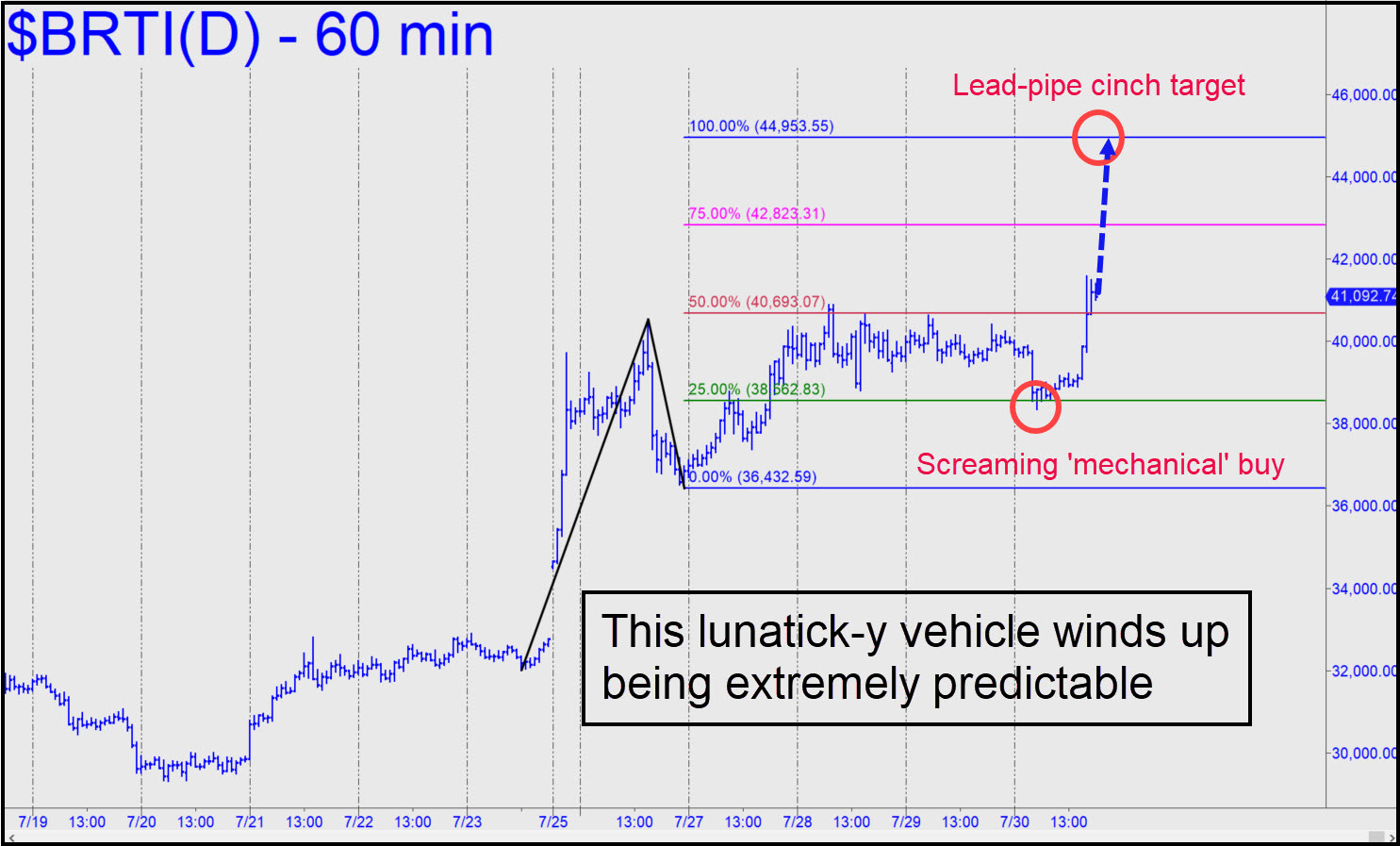

Although bitcoin is known for extreme volatility and savage ups and downs, it winds up being the most predictable and tradeable of all the vehicles I track. I cannot recall the last time a mechanical buy in BRTI did not produce a fat profit, and that’s going back a couple of years across trends both minor and major. I’ve established a tracking position for this move because a chat room regular used the pattern shown, buttressed by my explicit guidance, to get long ‘mechanically’ at the green line. Although I’ve warned about the thick layers of supply bitcoin will encounter above 40,000 enroute to possible new record highs, there is zero doubt at the moment that this thrust will reach the 44,953 target first broached here last week. Plan on shorting there aggressively if you’ve made money on the way up. _______ UPDATE (Aug 3, 4:35 p.m.): Ratcheting torture has stopped out bulls no fewer than six times since Sunday night’s peak at 41,806. Rick’s Picks subscribers appear to have avoided the rapid-fire treachery with a ‘mechanical’ entry at x=38,526 on Monday. It’s under water at the moment, but I still rate the trade ‘7.2’. The stop-loss is at 36431. _______ UPDATE (Aug 4, 10:31 p.m.): After dipping below the green line, BRTI bounced $2400 to 39,949 putting our position nicely in-the-black. Most subscribers who reported doing the trade in the chat room seemed to have taken a partial profit, but if you haven’t done so, exit half here (at 39,374) and use a 38,305 stop-loss for the rest. _____ UPDATE (Aug 5, 10:34 p.m.,): Okay, okay, we get the picture. The psychotics who play with this loaded pistol are clearly able to aim it 10% either way, and sometimes both, on a given day. This has not affected the reality that thicker and thicker layers of supply lie deposited every inch of the way between here and the wild blue yonder above 60,000. Only short-covering has enough power to eat through those layers, and we should therefore be alert to sharp turns that begin in discomfort zones. Today, for instance, the trampoline low began an inch beneath the previous day’s low. How clever! Subsequently, and for good measure, the day’s next reversal, a downturn, came from a couple of inches shy of the week’s high. This seems very predictable because it is. Such price action can be easily traded using the same rABC set-ups that we routinely practice during fortnightly tutorial sessions. I will be happy to vet set-ups for any Pivoteers who show an interest in the chat room, and if there is enough interest, I will put out a set-up myself in, say, GBTC, so that it would be accessible to all, even those who don’t trade futures. As always, you should not jump in unless you perfectly understand my instructions.

