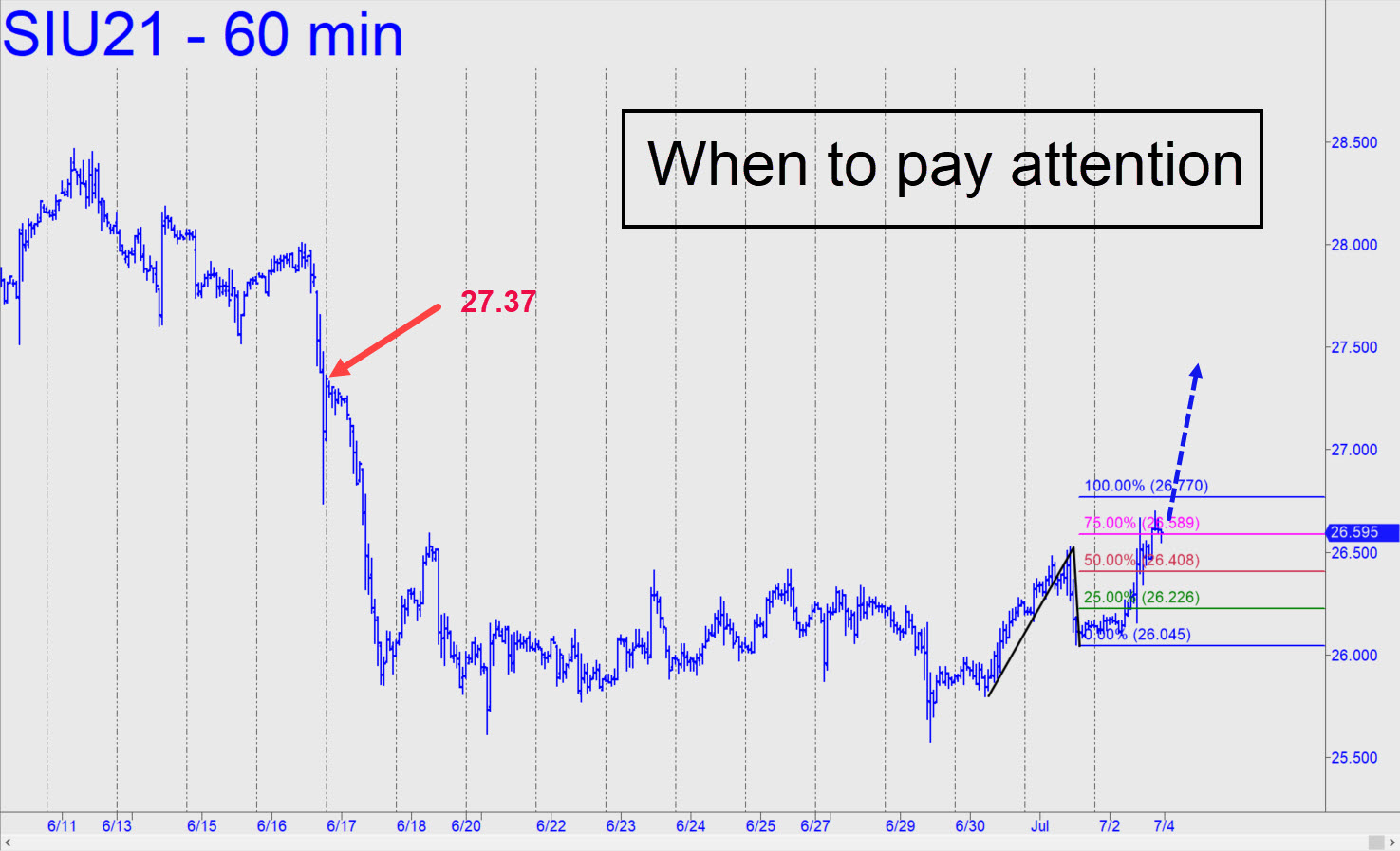

As usual, silver’s chart is more encouraging than gold’s, but not much. The impulse leg shown in the chart is legitimate, but we should want to see two further signs of health before we allow ourselves more encouragement. First, the spasmodic rally that tested bulls’ patience on Friday needs to exceed the ‘D’ target at 26.77; then, with no pussyfooting, the futures must surge above the 27.36 ‘external’ peak I’ve highlighted in the chart. Otherwise, expect more tedious ping-ponging between uninspired bulls and enfeebled bears. ______ UPDATE (Jul 8, 10:35 p.m.): This one is for rABC-savvy traders only, since I am not about to advertise its proprietary details explicitly. Suffice it to say, p=25.69 in this chart is ideally situated in the discomfort zone to set up an rABC long that I rate ‘7.9’. Try a=25.94 (7/8 at 3:00 a.m.), and don’t hesitate to give it a second try if you get stopped out. ______ UPDATE (Jul 9, 8:18 a.m.): So far no trade,, since the futures must come down to at least 25.70 to enable the rABC set-up noted above. The potential opportunity remains viable.

As usual, silver’s chart is more encouraging than gold’s, but not much. The impulse leg shown in the chart is legitimate, but we should want to see two further signs of health before we allow ourselves more encouragement. First, the spasmodic rally that tested bulls’ patience on Friday needs to exceed the ‘D’ target at 26.77; then, with no pussyfooting, the futures must surge above the 27.36 ‘external’ peak I’ve highlighted in the chart. Otherwise, expect more tedious ping-ponging between uninspired bulls and enfeebled bears. ______ UPDATE (Jul 8, 10:35 p.m.): This one is for rABC-savvy traders only, since I am not about to advertise its proprietary details explicitly. Suffice it to say, p=25.69 in this chart is ideally situated in the discomfort zone to set up an rABC long that I rate ‘7.9’. Try a=25.94 (7/8 at 3:00 a.m.), and don’t hesitate to give it a second try if you get stopped out. ______ UPDATE (Jul 9, 8:18 a.m.): So far no trade,, since the futures must come down to at least 25.70 to enable the rABC set-up noted above. The potential opportunity remains viable.

SIU21 – September Silver (Last:26.08)

Posted on July 5, 2021, 9:09 am EDT

Last Updated July 9, 2021, 8:19 am EDT

Posted on July 5, 2021, 9:09 am EDT

Last Updated July 9, 2021, 8:19 am EDT