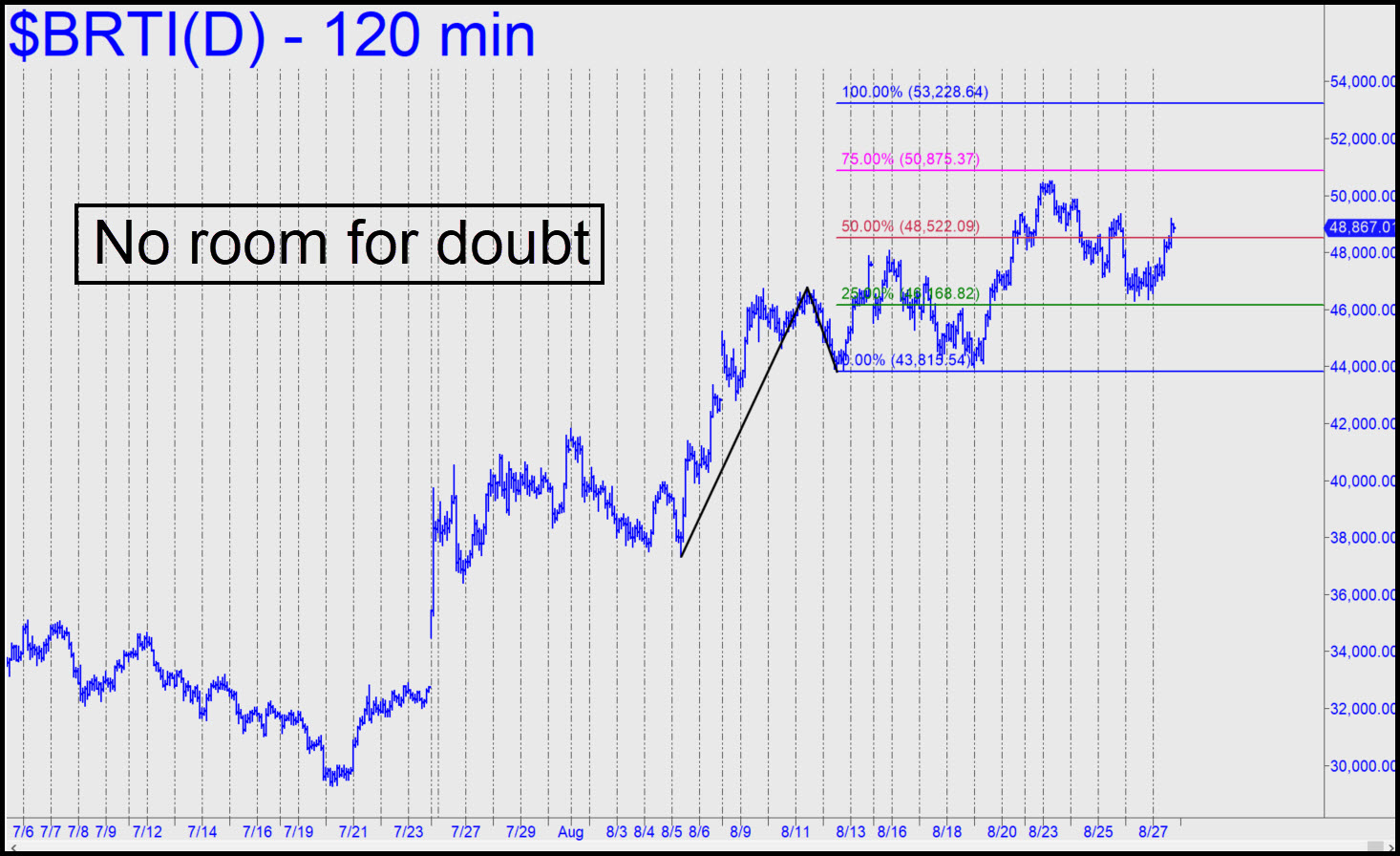

Bertie took off after I pulled the ‘mechanical’ bid at the green line, rebuking me for the unpardonable sin of gutlessness. Even so, I won’t start the new week feeling remorseful, since this vehicle has been very good to us whenever we’ve employed ‘mechanical’ bids on nasty pullbacks. This one simply wasn’t nasty enough or we’d have elected the trade. Looking just ahead, bulls will face supply of geometrically increasing density above 50,000, although that will only slow the rally down somewhat, not reverse it decisively. ‘Mechanical’ buying opportunities are spent for the time being, although a pullback to the red line after p2=50,875 has been touched (but not exceeded by much) could be bought with a 46,953 stop-loss and a target at D=53,228. _______ UPDATE (Sep 2, 8:01 p.m.): The yo-yos and algos seem to be working “our” HP levels to death. Look at how studiously Bertie has avoided touching every line relevant to what would have become winning ‘mechanical’ trades. (We passed up one such trade ourselves when a pullback missed the green line by a millimeter on Aug 26). I am going to have to be more careful about whom I admit to the Wednesday tutorial sessions, since I don’t want Goldman and Morgan Stanley riff-raff learning how we keep two steps ahead of their trading computers and math whizzes. _______ UPDATE (Sep 7, 10:01 p.m.): No sooner do I mention that the wack-jobs who flog this hoax have “figured out” ABCD levels and begun to use them ineffectually, than it dives 19% in the blink of an eye from within an inch of a too-clear ‘D’ target they’d fallen in love with. The news-media geniuses who pretend to make sense of such things embarrassed themselves as usual with an account that tied the plunge to El Salvador’s adoption of cryptocurrency as legal tender. The story, and others that followed on Bloomberg, made no more sense of the selloff than that last sentence, so don’t even try to figure it out. This graph shows the gratuitous excitement, with Bertie eventually settling near the middle of its freakish intraday range. Ordinarily, enough traders would be spooked to send bitcoin down to the low for a retest, but this is bitcoin, remember, and its deep-pocket sponsors have little enthusiasm for letting the riffraff aboard at the bargain prices that obtained for about three nanoseconds on Tuesday.