Although bitcoin is known for extreme volatility and savage ups and downs, it winds up being the most predictable and tradeable of all the vehicles I track. I cannot recall the last time a mechanical buy in BRTI did not produce a fat profit, and that’s going back a couple of years across trends both minor and major. I’ve established a tracking position for this move because a chat room regular used the pattern shown, buttressed by my explicit guidance, to get long ‘mechanically’ at the green line. Although I’ve warned about the thick layers of supply bitcoin will encounter above 40,000 enroute to possible new record highs, there is zero doubt at the moment that this thrust will reach the 44,953 target first broached here last week. Plan on shorting there aggressively if you’ve made money on the way up. _______ UPDATE (Aug 3, 4:35 p.m.): Ratcheting torture has stopped out bulls no fewer than six times since Sunday night’s peak at 41,806. Rick’s Picks subscribers appear to have avoided the rapid-fire treachery with a ‘mechanical’ entry at x=38,526 on Monday. It’s under water at the moment, but I still rate the trade ‘7.2’. The stop-loss is at 36431. _______ UPDATE (Aug 4, 10:31 p.m.): After dipping below the green line, BRTI bounced $2400 to 39,949 putting our position nicely in-the-black. Most subscribers who reported doing the trade in the chat room seemed to have taken a partial profit, but if you haven’t done so, exit half here (at 39,374) and use a 38,305 stop-loss for the rest. _____ UPDATE (Aug 5, 10:34 p.m.,): Okay, okay, we get the picture. The psychotics who play with this loaded pistol are clearly able to aim it 10% either way, and sometimes both, on a given day. This has not affected the reality that thicker and thicker layers of supply lie deposited every inch of the way between here and the wild blue yonder above 60,000. Only short-covering has enough power to eat through those layers, and we should therefore be alert to sharp turns that begin in discomfort zones. Today, for instance, the trampoline low began an inch beneath the previous day’s low. How clever! Subsequently, and for good measure, the day’s next reversal, a downturn, came from a couple of inches shy of the week’s high. This seems very predictable because it is. Such price action can be easily traded using the same rABC set-ups that we routinely practice during fortnightly tutorial sessions. I will be happy to vet set-ups for any Pivoteers who show an interest in the chat room, and if there is enough interest, I will put out a set-up myself in, say, GBTC, so that it would be accessible to all, even those who don’t trade futures. As always, you should not jump in unless you perfectly understand my instructions.

BRTI – CME Bitcoin Index (Last:40,326)

Posted on August 1, 2021, 5:16 pm EDT

Last Updated August 6, 2021, 11:30 am EDT

Posted on August 1, 2021, 5:16 pm EDT

Last Updated August 6, 2021, 11:30 am EDT