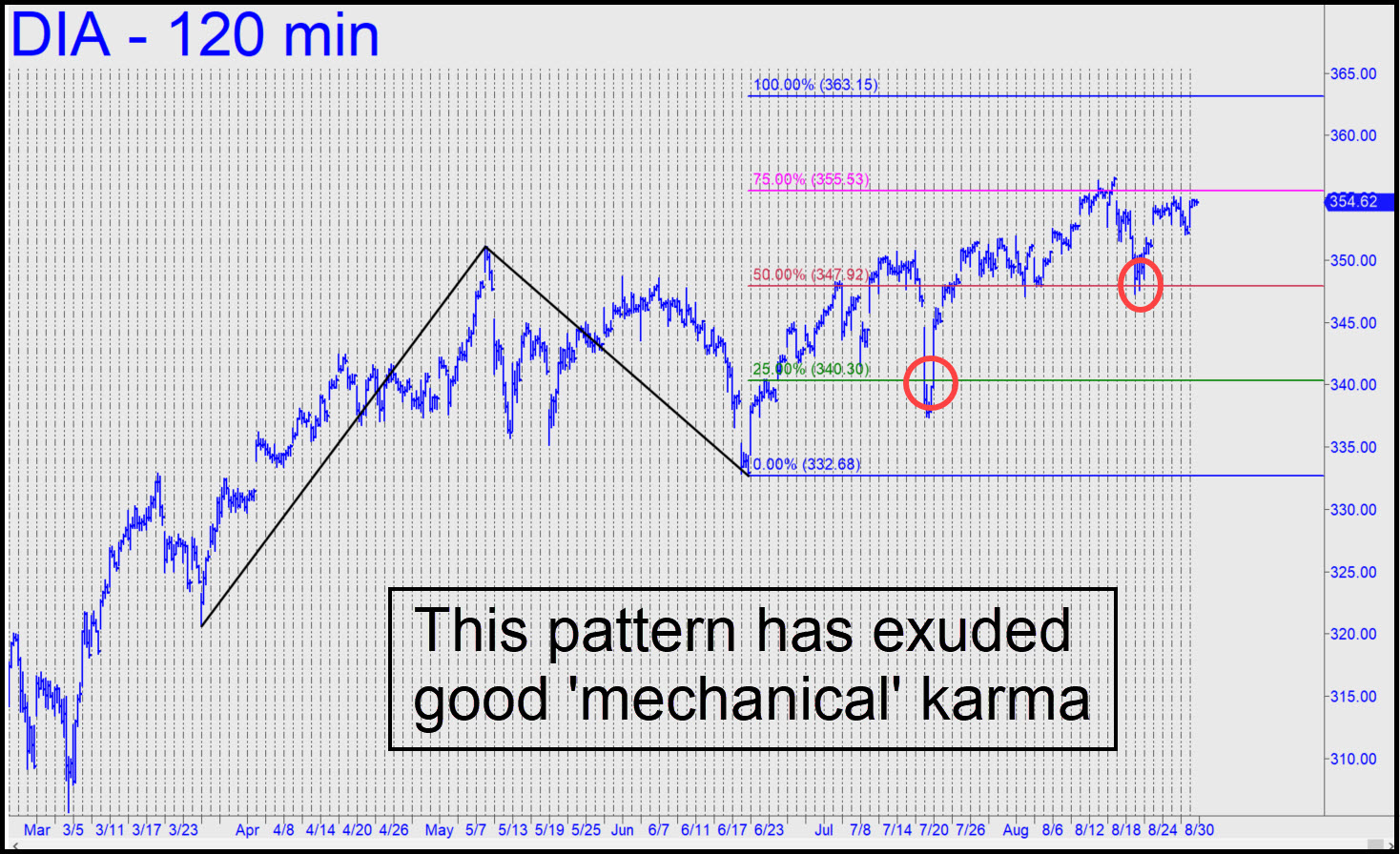

The pattern shown, with a 363.15 rally target that differs slightly from the one we’ve been using for months, has exuded good karma all the way up. Notice that it triggered two fetching ‘mechanical’ buys in places where most bulls would have been paralyzed by fright. That’s why these trades work, and why we should expect the rally to continue at least to D. As before, we will want to short the bejeezus out of a print at or near that Hidden Pivot, but without letting hubris cloud our judgment concerning whether we’ve seen The Top. If you butterflied calls a while back, please let me know in the chat room, since they should be coming home to roost shortly. ______ UPDATE (Aug 31, 11:05 p.m.): Although three weeks of patty-cake at p2 has somewhat dimmed our 363.15 lodestar, it hasn’t quite snuffed it. A short there is still warranted in any event, but I wouldn’t attempt a ‘mechanical’ buy unless DIA swoons precipitously to the green line. _______ UPDATE (Sep 4): Make that, four weeks of patty-cake at p2. _______ UPDATE (Sep 8, 9:06 p.m.): Bulls ran out of gas trying to stay aloft for yet more gratuitous head-butting of p2. Let’s see if bears can seize the advantage by pounding DIA hard ahead of the weekend. If so, it would be behavior we haven’t seen in a very long while.

The pattern shown, with a 363.15 rally target that differs slightly from the one we’ve been using for months, has exuded good karma all the way up. Notice that it triggered two fetching ‘mechanical’ buys in places where most bulls would have been paralyzed by fright. That’s why these trades work, and why we should expect the rally to continue at least to D. As before, we will want to short the bejeezus out of a print at or near that Hidden Pivot, but without letting hubris cloud our judgment concerning whether we’ve seen The Top. If you butterflied calls a while back, please let me know in the chat room, since they should be coming home to roost shortly. ______ UPDATE (Aug 31, 11:05 p.m.): Although three weeks of patty-cake at p2 has somewhat dimmed our 363.15 lodestar, it hasn’t quite snuffed it. A short there is still warranted in any event, but I wouldn’t attempt a ‘mechanical’ buy unless DIA swoons precipitously to the green line. _______ UPDATE (Sep 4): Make that, four weeks of patty-cake at p2. _______ UPDATE (Sep 8, 9:06 p.m.): Bulls ran out of gas trying to stay aloft for yet more gratuitous head-butting of p2. Let’s see if bears can seize the advantage by pounding DIA hard ahead of the weekend. If so, it would be behavior we haven’t seen in a very long while.

DIA – Dow Industrials ETF (Last:350.75)

Posted on August 29, 2021, 5:09 pm EDT

Last Updated September 8, 2021, 9:06 pm EDT

Posted on August 29, 2021, 5:09 pm EDT

Last Updated September 8, 2021, 9:06 pm EDT