Bertie took off after I pulled the ‘mechanical’ bid at the green line, rebuking me for the unpardonable sin of gutlessness. Even so, I won’t start the new week feeling remorseful, since this vehicle has been very good to us whenever we’ve employed ‘mechanical’ bids on nasty pullbacks. This one simply wasn’t nasty enough or we’d have elected the trade. Looking just ahead, bulls will face supply of geometrically increasing density above 50,000, although that will only slow the rally down somewhat, not reverse it decisively. ‘Mechanical’ buying opportunities are spent for the time being, although a pullback to the red line after p2=50,875 has been touched (but not exceeded by much) could be bought with a 46,953 stop-loss and a target at D=53,228. _______ UPDATE (Sep 2, 8:01 p.m.): The yo-yos and algos seem to be working “our” HP levels to death. Look at how studiously Bertie has avoided touching every line relevant to what would have become winning ‘mechanical’ trades. (We passed up one such trade ourselves when a pullback missed the green line by a millimeter on Aug 26). I am going to have to be more careful about whom I admit to the Wednesday tutorial sessions, since I don’t want Goldman and Morgan Stanley riff-raff learning how we keep two steps ahead of their trading computers and math whizzes. _______ UPDATE (Sep 7, 10:01 p.m.): No sooner do I mention that the wack-jobs who flog this hoax have “figured out” ABCD levels and begun to use them ineffectually, than it dives 19% in the blink of an eye from within an inch of a too-clear ‘D’ target they’d fallen in love with. The news-media geniuses who pretend to make sense of such things embarrassed themselves as usual with an account that tied the plunge to El Salvador’s adoption of cryptocurrency as legal tender. The story, and others that followed on Bloomberg, made no more sense of the selloff than that last sentence, so don’t even try to figure it out. This graph shows the gratuitous excitement, with Bertie eventually settling near the middle of its freakish intraday range. Ordinarily, enough traders would be spooked to send bitcoin down to the low for a retest, but this is bitcoin, remember, and its deep-pocket sponsors have little enthusiasm for letting the riffraff aboard at the bargain prices that obtained for about three nanoseconds on Tuesday.

BRTI – CME Bitcoin Index (Last:47,040)

Posted on August 29, 2021, 5:16 pm EDT

Last Updated September 8, 2021, 9:46 am EDT

Posted on August 29, 2021, 5:16 pm EDT

Last Updated September 8, 2021, 9:46 am EDT