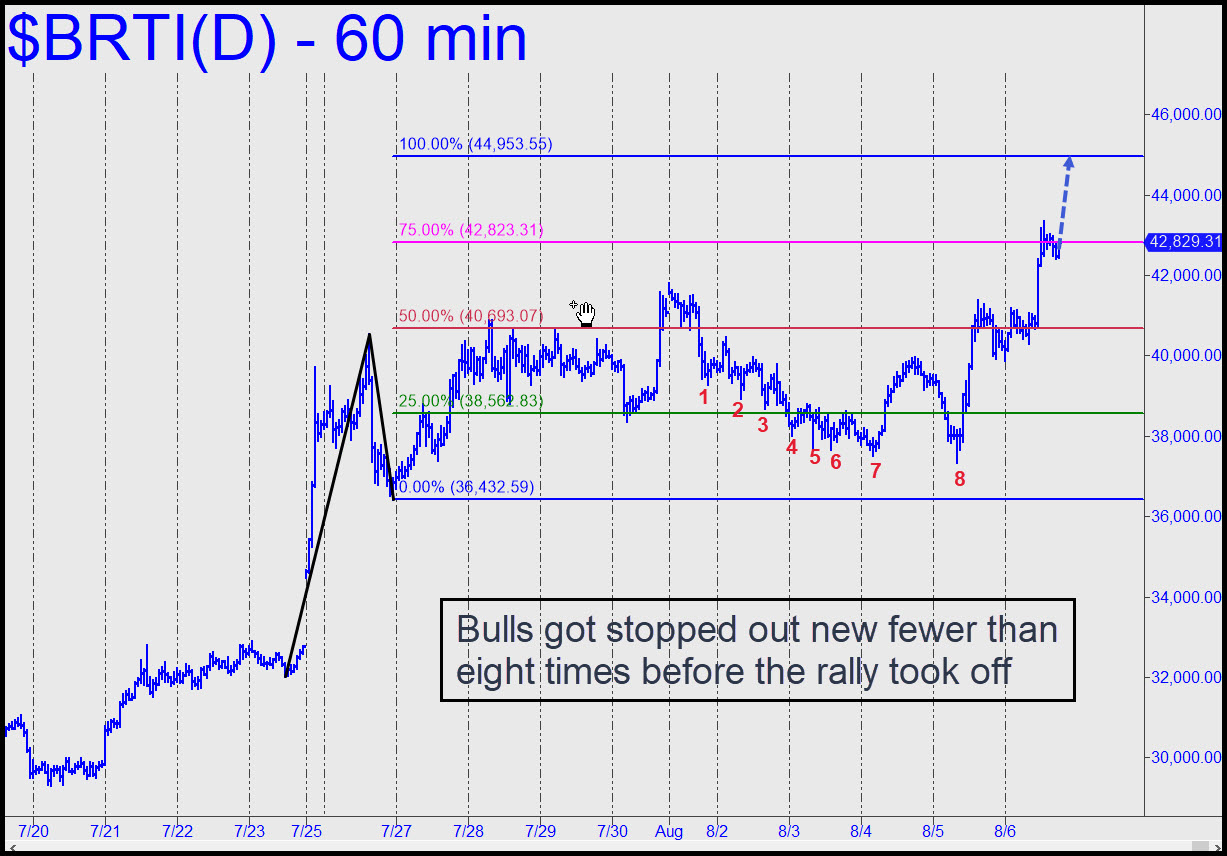

Bulls got stopped out no fewer than eight times last week by a series of lower lows on the hourly chart that ensured they were not aboard when BRTI finally took off. That happened on Thursday, and although we had caught piece of the ride by jumping on this bucking mare a day earlier, we were just spectators went it the explosive part of the move came. It is bound most immediately for the 44,953 target shown. Supply with thicken significantly with each thousand-point gain, but I won’t presume to know how quickly bitcoin fever will eat through it. For starters, let’s see how well bulls handle the 44,953 resistance, my minimum upside target for the near term. ______ UPDATE (Aug 8, 10:10 p.m.); My target, which was calculated on Saturday when Berty was trading around 42,000, missed the high of Sunday’s lunatic leap by less that a half of a percent. It also caught the top of a nearly $2400 selloff that completed a very nasty bear trap. I usually update touts on Sunday after 5:00 p.m., but next time I’ll try to remember to publish this one at the time it is composed, since bitcoin’s nutty swings are so predictable. As those of you who follow my BTC forecasts in the chat room and here will be aware, over the last couple of years, I have yet not posted a single losing trade among many that were mostly ‘mechanical’ buys. ______ UPDATE (Aug 9, 9:15 p.m.): I’ve lowered ‘A’ one rung to come up with the maxed-out 47665 rally target shown in this chart. You can short there using an rABC set-up, but be prepared to cover for a relatively small profit on a pullback. ______ UPDATE (Aug 12, 9:43 p.m.): At the risk of spoiling a perfect trading record in this vehicle, a winning streak stretching back almost two years, I’ll recommend a ‘mechanical’ buy following what would be a nasty dive to the red line (p=42,049), stop 40,177. Placing a bid at the green line would be even scarier, but I am raising it to the next level to avoid getting shut out on a swoon.

Bulls got stopped out no fewer than eight times last week by a series of lower lows on the hourly chart that ensured they were not aboard when BRTI finally took off. That happened on Thursday, and although we had caught piece of the ride by jumping on this bucking mare a day earlier, we were just spectators went it the explosive part of the move came. It is bound most immediately for the 44,953 target shown. Supply with thicken significantly with each thousand-point gain, but I won’t presume to know how quickly bitcoin fever will eat through it. For starters, let’s see how well bulls handle the 44,953 resistance, my minimum upside target for the near term. ______ UPDATE (Aug 8, 10:10 p.m.); My target, which was calculated on Saturday when Berty was trading around 42,000, missed the high of Sunday’s lunatic leap by less that a half of a percent. It also caught the top of a nearly $2400 selloff that completed a very nasty bear trap. I usually update touts on Sunday after 5:00 p.m., but next time I’ll try to remember to publish this one at the time it is composed, since bitcoin’s nutty swings are so predictable. As those of you who follow my BTC forecasts in the chat room and here will be aware, over the last couple of years, I have yet not posted a single losing trade among many that were mostly ‘mechanical’ buys. ______ UPDATE (Aug 9, 9:15 p.m.): I’ve lowered ‘A’ one rung to come up with the maxed-out 47665 rally target shown in this chart. You can short there using an rABC set-up, but be prepared to cover for a relatively small profit on a pullback. ______ UPDATE (Aug 12, 9:43 p.m.): At the risk of spoiling a perfect trading record in this vehicle, a winning streak stretching back almost two years, I’ll recommend a ‘mechanical’ buy following what would be a nasty dive to the red line (p=42,049), stop 40,177. Placing a bid at the green line would be even scarier, but I am raising it to the next level to avoid getting shut out on a swoon.

BRTI – CME Bitcoin Index (Last:44,742)

Posted on August 8, 2021, 5:12 pm EDT

Last Updated August 12, 2021, 9:44 pm EDT

Posted on August 8, 2021, 5:12 pm EDT

Last Updated August 12, 2021, 9:44 pm EDT