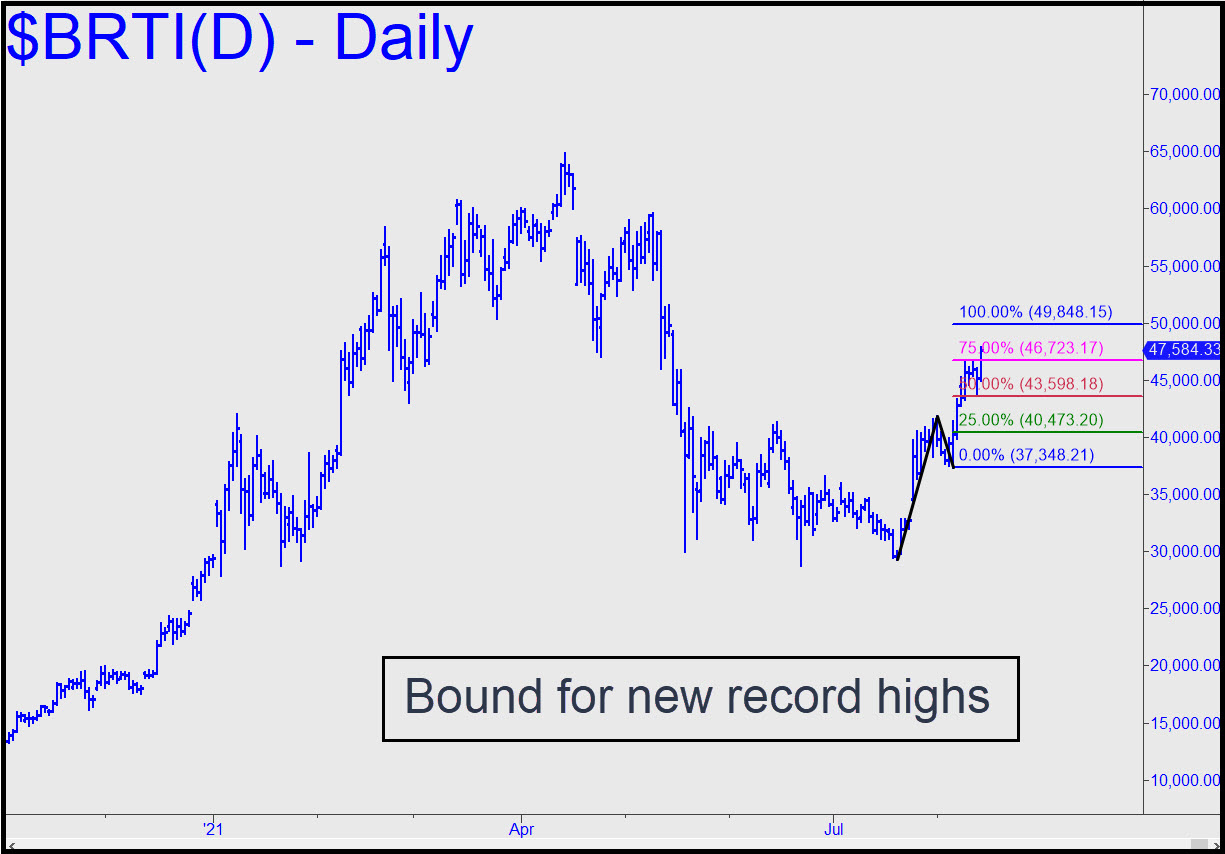

Bertie is bound most immediately for the 49,848 target shown in the chart, scaling an ABCD ladder that can still be used to get long ‘mechanically’, especially in the event of a violent pullback. To be clear, however, the trajectory leaves little doubt that the bull cycle begun from the summer’s lows near 30,000 will eventually exceed the target and achieve new record highs. This phase of the rally has been far steeper and less time-consuming than I had anticipated, but in retrospect we can see that the basing period entailed mostly churning bottom-fishers viciously until the last of them threw in the towel. On one recent day, for instance, Bertie stopped out bulls no fewer than nine times with a series of lower lows on the hourly chart. This sort of nastiness has been fractally replicated on the larger charts via fake-out rallies occurring off lows at, near or slightly beneath previous, too-obvious lows. My expectation of a more measured consolidation was based on the assumption that many bulls who got crushed by May’s steep selloff would be eager to exit on any rally above 40,000. Apparently not, and that attests to the strong institutional support that has supplanted the wild speculation that used to drive bitcoin. However, supply between 50,000 and 60,000 is another matter, and it is probably weighty enough that it will require at least 5-7 weeks of ceaseless munching, chewing and mastication for bulls to push above 60,000. Price swings are very likely to be tradeable, since this vehicle, for all its nuttiness, has yet to trigger a losing ‘mechanical’ trade.

Bertie is bound most immediately for the 49,848 target shown in the chart, scaling an ABCD ladder that can still be used to get long ‘mechanically’, especially in the event of a violent pullback. To be clear, however, the trajectory leaves little doubt that the bull cycle begun from the summer’s lows near 30,000 will eventually exceed the target and achieve new record highs. This phase of the rally has been far steeper and less time-consuming than I had anticipated, but in retrospect we can see that the basing period entailed mostly churning bottom-fishers viciously until the last of them threw in the towel. On one recent day, for instance, Bertie stopped out bulls no fewer than nine times with a series of lower lows on the hourly chart. This sort of nastiness has been fractally replicated on the larger charts via fake-out rallies occurring off lows at, near or slightly beneath previous, too-obvious lows. My expectation of a more measured consolidation was based on the assumption that many bulls who got crushed by May’s steep selloff would be eager to exit on any rally above 40,000. Apparently not, and that attests to the strong institutional support that has supplanted the wild speculation that used to drive bitcoin. However, supply between 50,000 and 60,000 is another matter, and it is probably weighty enough that it will require at least 5-7 weeks of ceaseless munching, chewing and mastication for bulls to push above 60,000. Price swings are very likely to be tradeable, since this vehicle, for all its nuttiness, has yet to trigger a losing ‘mechanical’ trade.

BRTI – CME Bitcoin Index (Last:47,584)

Posted on August 15, 2021, 9:28 am EDT

Last Updated August 15, 2021, 10:22 am EDT

Posted on August 15, 2021, 9:28 am EDT

Last Updated August 15, 2021, 10:22 am EDT